Boost for holidaymakers as pound surges to new high: UK travellers urged to purchase foreign currencies now to lock in the best rates

By Mark Duell and John-Paul Ford Rojas

13:37 12 Jul 2024, updated 13:43 12 Jul 2024

The pound has climbed to its highest level in a year in a boost for UK holidaymakers – with experts advising tourists to start ‘purchasing their foreign currency now’.

Sterling rose to nearly $1.30 this afternoon after strong economic growth cast fresh doubt over when the Bank of England will finally cut interest rates next month.

The pound is now on course for its best two-week performance against the dollar in eight months since last November, and has now gained 2.4 per cent in a fortnight.

Sterling was up 0.36 per cent at $1.2964 by midday today, which was its highest level since July 2023 and made it one of the day’s best performing major currencies.

It comes after the Office for National Statistics revealed UK output is rising at the fastest pace for two years, with the pound also boosted by data showing US inflation fell more sharply than expected to 3 per cent last month – weakening the dollar.

The growth figures in Britain yesterday dented hopes that the Bank of England will cut interest rates in August. They remain at a 16-year high of 5.25 per cent.

At the same time, the drop in inflation in America suggested the US central bank, the Federal Reserve, may cut rates sooner than previously thought.

The result on the currency markets, where higher interest rates strengthen a currency while lower borrowing costs do the opposite, was a stronger pound and weaker dollar.

And financial experts pointed out that this was good news for Britons going abroad during the summer holidays, with two telling MailOnline that they should buy foreign currency now.

Anita Wright, an independent financial adviser at Bolton James, said: ‘For those eyeing European destinations, the current exchange rate means more euros for every pound exchanged.

‘Those exchanging larger sums of money will particularly benefit from the improved exchange rate. Given these favourable conditions, it is advisable for holidaymakers to consider purchasing their foreign currency now.

‘With the pound at a high, locking in the current exchange rate can protect against potential future declines. Although predicting currency movements with certainty is challenging, the present economic indicators suggest a window of opportunity for securing advantageous rates.’

Katy Eatenton, mortgage and protection specialist at Lifetime Wealth Management, had a similar view.

She said: ‘Brits heading across the Channel may want to think about exchanging their pounds into Euros now.

‘The pound is flying at the moment and could mean more pina coladas and moules frites.

‘Clearly, currencies are very volatile and the pound could rise even higher but now is not the worst time to buy. It may not save you a fortune on smaller amounts but every penny counts.’

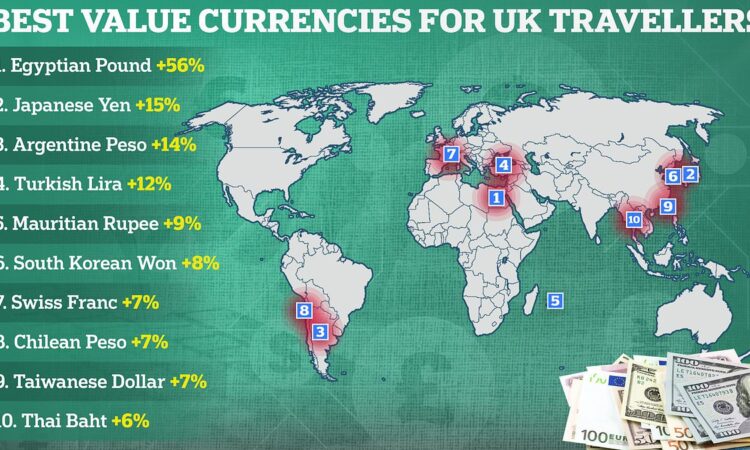

It comes as analysis by No1 Currency found the pound has strengthened against the currencies of 50 out of 54 top travel spots since the start of 2024.

Egypt has seen the biggest change, with sterling surging 56 per cent against the Egyptian Pound since January 1. Sterling has also risen 15 per cent against the Japanese Yen and 14 per cent against the Argentine Peso so far this year.

The pound has weakened against just a handful of currencies, losing 17 per cent of its value against the Kenyan Shilling and dropping 6 per cent against the Sri Lankan Rupee. It has also fallen 0.7 per cent against the South African Rand, and 0.2 per cent against the Kuwaiti Dinar.

Sterling has gone up 2.6 per cent against the Euro since the turn of the year, putting the Euro at 29th place and outside the top 25 best value currencies in 2024 so far.

Separate data from No1 Currency also showed a surge in the number of Britons exchanging sterling for Egyptian currency.

Purchases of Egyptian Pounds in No1 Currency’s network of more than 200 high street stores went up by 108 per cent in the first half of 2024 compared to the same six months last year, reflecting Egypt’s growing popularity as an holiday destination for Britons.

The company added that during the first six months of 2024, purchases of Japanese Yen and Chilean Pesos increased by 42 per cent and 37 per cent respectively compared to the same period last year.

Giving advice to UK tourists, Riz Malik, independent financial adviser at R3 Wealth, said: ‘What holidaymakers should do is research where they will get the best exchange rates.

‘This is usually by using cards for their transactions rather than the bureau de change at the airport. Shop around for a card with low fees for using abroad.’

And Joshua Gerstler, chartered financial planner and owner at The Orchard Practice, told MailOnline: ‘What is easier for most people nowadays is to use a card overseas, which does not charge commission on foreign currency and will give you a good rate on the day.’

In the UK, yesterday’s growth figures from the Office for National Statistics showed the economy grew 0.4 per cent in May, twice as fast as expected.

And for the three months to May, output was 0.9 per cent higher than in the previous three months, the strongest pace of growth since January 2022.

That could persuade wavering Bank of England rate-setters to hold off on cuts when they meet on August 1.

It is the latest dampener on market expectations of a cut, after hopes had been fuelled by a fall in inflation to the Bank of England’s 2 per cent target.

The futures market attaches a 52 per cent chance of an August cut from the Bank of England and an 88 per cent chance of a September one.

A week ago, those chances were at 61 per cent and 92 per cent.

Chancellor Rachel Reeves said yesterday that while the Bank was ‘rightly independent’, the public ‘would welcome some relief with lower mortgage costs’.

However, hopes of a cut have been dented – first by cautious speeches from Bank of England chief economist Huw Pill and fellow rate-setter Catherine Mann indicating that they were still worried about underlying inflation pressures.

And they took a further blow on the GDP figures, which added to evidence that the economy is bouncing back after a recession at the end of last year.

The UK enjoyed first-quarter growth of 0.7 per cent, described as ‘gangbusters’ by the ONS.

And Lee Hardman, a currency analyst at MUFG, said: ‘The pound has been supported by further evidence revealing that the UK economy is recovering more strongly than expected.’

Investment bank Goldman Sachs has now increased its forecast for UK GDP for 2024 from 1.1 per cent to 1.2 per cent.

Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, said: ‘These GDP figures may make an August rate cut less likely by providing rate setters, concerned about underlying price pressures, with sufficient confidence about the UK’s economic recovery to continue putting off loosening policy.’

Sterling has also been buoyed by the prospects for the new Labour government.

Shahab Jalinoos, global head of FX research at UBS Investment Bank in New York, said: ‘The UK now has arguably the most stable government in the G7 over the next five years, due to the size of the majority.’