(Bloomberg) — Major currencies held to narrow ranges and US equity futures made small gains in cautious trading Monday as the Asian session got underway.

Most Read from Bloomberg

Investors are weighing the US jobs report, which sent policy-sensitive two-year Treasury yields back to around 4% when it was released Friday. The data support bets for another Federal Reserve rate increase to quell inflation while also easing some concerns the US economy is careening toward recession.

Contracts for the S&P 500 rose 0.1% on Monday after small gains for futures when the non-farm payrolls figures were released. The dollar’s moves against Group-of-10 currencies was confined to about 0.2% early Monday.

Oil was marginally higher, gold inched lower and cryptocurrencies were little changed.

Chinese military drills around Taiwan, following the island’s president visiting the US, may add to the sense of caution in Asian markets. Easter holidays will also keep trading shuttered Monday in Hong Kong, Australia and New Zealand, along with most of Europe.

“March’s NFP report delivered only a half-victory for the market but effectively reminded Fed of its undone job,” said Hebe Chen, an analyst at IG Markets Ltd. “The ‘glass half-full’ sentiment is poised to bake into a more divided and fragile risk appetite.”

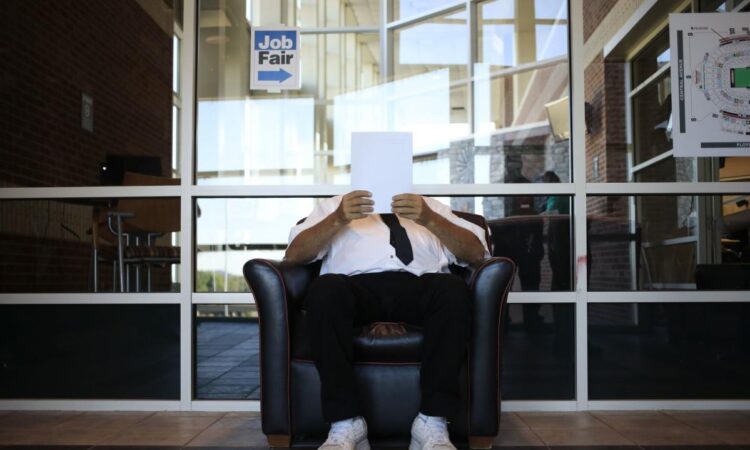

US payrolls rose at a firm pace in March of 236,000, which was in line with forecasts and followed an upwardly revised 326,000 advance in February. The unemployment rate dropped again near record lows to 3.5%.

Swaps trading showed the odds for a quarter percentage point interest-rate increase at the Fed’s May meeting rose to about two in three, up from roughly 50-50 before the data landed. Investors have been aggressively pricing in rate cuts later this year as economic data falls short of estimates, suggesting the American economy is slowing.

“In the short term we are not expecting any surprises for Asian equities over the coming week, unless something major changes the landscape,” said Peter McGuire, chief executive officer of Trading Point. “Markets remain cautious due to central bank’s policy and inflation. There certainly could be trouble brewing in the not-to-distant future as layoffs and earnings will show us all who has no clothes when the tide runs out.”

The next major data point for the Fed is a report on consumer prices, due April 12. Officials deliver their policy move on May 3.

Key events this week:

-

US wholesale inventories, Monday

-

New York Fed President John Williams takes part in discussion hosted by the Economics Review at New York University, Monday

-

China PPI, CPI, Tuesday

-

IMF world economic outlook, global financial stability reports, Tuesday

-

Chicago Fed’s Austan Goolsbee, Minneapolis Fed’s Neel Kashkari and Philadelphia Fed’s Patrick Harker speak at separate events, Tuesday

-

Canada rate decision, Wednesday

-

US FOMC minutes, CPI, Wednesday

-

Richmond Fed’s Thomas Barkin speaks, Wednesday

-

China trade, Thursday

-

US PPI, initial jobless claim, Thursday

-

US retail sales, business inventories, industrial production, University of Michigan consumer sentiment, Friday

-

Major US banks JPMorgan Chase, Wells Fargo and Citigroup report earnings, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.1% as of 8:09 a.m. Tokyo time.

-

Nasdaq 100 futures were little changed

-

Nikkei 225 futures rose 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0909

-

The Japanese yen rose 0.1% to 131.98 per dollar

-

The offshore yuan was little changed at 6.8753 per dollar

-

The Australian dollar was little changed at $0.6670

Cryptocurrencies

-

Bitcoin rose 0.8% to $28,373.04

-

Ether rose 0.3% to $1,862.39

Commodities

-

West Texas Intermediate crude rose 0.3% to $80.98 a barrel

-

Spot gold fell 0.1% to $2,005.30 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Isabelle Lee and Abhishek Vishnoi.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.