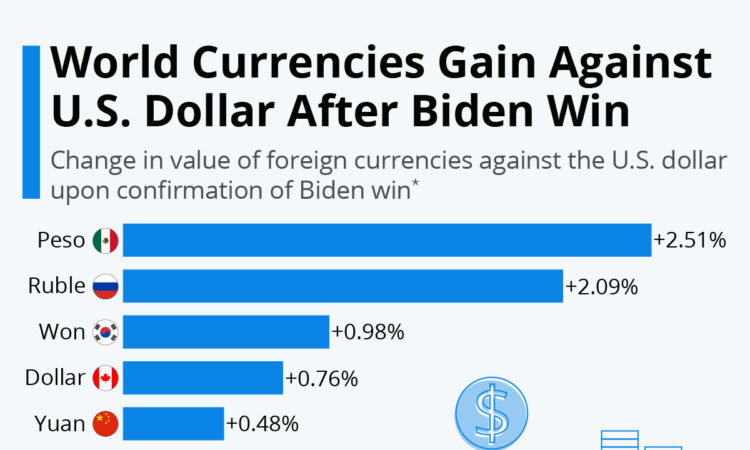

On a first day of regular trading after Saturday’s announcement that Democrat Joe Biden had won the 2020 U.S. presidential election, world currencies showed a tendency to gain on the dollar. Major currencies trended up at the commencement of weekday trading, with the Mexican Peso and – surprisingly – the Russian Ruble – having shown some of the highest peaks as of 2 p.m. CET. The normalization of trade relations and less volatility expected under Biden are reasons for currencies becoming more valuable in relation to the dollar across the board.

Asian currencies also showed gains, with the South Korean Won temporarily trending almost 1 percent above Friday closing after a full day of trading on the Asian markets. Expectation of a trade-friendly Biden administration and an end to China tariffs had caused Asian stock markets to start a rally even before the weekend, while also increasing a demand for local currencies deemed to gain importance again in a post-Trump world economy.

The Nikkei gaining more than 2 percent on Monday was well-received among traders, while an upward-trending Yen caused concerns in export-oriented Japan that has been battling a deep COVID-19 recession. As of Monday, the Yen had only increased in value slightly, but it remains to be seen how the currency will be valued against the dollar in the medium term. Not all currencies stayed above Friday’s closing levels throughout the day Monday.

A 2017 analysis shows that the Mexican Peso lost most value against the dollar by Trump’s inauguration time, while the Russian Ruble gained most. Despite a tougher stance on Russia expected from Biden, the differing reaction could be explained with the lack of reports of Russian election interference in 2020, according to the Moscow Times.