- This weekly round-up brings you the latest stories from the world of economics and finance.

- Top economy stories: Big central banks pause interest rate rises; Surprise slowdown in Eurozone inflation; Japan to roll out economic stimulus package.

1. Big central banks pause interest rate rises

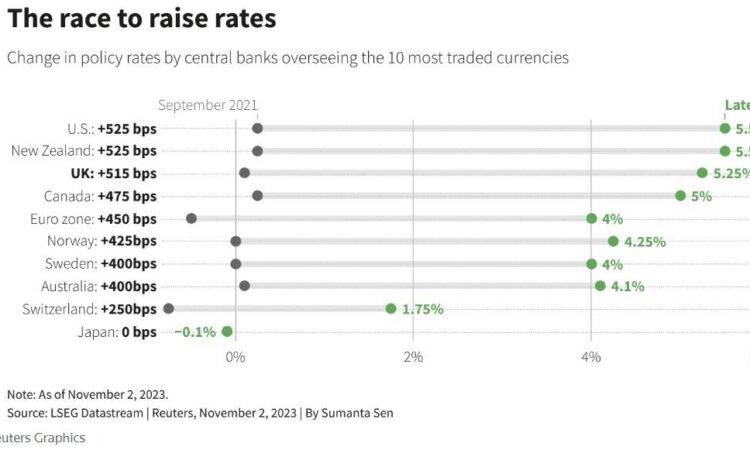

The world’s three major central banks have kept their interest rates unchanged this week. The US Federal Reserve, European Central Bank (ECB) and Bank of England (BoE) all decided to hold still as they wait to see how inflation trends develop.

The Fed’s benchmark overnight interest rate remains at 5.25-5.50% as it watches job and price data, Reuters reports. “Inflation has been coming down, but it’s still running well above our 2% target,” Fed Chair Jerome Powell said. “A few months of good data are only the beginning of what it will take to build confidence.”

The ECB’s decision to pause on rate hikes brings to an end a run of 10 rises in a row. Its deposit rate remains at a record high of 4% while its main rate is 4.5%.

But talk of impending rate cuts is “totally premature”, ECB President Christine Lagarde said. Instead, rates will likely sit at current levels for the next few months as the bank waits for confirmation that inflation heading downwards, Dutch ECB governing council member Klaas Knot says.

BoE rates remain at a 15-year high of 5.25%, following the second rate freeze in as many months, on the back of 14 consecutive rises. However, there was talk of more rises as the bank looks to tame what it sees as overly high inflation of 6.7%.

“We will be watching closely to see if further increases in interest rates are needed,” BoE Governor Andrew Bailey said. “But even if they are not needed, it is much too early to be thinking about rate cuts.”

2. Surprise slowdown in Eurozone inflation

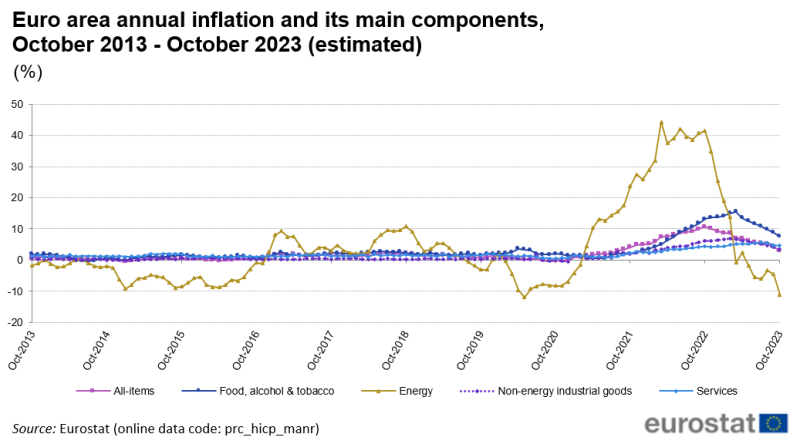

Eurozone inflation fell to a more than two-year low of 2.9% in October. This is far below the 4.3% recorded in September and down from 9.2% for the whole of 2022.

The swift decline was led by an 11.1% drop in energy prices. Food, alcohol and tobacco showed the highest inflation at 7.5%, although this was down from 8.8% in September.

The decline shows the impact of interest rate hikes by the European Central Bank (ECB) – up by 4.5 percentage points since July 2022.

But the sharp drop in inflation has other possible implications – namely a potential recession, with the eurozone economy contracting by 0.1% in the third quarter.

Some relief may come from the ECB appearing to have paused its rate rises (see lead story). But price pressures remain high and the conflict in the Middle East could result in energy prices being forced upwards, ECB President Christine Lagarde says.

“The fact that we are holding doesn’t mean to say that we will never hike again,” Lagarde adds. “Sometimes inaction is action. A decision to hold is meaningful.”

3. News in brief: Stories on the economy from around the world

Japan will roll out a larger-than-expected economic stimulus package as it looks to generate growth and help reduce the sting of inflation. The $113 billion programme will include income and residential tax rebates, Bloomberg reports.

China’s economy showed further signs of a slowdown, with manufacturing activity shrinking unexpectedly in October. The official purchasing managers’ index dropped to 49.5 from 50.2 in September, with anything below 50 indicating contraction. New export and import orders dropped for the eighth month in a row.

Canada could enter recession in the third quarter, after economic growth came to a standstill in August and July GDP was revised down to marginally negative. High-interest rates, inflation, forest fires and drought conditions hurt growth in August, Statistics Canada said.

Germany’s GDP dropped by 0.1% in the third quarter, edging the economy towards a recession. And German unemployment increased by a larger margin than anticipated in October. Another 30,000 people joined to jobless list, double the expected amount, pushing the seasonally adjusted unemployment rate to 5.8%.

US unemployment claims have risen to a six-month high. However, some economists claim the increase is down to seasonal variations and that a similar trend was seen last year.

The financial services industry is facing several future risks, including vulnerabilities to cyberattacks due to artificial intelligence and new financial products creating debt.

The World Economic Forum’s Centre for Financial and Monetary Systems works with the public and private sectors to design a more sustainable, resilient, trusted and accessible financial system worldwide.

Learn more about our impact:

- Net zero future: Our Financing the Transition to a Net Zero Future initiative is accelerating capital mobilization in support of breakthrough decarbonization technologies to help transition the global economy to net zero emissions.

- Green Building Principles: Our action plan for net zero carbon buildings offers a roadmap to help companies deliver net zero carbon buildings and meet key climate commitments.

- Financing biodiversity: We are convening leading financial institutions to advance the understanding of risks related to biodiversity loss and the opportunities to adopt mitigation strategies through our Biodiversity Finance initiative.

Want to know more about our centre’s impact or get involved? Contact us.

Mexico’s GDP has now grown for eight quarters in a row, following a 0.9% expansion in July-September. Healthy domestic consumption and strong industrial activity are driving Latin America’s second-largest economy.

New measures to prevent bank runs are under consideration by Swiss authorities. Their discussions follow the UBS takeover of Credit Suisse this year, with options including staggering withdrawals over longer periods and charging fees to shut accounts, Reuters reports.

Almost $400 billion is the amount developing countries will need to adapt to climate change, according to the UN. Its estimate of $387 billion is $47 billion higher than it was a year ago, and 10-18 times higher than current flows in international public finance, the Financial Times reports.

4. More on finance and the economy on Agenda

The economic toll of extreme weather has grown substantially, reaching nearly $1.5 trillion in the decade to 2019, according to a World Meteorological Organization report.

Central bank digital currencies (CBDCs) offer potential benefits for financial inclusion, but some concerns need to be considered. Governments and central banks should be transparent and honest about the potential advantages and risks of digital currencies to build public trust in CBDCs.

Institutional investors and a limited group of individuals have long enjoyed the return and diversification benefits of private markets. But, retail investors should be able to share in those benefits to help build their wealth and ensure long-term financial security.