In Europe, however, consumers are just starting to feel the pinch from higher energy costs. Moreover, the war in Ukraine feels much closer. As for the UK, despite the dire warnings, nothing has really happened yet. That is about to change. As Brits deal with rising household energy bills, higher food prices, more expensive mortgages and tax hikes they face the most almighty new year hangover.

From the year behind us: How Target and Walmart became victims of their own supply-chain success: The mountain of inventory that US retailers had to grapple with was laid bare in May when Walmart Inc. and Target Corp. warned on profit after a pullback from consumers in the spring coincided with stock arriving late into US ports. Almost overnight, they went from seeing their profits stuck on a ship in the Pacific to languishing on the shelf.

Fashion hasn’t been this fashionable since Sex and the City: Spending more on essentials, under pressure consumers reined in their appetite for the items they simply wanted. But on both sides of the Atlantic, many people still had strong personal balance sheets and were keen to spend their pandemic savings making up for all the fun they had missed out on over the past two years. That meant swapping sweatpants for smart suits and chichi dresses.

Crypto meltdowns claimed Rolex and Patek Philippe as victims: It wasn’t just mid-market retailers that suffered a change in fortunes. As stock markets stumbled and crypto-currencies slumped, appetite evaporated for in-demand timepieces, such as the Rolex Daytona.

The rich seem to be living in a different world to other consumers, but the Rolex retrenchment could be a warning sign for other coveted items, such as luxury handbags.

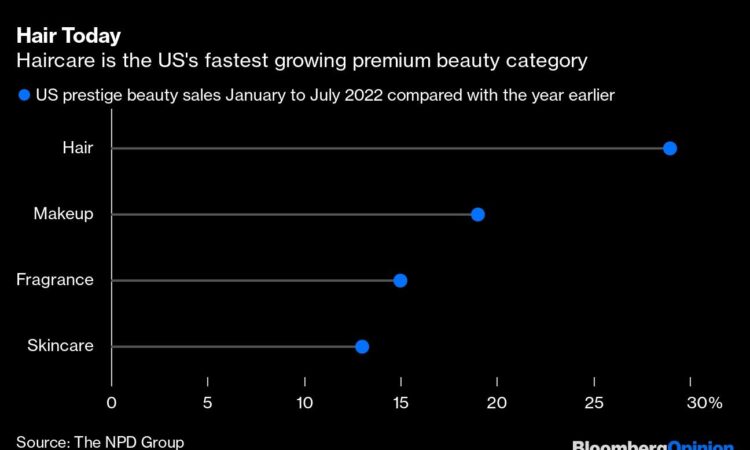

Our lipstick obsession says a lot about the economy: Some parts of the consumer economic are still going strong, such as beauty. These categories tend to do well when times are tough, as women – and men – trade down from more extravagant purchases to small treats.

This time round, not only is lipstick flying off the shelves as economies reopen, but perfume and hair styling products are proving to be popular pick-me-ups. Fragrance Index or Bouncy Blowout Effect anyone?

Walmart has a cartful of reasons to love inflation: Here’s one I got spectacularly wrong: I predicted that Walmart would be a winner from inflation. Unfortunately, I didn’t factor in the surfeit of stock. My bet for 2023 is that this prophecy will look less foolish. Already Walmart is attracting more middle-class consumers as they trade down to its low prices. It also sells fewer discretionary items than Target, which should put it in good stead. What’s more, being the world’s biggest retailer, Walmart has the most clout with suppliers. As branded manufacturers start to see their volumes decline, and are prepared to offer more promotions to stimulate sales, Walmart will be in a strong negotiating position. Over the coming months, watch what happens in the Walmart grocery aisle. It may look very different from 2022.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andrea Felsted is a Bloomberg Opinion columnist covering consumer goods and the retail industry. Previously, she was a reporter for the Financial Times.

More stories like this are available on bloomberg.com/opinion