Key takeaways

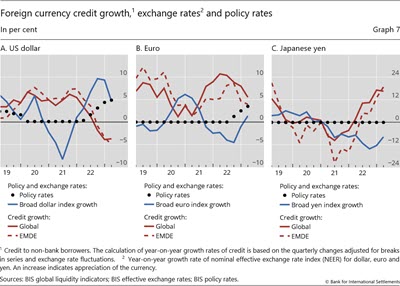

- The BIS global liquidity indicators (GLIs) show that foreign currency credit denominated in US dollars contracted year-on-year, while that denominated in euro expanded but at a slower rate. These developments are in line with rising funding costs and the strength of the respective currencies.

Global liquidity indicators at end-March 2023

The BIS global liquidity indicators (GLIs) track credit to non-bank borrowers, covering both loans extended by banks and funding from global bond markets through the issuance of international debt securities (IDS). The main focus is on foreign currency credit denominated in three major reserve currencies (US dollars, euros and Japanese yen) to non-residents, ie borrowers outside the respective currency areas.9

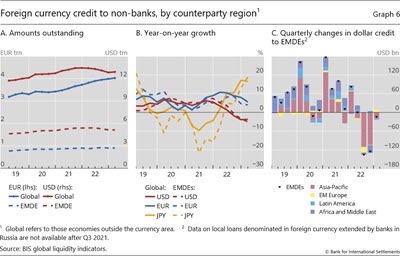

Global foreign currency credit in the three major currencies rose slightly in Q1 2023. The quarterly increase of $79 billion in US dollar credit to non-banks outside the United States left the outstanding stock at $12.9 trillion (Graph 6.A, solid red line). Even so, the yoy growth rate remained firmly negative (Graph 6.B, solid red line). Euro-denominated credit to non-banks outside the euro area also lost momentum (Graph 6, blue solid lines), bringing the stock to €4 trillion, 5.5% higher than the year before. In contrast, yen credit outside Japan continued to expand at a rapid pace (yellow line).

Foreign currency credit to non-banks in EMDEs remained fairly steady in Q1 2023 (Graph 6.A, dashed lines). Dollar credit inched down while euro credit rose slightly, leaving the respective stocks at $5.1 trillion and €0.9 trillion. Yet the yoy growth rates for dollar and euro credit continued to decline, with dollar credit shrinking at an annual rate of 5%. By contrast, the growth in yen credit accelerated further due to brisk bank lending (Graph 6.B, dashed lines).

The divergence in global foreign currency credit growth across the three major currencies continues to reflect their respective funding costs and associated exchange rate movements. The growth in dollar- and euro-denominated credit has fallen as interest rates rose and the respective currencies strengthened (Graphs 7.A and 7.B, solid lines).10 This pattern was more pronounced for credit to EMDEs (dashed lines). Even as the pace of US tightening slowed in 2023, US funding rates and the dollar index remained elevated, resulting in tight financial conditions. By contrast, the Bank of Japan’s continued monetary easing contributed to the sustained increase in yen-denominated credit growth (Graph 7.C).

The BIS ceased receiving data from public authorities in Russia after 28 February 2022. Where possible, data publication will be continued if the BIS is able to use data from public or commercial sources.