- Zimbabwe’s central bank has introduced a new gold-backed currency, ZiG, to combat high inflation.

- This is Zimbabwe’s sixth attempt at a new currency since 2008.

- The African nation is aiming to phase out its multi-currency system where the US dollar is dominant.

Inflation-hit Zimbabwe has a new currency — again.

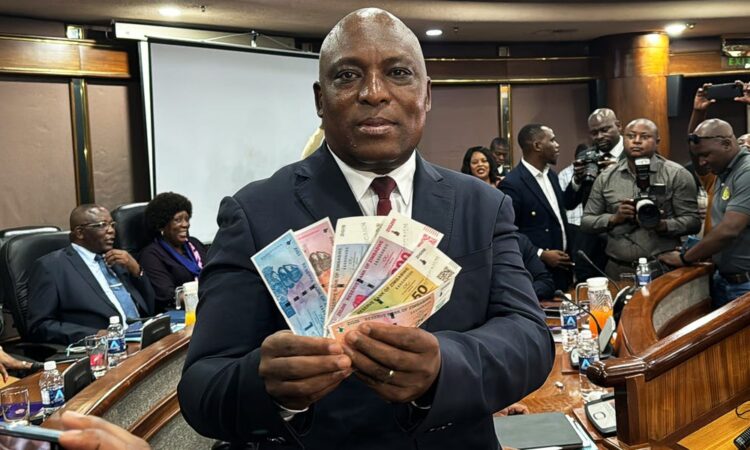

Last week, the country’s central bank introduced a new gold-backed currency called Zimbabwe Gold, or ZiG, in an attempt to tame price gains that reached a seven-month high of 55% in March.

It’s the country’s sixth attempt at creating a new currency since 2008. The Zimbabwe dollar — the currency the country most recently used — has tanked 80% this year alone.

There’s been so little confidence in Zimbabwe’s local currency that about 80% of the country’s population transacts in the US dollar.

On Thursday, Zimbabwe’s central bank governor, John Mushayavanhu, said the country has real gold and mineral assets to back up the new ZiG currency. Mushayavanhu said Zimbabwe’s central bank holds 2.1 tons of gold and other assets, including diamonds, that are equivalent to 0.4 tons of gold, according to Voice of America.

The ZiG started trading on Monday at an exchange rate of 13.56 to the dollar set by the central bank.

Reservations about Zimbabwe’s new currency

There are reservations about the new ZiG currency.

In a note on Sunday, Hasnain Malik of research firm Tellimer wrote that Zimbabwe’s economy needs fundamental fixes like reductions in fiscal deficit and external debt, not a new currency.

However, moving to the new ZiG currency could solve at least one problem, for a start: a shortage of US coins.

Zimbabwe’s shortage of US coins has resulted in people receiving their change in sweets, chocolates, and pens, according to the BBC.

Zimbabwe has been trying to wean itself off the US dollar

If successful, ZiG may be able to replace some — if not all — transactions that currently take place with the US dollar.

Zimbabwe has already applied for membership to the BRICS’s New Development Bank, which is seeking to expand the use of local currency loans.

Zimbabwe’s central bank said in its 2024 monetary policy statement, released last week, that it will be preparing a “structured roadmap to gradually promote the increased use of the new local currency.”

For a start, it’s making it compulsory for companies to settle at least half of their quarterly taxes in ZiG, according to the central bank report.

The African country has been trying to wean itself off the US dollar for years, with little success. The country has seen runaway inflation due to years of economic mismanagement under its former leader, Robert Mugabe.

At one point in 2008, annual inflation reached 500 billion percent, according to the International Monetary Fund.

Zimbabwe’s government banned the use of foreign currencies as legal tender in 2019. The country’s former central bank governor said at the time that the country’s economy was “at the mercy of US dollar pricing, which has been a root cause of inflation,” the BBC reported.

The country was forced, however, to reverse the ban in June 2022 to rein in inflation.

The government had initially planned to end the multi-currency system in 2025, but extended it until 2030.