Summary of key points: –

- Chinese negativity quickly forgotten by currency markets

- “Short-sold” Kiwi dollar market speculative positioning increased

- Lower inflation and softer jobs set to continue in the US

- The RBNZ were selling the Kiwi dollar again in August

Chinese negativity quickly forgotten by currency markets

There has been a rapid shift in sentiment and direction of the Kiwi dollar over the last two weeks, switching from the NZ dollar underperforming the Euro and UK Pound against the US dollar, to decisively outperforming those two currencies.

A month ago, the NZ dollar and Aussie dollar were being singled-out and hammered downwards in global forex markets as the financial media speculated that the Chinese economy was in serious trouble and was imploding-in on itself. The antipodean currencies are always speculated against when the news out of China is bad, as our economies (and therefore currencies) are seen as heavily reliant on China.

The NZD/USD exchange rate depreciated to a low of 0.5868 on 7th September and the AUD/USD rate was sold-down to a low of 0.6360 on the same day. However, since that time the earlier economic deterioration in China has stabilised and the earlier wild speculation about economic contagion has stopped. The Chinese Government authorities have stepped in to “shore-up” matters, as we thought they would. The attention of the media and financial/investment markets has therefore swung away from China to the economic concerns in the UK and Europe. The EUR has continued to weaken against a strong USD as the European Central Bank hinted at no further interest rate increases after their latest lift to 4.00%. Whilst the Aussie dollar did dip below the previous low of 0.6360 last week, the Kiwi found some buying support at 0.5900 and has since appreciated back up to 0.6000.

Evidence of the sudden turnaround in the Kiwi dollar’s fortunes is seen in the NZD/GBP and NZD/EUR cross rates. Both cross-rates dropping sharply when the China factors sent the Kiwi lower in July and August, however reversing higher over the last two weeks (refer charts below).

In the short-term, two events may add to the renewed Kiwi dollar positivity, this week’s RBNZ interest rate review and the following week’s NZ general election. The RBNZ will not be increasing the OCR from 5.50%, however they cannot be too satisfied at the still persistent high inflation after 12 months of tightening monetary policy. The rebound in the Kiwi dollar may also be an element of the “smart money” buying up an under-valued currency in anticipation of a change of Government to a more business-friendly centre-right coalition. Whilst the NZ economy is not exactly expanding currently, business confidence is lifting and the negative impact from China appears to have been much exaggerated and over-rated.

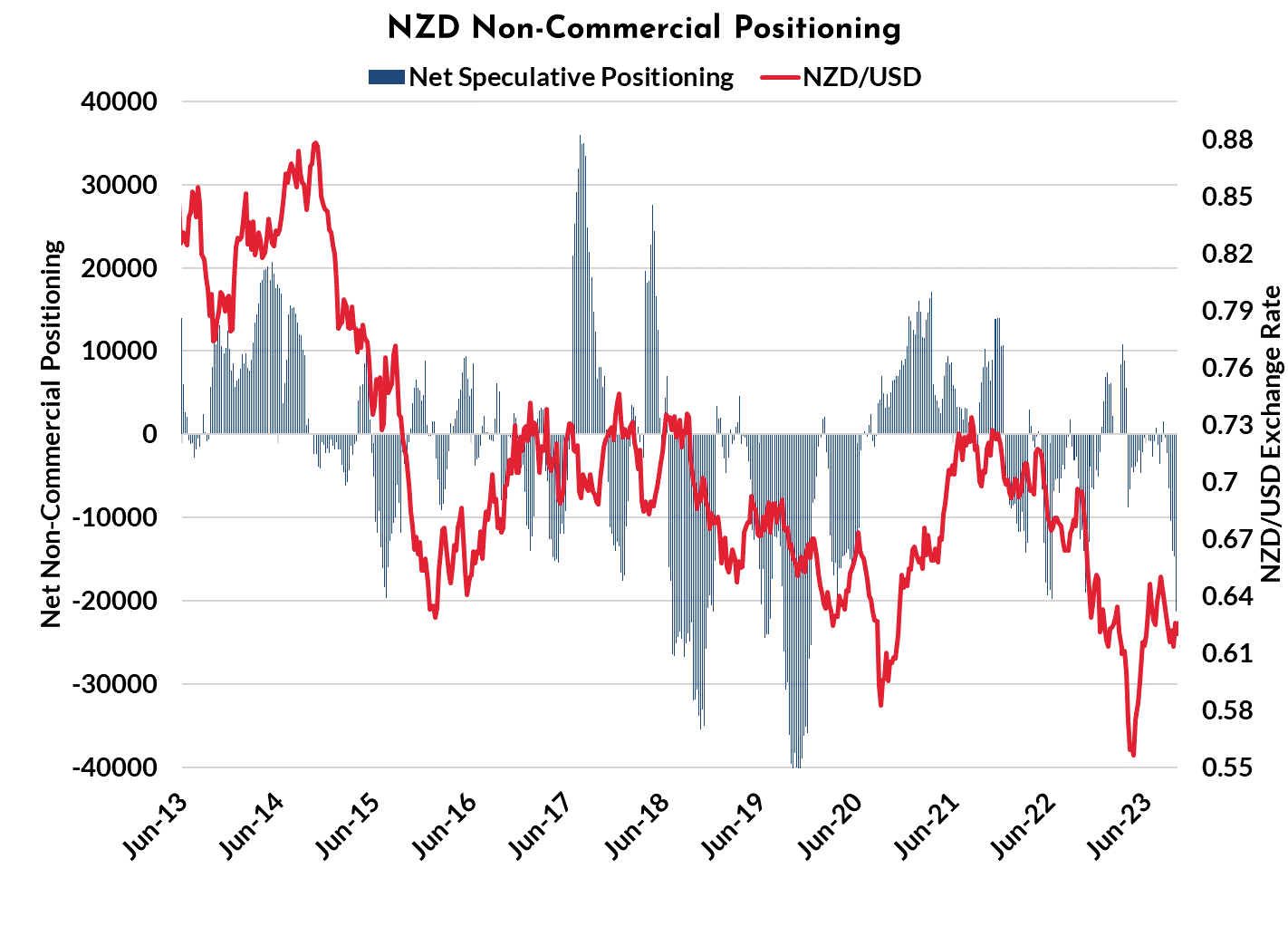

“Short-sold” Kiwi dollar market speculative positioning increased

The negative Chinese economic news three weeks ago has also encouraged currency speculators to add to their “short-sold” NZ dollar positions. The chart below (blue bars) confirms the significant increase in the number of open futures contracts over the last two weeks from near zero to -20,000 open short-sold positions. What is interesting is the fact that despite the heavy speculative NZD selling volumes, the NZD/USD exchange rate has not gone down. In fact, the opposite has occurred, with the Kiwi dollar appreciating back to 0.6000. The only conclusion is that somehere else in the world, away from US futures markets, there are some large Kiwi dollar buyers outweighing the sellers.

If you were a London-based hedge fund looking for opportunities to buy under-valued or over-sold currencies to shift away investments from the UK Pound or Euro, the NZ dollar and the Aussie dollar would be stand-out contenders right now. It is not hard to imagine that the large NZ dollar buyers are coming from these types of sources.

Interest rate differentials always play a central role in currency movements and the NZD and AUD have lost ground over recent months from the view that our interest rates are going no higher, whereas US market interest rates have increased and the Fed member’s recent dot-plot of interest rate forecasts had their rates higher for longer next year. However, perhaps we are already starting to see FX markets pricing the NZD and AUD higher as they anticipate a higher probability of our interest rates still having to increase to get the sticky, wage-push inflation down. Weaker economic trends in the US would suggest the opposite from here for US interest rates.

Another one cent gain by the Kiwi dollar to 0.6100 would trigger “stop-loss” NZD buy orders placed by the currency punters to close-out their sold NZD positions entered in recent weeks.

The Australian interest rate markets are forward pricing a 40% chance of a further 0.25% hike by the RBA in October and a 65% chance of one by December. New RBA Governor, Michelle Bullock’s first meeting this coming Tuesday may well deliver a message that increases those odds.

Lower inflation and softer jobs set to continue in the US

US CPI and PCE core inflation measures continue to trend down, in complete contrast to those Fed members who must see inflation reversing upwards again to support their “higher for longer” interest rate forecast for 2024. Outside of the impact of the temporary higher oil prices, there is nothing to suggest that constrained supply or excessive demand in the US economy is going to cause consumer prices to increase again. Household spending and sentiment is more likely to weaken over coming months under the weight of Covid-related savings running out and credit card/auto loan arrears, defaults and delinquincies all increasing to above 2009 GFC levels. Add on 7.50% interest rates for new mortgages all but stopping new home-building activity, it is not hard to construct a case for the recent steep rises in US market interest rates completely reversing in direction. Lower US interest rates from here equates to a weaker US dollar value.

US Non-farm Payrolls jobs numbers for September on Friday 6th October will confirm the significant slowdown of new jobs being created in the US economy over recent months. Consensus forecasts are for only 150,000 to 165,000 new jobs, well below historical averages. ISM manufacturing and services survey data earlier in the week is also expected to print on the weaker side, as higher US interest rates take their toll on economic activity. There have been some reports that the US dollar has strengthed of late because the US economy is demonstrating that it can handle high interest rates better than others. Upcoming softer economic data may cause a revision of that viewpoint.

The RBNZ were selling the Kiwi dollar again in August

The ill-conceived and irresponsible selling of the Kiwi dollar (NZ$4 billion) by the RBNZ to buy US dollars to increase their foreign currency intervention reserves in one “jumbo hit” in July (reported in our 17 September commentary) continued into August. The RBNZ war chest of foreign reserves was increased by another NZ$874 million during August. Westpac’s FX Strategist and Chief Economist don’t believe the FX tranactions have ruffled the NZD forex markets. However, as we have previosuly stated, the NZD/USD exchange rate is around two cents lower today due to this specific RBNZ NZD selling, compared to where it would otherwise be trading at on general USD movements. It is somewhat surprising that Westpac are commenting about this in the public arena/media, as the bank was most probably a counterparty to the FX deals with the RBNZ and client confidentiality rules would typically prevent comment.

Let’s hope that the new Government after 14 October will add this debacle to their review of the RBNZ’s mandate and operations (removing the specific employment target). Motorists paying much more for their petrol at the pump can thank the RBNZ for pushing the NZ dollar down, adding to the already substantial increases from higher crude oil prices.

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.