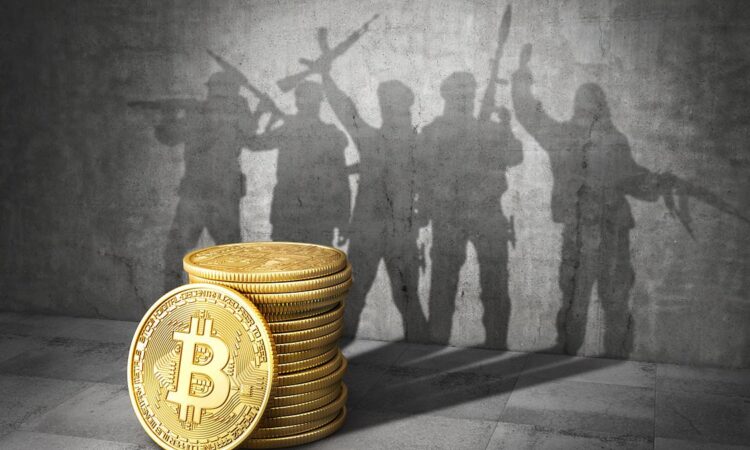

The capacity of the crypto industry for denial amid the atrocities of ‘Black Sabbath’ in Israel on October 7 and the subsequent killing fields in Gaza knows no bounds.

One key player even described a recent £3.4 billion settlement between Binance and the US Department of Justice as having a ‘silver lining’ for the reputation of crypto.

Most people would struggle to find any redeeming elements in a case where Treasury Secretary Janet Yellen slammed Binance – which operates the world’s largest cryptocurrency exchange – for turning ‘a blind eye to its legal obligations in the pursuit of profit’.

Yellen also attacked Binance for ‘wilful failures’ that ‘allowed money to flow to terrorists, cybercriminals and child abusers through its platform’.

But in a feat of contorted logic, crypto-fans argue the fact that the US authorities agreed a settlement and did not close Binance down completely is a recognition of the legitimacy of the whole digital money industry.

That ignores the fact that in the very same settlement, Binance acknowledged money laundering for Hamas’s murderous Al-Qassam brigades.

Far from showing that crypto-players are ready to clean up their act, it has demonstrated how the use of computer-generated tokens and currencies has proved a boon for terrorist organisations seeking to circumvent the strict money laundering restrictions which are forced upon conventional finance.

As any individual or organisation seeking to open a bank or investment account knows, disclosure requirements are intrusive and exhaustive. Even the smallest accidental discrepancy can lead to the closure of a bank account which has been operating for many years.

Related Articles

HOW THIS IS MONEY CAN HELP

HSBC fell foul of US authorities over money laundering for Mexican drug cartels a decade ago. Then in 2019, Standard Chartered paid fine of nearly £1 billion for Iran sanctions-busting. As a result of such appalling behaviours compliance and enforcement in mainstream banking is, if anything, over-zealous.

Cryptocurrencies and their platforms have become the new frontier in the battle against financial crime. It was not meant to be like this. When the idea of computer-generated currencies first emerged after the great financial crisis it was seen as a breakthrough for finance and mankind.

Blockchain recording of transactions – a form of distributed ledgers – was seen as offering transparency and the way forward when financial transfers were moving online.

It has not worked like that. Bitcoin and its imitators have been a speculator’s dream.

The computing power required to create crypto has put it on the wrong side of zero carbon. But most disturbing of all, it has offered criminal elements and terror groups a refuge from the authorities. The US Department of Justice’s action against Binance last month cast a light on an unregulated corner of finance.

Binance’s controlling mind Changpeng Zhao pleaded guilty to money laundering charges and will pay a £40 million fine after his platform was colonised by Islamic State and Hamas. He was penalised a further £120 million by the Commodity Futures Trading Commission and he has since stepped down as head of Binance.

Yellen saw the Binance case as sending a message to the virtual currency industry that the US will no longer tolerate such behaviours. Zhao wants to leave for the United Arab Emirates, but must remain in the US until February pending a sentencing hearing.

Far from ending abuse, the villainous behaviour of Binance, which arguably cost thousands of innocent lives, has done nothing to end the crypto fiasco.

Tom Alexandrovich, head of Israel’s cyber defences, said there has been a ‘super’ increase in crypto funding for terrorism since the conflict began.

Crushing Bitcoin and other crypto finance for terrorism is like playing the fairground game of ‘Whack a Mole’. As soon as one platform is put under special measures another pops up. A new fast-growing network called Tron is now being used to finance Iran-backed groups including the enemy on Israel’s northern border Hezbollah as well as Hamas. Israel’s Bureau for Counter Terrorism Financing froze 143 Tron wallets – a fancy name for accounts – between July 2021 and October 2023.

Based in the British Virgin Islands, Tron agrees that it could be used for ‘questionable activities’.

But it also says it does not have control over who uses the facilities and is NOT linked to groups identified by Israel as responsible for the October 7 assaults.

Yet two-thirds of Israel’s 87 Tron seizures this year have allegedly involved Hezbollah, Hamas and Islamic Jihad.

All of this is having very little impact on market prices. Bitcoin has rallied strongly in recent months. The geo-political trauma has given it a new lease of life and cryptocurrencies remain the preferred conduit for terrorists.

The collapse of cryptocurrency exchange FTX – and the subsequent fraud trial – coupled with the Binance scandal have done little to suppress this evil.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.