InsightShippingChinaFood SecurityUSTrade

16 May 2023

The US dollar is nowhere close to being dethroned as the dominant reserve currency and standard for global trade. But a series of recent moves by China signal that countries around the world are newly open to exchanging goods for yuan, rather than US dollars.

Cementing yuan-based trade relations with additional countries furthers China’s goal to diversify its sources of agricultural imports away from the US, an important part of China’s push for increased food security.

China also has increasingly promoted global usage of the yuan, also known as renminbi, in an effort to make it one of the world’s reserve currencies, potentially even challenging the US dollar. In line with this, China has expanded foreign investors’ access to its commodity exchanges, including trading of yuan-denominated contracts for a host of agricultural commodities.

Among recent developments, Argentina agreed to start paying for imports from China in yuan, rather than dollars, which has historically been the currency of trade. Brazil has made similar arrangements with China, and Egypt has said it is considering approving trade in the currency of a number of its trade partners including China and Russia.

Beijing also recently signed a deal to pay for liquified natural gas (LNG) from the United Arab Emirates in yuan, a small step in Chinese President Xi’s pursuit to end the era of the “petrodollar.”

Among factors underlying various countries’ willingness to forsake the dollar in global transactions is the strengthening of the currency following US interest rate hikes, which has bloated dollar-denominated foreign debt and worsened trade balances for many countries. Taken together, these factors have led to a number of countries facing a scarcity of dollars.

While the US currency’s dominance has been challenged before during times of high relative value for the dollar and geopolitical uncertainty, China appears to be making some strides in taking advantage of the current situation.

In the case of Argentina, drought-hit corn and soybean crops are depriving the country of needed exports to earn foreign currency at a time when the country’s foreign exchange reserves dropped by 15% between December and March, according to the IMF. Brazil’s yuan-based trade agreements appear to be an acknowledgement of the growing value of its trade with China, which includes soybeans and corn as well as commodities such as iron ore.

Egypt also has seen its foreign exchange reserves plunge by 40% from a peak in 2019, before the COVID pandemic. The North African country, which counts China and Russia among its major trade partners, is a net importer of energy and agricultural products.

Import tariffs on commodities that are priced in US dollars tend to drive a country’s food price inflation higher when translated into the local currency. For Egypt, that has helped drive food prices up by 167% since the beginning of 2020, when global food price rises began to accelerate, according to Gro’s Agricultural Price Inflation Application.

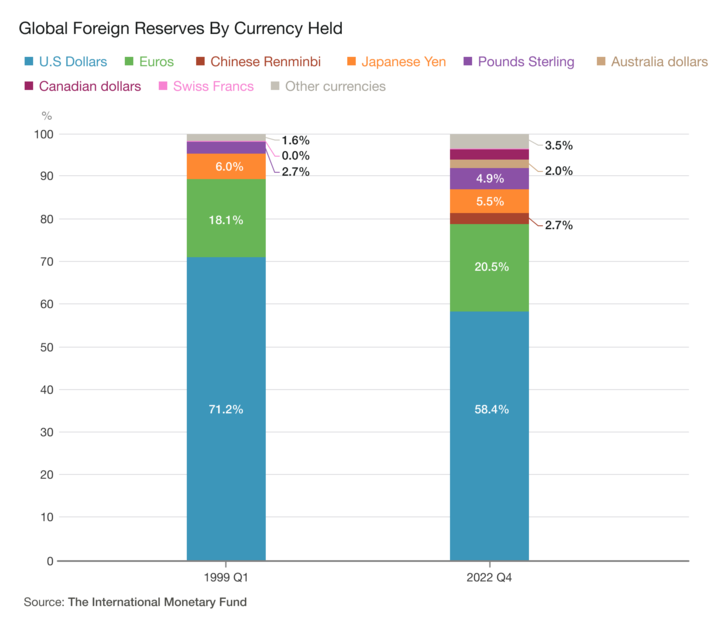

For now, the United States remains the world’s leading economy, with an extensive and relatively stable banking system, that helps maintain the US dollar as the dominant currency in global trade and finance. The dollar — at nearly 60% — still represents the lion’s share of global foreign exchange reserves. By contrast, the Chinese yuan declined between Q1 and Q4 2022 to 2.69% from 2.87% and lags the euro, the Japanese yen, and the British pound as a reserve currency. (See chart below.)

The role of the dollar in global trade is even more pronounced, accounting for 96% of trade transactions in the Americas, 74% in the Asia-Pacific region, and 79% in the rest of the world, excluding Europe where the euro dominates, according to Federal Reserve data for 1999-2019.

The Chinese renminbi represented 2.7% of global foreign exchange reserves at the end of 2022, below the Japanese yen, British pound, and, especially, the US dollar, which stood at 58.4%.