By the time dozens of top security officials from across the globe touched down in Saudi Arabia to attend a conference on Ukraine this month, Crown Prince Mohammed bin Salman’s main task was complete.

At a similar but smaller gathering in Copenhagen in June, France had asked Riyadh to help pull together a follow-up in the belief that some nations from the so-called global south, including China, would be more comfortable attending if it was organised outside of Europe.

Prince Mohammed duly delivered — personally intervening to help convince Beijing to send a representative, according to diplomats. In all, officials from 42 states, including many that have resisted western pressure to take sides on Russia’s war in Ukraine, attended the gathering in Jeddah.

By the talks’ end, there were few discernible developments beyond China hinting that it may be willing to take part in future discussions. But for Prince Mohammed the two-day gathering was an undoubted success. It gave the young Saudi royal the perfect stage to project his worldview — one that envisages the kingdom as a rising power whose influence stretches from east to west.

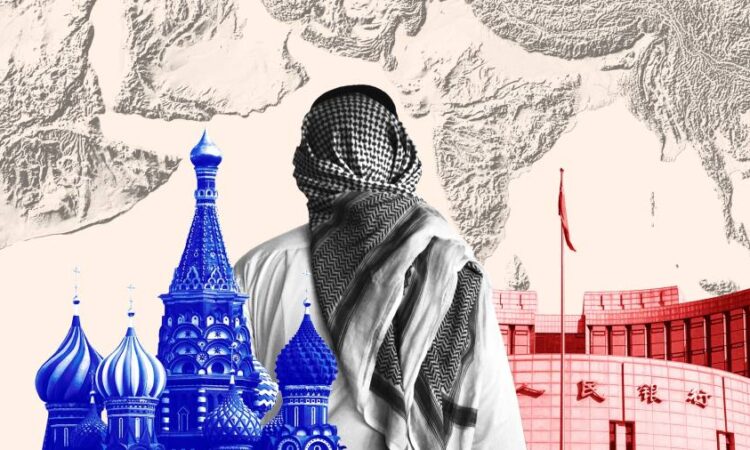

It is a mindset that reflects the lofty ambitions and soaring confidence of oil-rich Gulf states — buoyed by petrodollar windfalls after last year’s surge in energy prices — that are determined to chart their own courses in an era of polarising, shifting global dynamics.

The rise of the middle powers

This is the third in a series on how the stand-off between America and China has ushered in a new era of opportunity for countries around the world

Part 1: The à la carte world: our new geopolitical era

Part 2: China’s blueprint for an alternative world order

Part 3: UAE and Saudi Arabia — the Gulf powerhouses

Part 4 on Thursday: The fight to dethrone the dollar as the world’s currency

At the forefront are the Gulf’s two powerhouses: Saudi Arabia, the world’s top oil exporter, and the United Arab Emirates, the region’s dominant trade hub, both of whose focus has been increasingly turning eastwards.

Where others view the shifting global currents through the lens of risk, Riyadh and Abu Dhabi see opportunities as they leverage their financial muscle and abundant oil resources to strategically hedge against their traditional relations with the west.

The common theme in both Gulf states is one of self-assured, assertive leaders who are no longer willing to accept binary “with us or against us” US demands.

The UAE’s leader Sheikh Mohammed bin Zayed al-Nahyan has for years deployed his small state’s military prowess and financial firepower to ensure it punches above its weight. Equally, Prince Mohammed has been quick to deploy hundreds of billions of dollars in pursuit of grandiose plans to develop his nation, and wants it to be recognised as a top G20 power, economically and diplomatically.

Allies, but also increasingly economic competitors, both Riyadh and Abu Dhabi are bent on projecting their standing on the international stage through broader networks as so-called friends with all, and pursuing their own self-interest.

Partly driven by shifting trade patterns but also the result of geopolitics, it is manifesting itself in the diversification of ties with the US — long the dominant foreign power in the Gulf — and deepening relationships with Asian powers, particularly China and India.

“Saudi Arabia and the UAE see more opportunities than risks in this changing world order, and they think they have the policies and instruments to become poles of the emerging multipolar world,” says Emile Hokayem, director of regional security at the International Institute for Strategic Studies. “They have a very opportunistic, flexible and transactional approach. The time when one could expect full alignment from them is over.”

Building new bridges

The shift in the Gulf has been driven most visibly by trade. China — the region’s biggest trading partner — India and Japan have become the prime buyers of Gulf crude, while US oil imports from the region have declined over the past 15 years following the shale gas boom in North America.

Yet relationships with Asian powers have also developed far beyond oil, with the Gulf states thirsty for new technologies across artificial intelligence, energy, logistics and life sciences to support domestic development plans and diversify oil-dependent economies.

“Our ties to established markets are unshakeable,” says a senior Emirati official. But “at the same time, from a macro sense, where is new growth coming from if we look at the next 10, 20 years? It’s coming from big markets in Asia, some in South America, and potentially some African markets.”

Both the Gulf states have sealed “comprehensive strategic” partnerships with China. When Prince Mohammed hosted Chinese president Xi Jinping in Jeddah for a series of Arab summits in December, he said the gatherings launched a “new historical era” in relations with Beijing, adding that the kingdom was working on “enhancing co-operation to serve international stability”.

A Chinese official tells the FT that Beijing’s relations with the Gulf “are a model for the developing world and for participants in the Belt and Road Initiative”. Describing deepening co-operation on energy, infrastructure, finance, technology, the official says the Gulf and China “can help to build a fairer multilateral order in the Middle East that respects sovereign rights and resists the hegemony of certain powers.”

It is not just China that the Gulf nations are focusing on. The UAE, home to sovereign investment funds that manage more than $1.3tn, has signed free trade agreements with six nations, including India and Indonesia, in the past 18 months.

When Indian prime minister Narendra Modi visited the UAE in July — his fifth visit to the Gulf state in eight years — it was announced that the $850bn Abu Dhabi Investment Authority would establish a presence in Gujarat in the next “few months”. The only overseas office for Adia is in Hong Kong.

The two Gulf states are also seeking to join Brics, the economies that include China, India, Brazil, Russia and South Africa. Gulf officials say it is a logical move given global trade patterns, but also one that grants them a voice in an important — and welcoming — diplomatic network.

“Any country wants to be consequential, wants to have a seat at the table,” says Anwar Gargash, an adviser to Sheikh Mohammed, speaking about the UAE’s wider ambitions. “We want to build bridges with everyone.”

The trend has complicated US relations with traditional Arab allies, with divisions becoming more visible in the wake of Russia’s invasion of Ukraine.

Like Turkey and Brazil, “they don’t want to have to choose between the United States and China, they don’t want to have to choose a side in the Ukraine war,” says former US diplomat Jeffrey Feltman. “They, in fact, have some benefits to not making a choice, in the same way the United States liked having China and the Soviet Union to be able to leverage one against the other during the cold war.”

At the Ukraine war’s outset, the UAE rattled the Biden administration by using its temporary seat on the UN Security Council to join China and India in abstaining on a US resolution condemning Moscow, in an extraordinary expression of frustration with American policies.

Both Abu Dhabi and Riyadh have rebuffed western efforts to cajole them into abandoning Vladimir Putin, with whom they co-operate on oil through Opec+ and consider an important player — and potential spoiler — in the Middle East.

A month before Modi’s visit to Abu Dhabi, Sheikh Mohammed was telling the Russian president that he wished to build on the relationship with Moscow.

He was one of the few global leaders to attend the St Petersburg International Economic Forum which his adviser Gargash describes as a “calculated risk”. The UAE, like Saudi Arabia, offers itself as a mediator between Moscow and the west. “A lot of people would criticise him [for making] the trip,” he adds. “But Sheikh Mohammed was saying ‘I’m here to help in whatever way.’”

The US and them

For decades, the Gulf was firmly in the US’s orbit with relationships founded on the unwritten compact that Washington would be their security guarantor while Arab oil producers ensured stable global energy supplies. Saudi Arabia, once a staunch opponent of communism, only recognised China in 1990.

The UAE in particular actively carved out a role as arguably Washington’s closest Arab ally, taking part in every US-led military coalition since the 1991 Gulf war, bar the 2003 invasion of Iraq. Both Saudi Arabia and the UAE spent tens of billions of dollars on American military hardware, while investing much of their petrodollar surpluses in US assets.

Yet relations grew increasingly fractious after then President Barack Obama was perceived to have ignored Saudi and Emirati interests in the wake of the 2011 Arab uprisings. Ties were further strained by Obama’s decision to sign the 2015 nuclear agreement with their rival, Iran.

The mood improved after Donald Trump entered the White House and pursued transactional relationships, paid zero attention to rights abuses in the autocratic Gulf and abandoned the nuclear deal.

But Arab officials became wary of his unpredictability, frustrated by what they considered to be limp responses to attacks on tankers in the Gulf and Saudi oil infrastructure that were blamed on Iran.

His successor Joe Biden’s decision to shun Prince Mohammed and condemn abuses in the kingdom, particularly the 2018 murder of Jamal Khashoggi by Saudi agents, then pushed relations with Riyadh to new lows.

Last year, Washington’s sluggish response to missile and drone attacks on Abu Dhabi by Iranian-aligned Yemeni rebels infuriated Sheikh Mohammed, who has not visited the US since 2017, and exposed the absence of personal relationships that were traditionally core to US-Gulf alliances.

Tensions have since eased, but there remain points of friction. In May, the UAE pulled out of a US-led maritime task force over frustrations about its rules of engagement after Iranian forces seized two tankers in the Gulf.

Yet for all the testiness, all sides acknowledge they need each other. The Biden administration set aside its repugnance for Saudi Arabia’s human rights record to engage Riyadh on issues ranging from energy stability, regional policies and the Ukraine war, culminating in a frosty trip by the president to Jeddah last year. Washington has reassured Abu Dhabi of its commitment to the region’s security after the UAE suspended its participation in the naval task force and dispatched additional warships and fighter jets to the Gulf.

Saudi and Emirati officials also have no illusions about their dependence on the US for their main defence needs. Indeed, their demand is more not less: both Riyadh and Abu Dhabi are pushing Washington to agree to more institutionalised security partnerships.

The discussions with the UAE picked up after last year’s attacks on Abu Dhabi. US talks with Saudi Arabia are part of efforts to cajole the kingdom into normalising relations with Israel and, if successful, could be used by Washington to try and curb elements of Riyadh’s relationship with Beijing, such as military co-operation and technology transfers.

But Ali Shihabi, a Saudi commentator close to the royal court, says that while there could be “adjustments” if the US agrees to a security alliance with the kingdom, Riyadh would resist pressure to dilute ties with China.

“There’s no going back. Saudi Arabia will not give up the bridges it has built with the global south, with Russia or China, because those are integral to the functioning of the Saudi economy and to the kingdom’s long term market needs,” he says. “The Saudi leadership is much more independently minded; 10 years ago there was a whole generation that was just instinctively more deferential to American requests.”

The war in Ukraine has underscored to the Gulf what the US is capable of when committed to a cause. But the question at the core of Emirati and Saudi concerns is the extent of Washington’s commitment to their objectives.

“I don’t think that American economic, military or political power is less formidable today, or will be in the next 10 years, than it was in the last 10 years,” says Gargash. “What I’m trying to understand is what is the commitment to the region and the UAE.”

‘A delicate game’

It is not just American military hardware that binds the Gulf to the US.

The Gulf states peg their currencies to the dollar and continue to view the US as a key investment market. More than 40 per cent of Abu Dhabi’s investment fund wealth is deployed in the US. Many of Saudi Arabia’s $650bn Public Investment Fund’s high-profile investments have been in American assets, including stakes in Uber and electronic vehicle maker, Lucid.

Officials point out that Gulf’s state funds find it much easier to invest in the US than less liberalised Asian markets, particularly at the scale required to meet their ambitions. There is also acknowledgment that much of the kind of state-of-art tech the Gulf wants to tap into is being developed by American companies.

Yet Gulf trade with Asia is only heading in one direction, and sovereign funds across the region are ramping up their exposure to Asian markets.

In 2021, Saudi Arabia’s $81.7bn total trade with China briefly exceeded Riyadh’s with the US, the UK and the euro area combined, according to a report by London-based Asia House.

The report, released last year, added that it expected the UAE to follow a similar pattern, with the difference between Gulf’s state trade with China and with the US, the UK and the eurozone narrowing to a few billion dollars compared to $28bn in 2010.

And as the world transitions away from fossil fuels, the Gulf states know it is likely to be China and India that buy their last barrels of oil.

China has not sought to challenge or displace the US’s security role in the Middle East, but there are hints that it wants to move beyond traditional commercial partnerships. Its success in brokering an agreement in March for arch rivals Saudi Arabia and Iran to restore relations was interpreted by many as a sign of Beijing’s willingness to adopt a more political role in the region.

However, Gulf officials also recognise the dangers of getting caught in the crossfire of US-China rivalry, as the two global powers aim to “decouple” their economies.

“This risk is in all this decoupling conversation [in Washington] because suddenly if we are looking at two competing technologies, the world is turning into VHS and Betamax,” a UAE official says, a reference to home video format war in the 1980s.

Still, the Gulf states are willing to rankle Washington by deepening ties with Beijing and tapping into Chinese technology, such as 5G telecommunications networks. Two years ago, the UAE was forced to address US suspicions that China was building a military base at an Abu Dhabi port.

The UAE is this month conducting its first joint air exercise with China, according to Chinese state media. It was also reported that Saudi Arabia bought $4bn of weapons from China after the Zhuhai Air Show in November, which would make it far larger than previous Saudi-Chinese arms deals.

The message to the US from Riyadh and Abu Dhabi is, “We will come to you first, but if you don’t deliver we will go elsewhere,” analysts say, be it weapons or technology. They add that the Gulf states are not averse to playing one country off against another. But it is a fine balance.

“The fundamental strategic dilemma for them remains that their security is in the west, their energy politics is with Russia and their prosperity is increasingly with China and the rest of Asia,” Hokayem says.

“It requires careful footwork and constant engagement to manage these complex relationships. They have to massively invest in all those capitals, in political, economic and geoeconomic terms. It’s a delicate game.”

Additional reporting by Sarah White in Paris and James Kynge in London

Data visualisation by Keith Fray