The de-dollarization of the world economy has been thrust back into the spotlight with the BRICS summit, which took place in Johannesburg, South Africa, in late August. While lacking a spot on the agenda, decreasing the prevalence of the U.S. dollar in trade and financial transactions among the Global South was repeatedly referenced by the world leaders in attendance, for example Brazilian President Luiz Inacio Lula da Silva, who even called for a new common currency for the BRICS bloc.

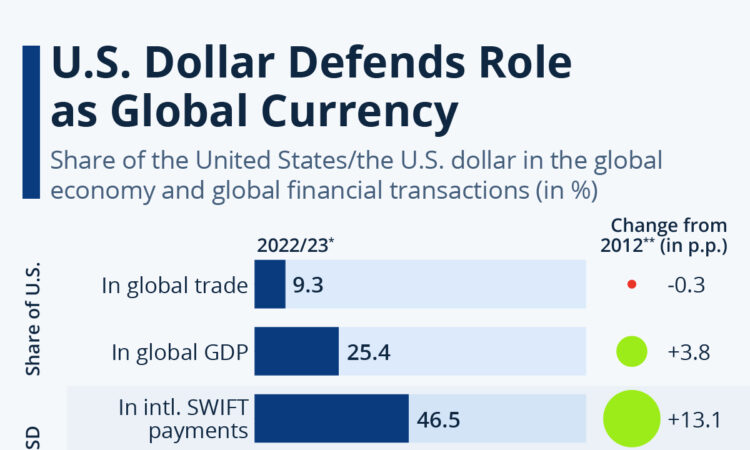

Looking at trade and transaction data for the U.S. dollar in the past ten years, the currency has so far defended the major role it plays in international markets. The U.S. share of global GDP stands at around one quarter while the country’s share in global trade in commodities and commercial services is lower, at around 10 percent. In this light, the U.S. dollar’s outsized role in global trade, reserves and currency exchange that extends far past its country of its origin becomes apparent. Due to the United States’ importance in global capital markets and international debt, the dollar continues to play a significant role internationally, Reuters reports.

In July, international SWIFT payments in U.S. dollars hit a new all time high of 46.5 percent of all payments, up more than 13 percentage points since December 2012. The Chinese yuan, an obvious competition to the dollar, also reached a new high – albeit at just 3 percent of all international payments.

An area where the yuan has been more successful – yet also on a small-ish scale – has been foreign reserves. Here, the U.S. dollar has lost 2.5 percentage points in 10 years and 7.5 percentage points in 20 years, while the Yuan climbed from 1.1 percent of international foreign reserves at the end of 2016 to currently 2.6 percent. The biggest – and a very stable – footprint of the dollar is in foreign exchange transactions, more than 88 percent of which involved the currency in 2022.