(Bloomberg) — Money managers from Citigroup Inc. to Morgan Stanley are positioning for peak inflation and a less aggressive monetary policy from the Federal Reserve: Their first port of call is emerging-market currencies.

Most Read from Bloomberg

Citigroup strategists including Luis Costa downgraded their dollar position from overweight back to neutral in the bank’s model portfolio. The move came on Monday amid a risk-on shift that saw equities and bonds shrug off a string of bad news — from China’s affirmation of its strict Covid Zero policy to hiccups in US corporate performance.

It follows a call from Morgan Stanley analysts last week, including James Lord and Filip Denchev who raised developing-nation currencies to neutral from bearish against the dollar, saying the worst is over for them.

Citigroup said the calming of the Treasury market and the nearing of an end to the Fed hiking cycle made them expect a return of investors into emerging-market currencies, especially ones which occupy heavily underweight positions in portfolios.

“This is why we are bringing our overweight dollar stance back to neutral in our model portfolio,” they said. “We are now positioned flat on the currency front in our model portfolio.”

Growth Model Flips to Modestly Bearish on the Dollar: JPMorgan

Lord and his colleagues at Morgan Stanley said investors can start to “lean against” dollar strength as less aggressive monetary policy “should result in more stable markets,” they wrote in a note. Emerging-market currencies are now “more or less in line with our current year-end forecasts” and the analysts don’t see an attractive risk/reward in cutting those projections just to maintain a bearish view.

“The relatively mature phase of the Fed hiking cycle and relatively fair pricing for US terminal rate expectations suggest poor risk-reward in continuing to build long dollar positions,” the strategists said. “Additional emerging-market currency weakness from current levels looks unlikely.”

READ: Era of Peak Yields Signals Entry Point for Emerging-Market Bets

Both Citi and Morgan Stanley’s stances reflect growing optimism that an end to the Fed’s tightening campaign is coming into view and emerging markets can rebound from their cheap valuations.

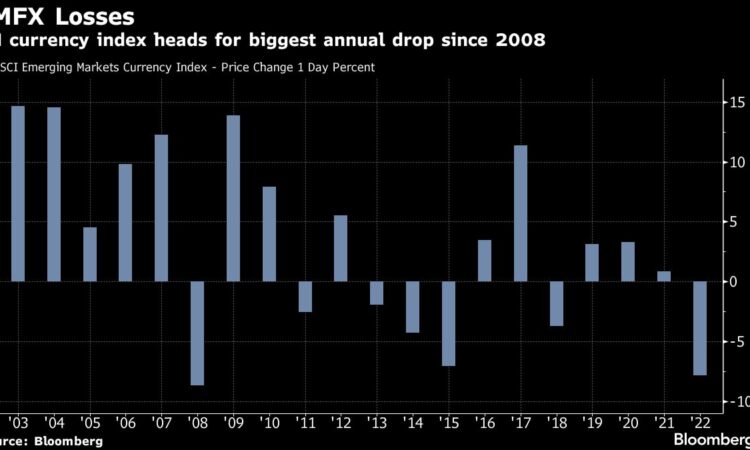

A strengthening dollar, the yuan’s relentless slide and war in Ukraine have been a toxic mix for emerging-market currencies this year. Only four of the 23 developing-nation exchange rates monitored by Bloomberg have made any headway against the greenback in the year to date. MSCI’s gauge of emerging-market currencies has weakened about 8% this year, near the record annual drop of 8.7% posted during the 2008 crisis.

–With assistance from Akshay Chinchalkar and Netty Ismail.

(Updates with Citigroup’s view; An earlier version of the story was amended to clarify when Morgan Stanley made its original call)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.