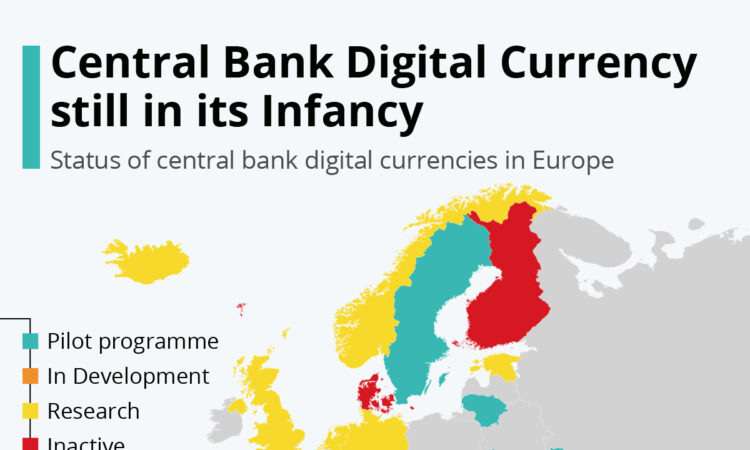

Just 15 European countries are currently participating in developing a central bank digital currency (CBDC). This digital currency is comparable to Bitcoin or Ethereum but is issued and backed by an official central bank instead of created on a decentralised blockchain. While some countries have already launched pilot programmes, the D-Euro proposed by the European Central Bank has only managed to elicit a lacklustre response.

The technology behind the D-Euro, which will not be rolled out before 2026, is conservative and more akin to a PayPal-like digital bank account than a blockchain wallet. While France is actively invested in experimental programs involving the D-Euro, other countries like Germany are more sceptical. Sweden, Lithuania and the Ukraine have already started preliminary rollouts of their respective e-currencies, while the United Kingdom is currently researching ways to implement a centralised digital currency. Though there’s no word if the Bank of England will go ahead with a concrete plan, it launched a CBDC taskforce in April 2021 and, according to a recent paper, will continue to investigate the pros and cons of digital money.

Up until now, only five countries have launched their own CBDC. DCash is available in St. Kitts and Nevis, Antigua and Barbuda, St. Lucia and Grenada as of March 2021, and the Bahamas’ Sand Dollar has been around since 2019.