Above: Bank of England Governor Bailey speaks at the November policy update in London. Image © Bank of England.

The British Pound rose against the Euro, Dollar and other major currencies after the Bank of England kept interest rates at 5.25% and managed to deliver a credible message that interest rates would stay at current levels for an extended period.

However, by the time Bank of England Governor Andrew Bailey had completed his press conference the UK currency had relinquished its gains, which suggests the market is inclined to bring forward expectations for the first rate cut to earlier in 2024.

The Bank did as much as it could to avoid such an outcome: a 6-3 split vote on the Monetary Policy Committee (MPC) for unchanged rates was a ‘hawkish’ outcome, as there was some speculation that one member would break rank and vote for a cut.

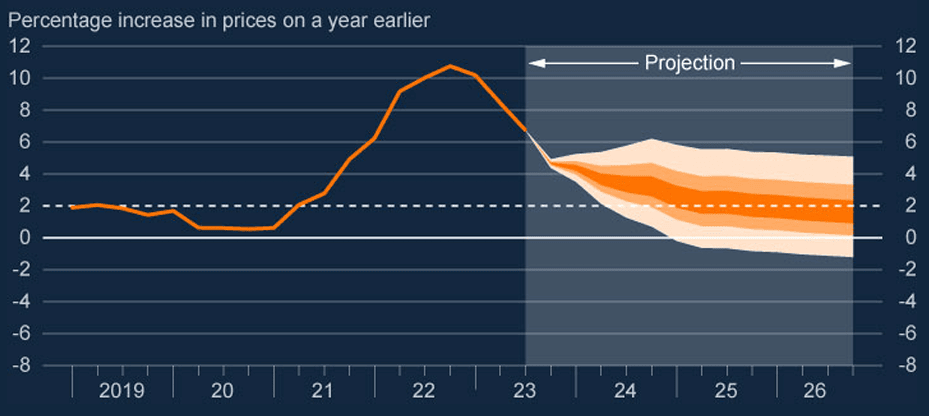

Also supportive of the Pound was a lift to the Bank’s forecast for inflation in three year’s time. The Bank raised its three-year inflation forecast – which is based on the market’s current expectations for Bank Rate – to 1.90% from 1.65% in August.

This means that the Bank cannot afford to cut rates too soon; “the Committee continues to judge that the risks to its modal inflation projection are skewed to the upside,” read the Statement.

“The MPC’s latest projections indicate that monetary policy is likely to need to be restrictive for an extended period of time. Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures,” it adds.

“The statement rather forcefully pushed back against the prospect of rate cuts any time soon. This has both supported the pound and reinforced our view that policy easing is unlikely to begin until late 2024 at the earliest,” says Matthew Ryan, Head of Market Strategy at Ebury.

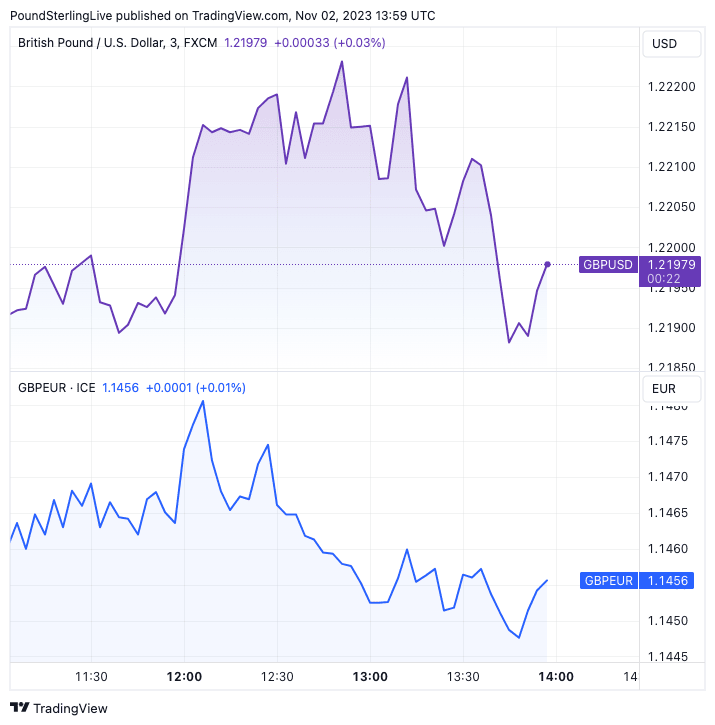

The Pound to Euro exchange rate rose in the aftermath of the decision to 1.1480 but soon slid to 1.1450. The Pound to Dollar exchange rate rose to 1.2215 but relinquished all its post-decision gains to trade at 1.2187 at the time of this update.

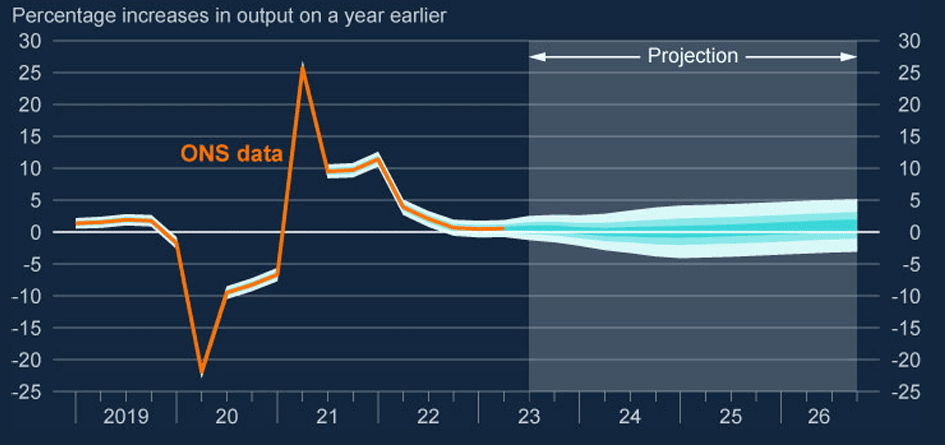

Keeping a lid on the Pound will be the ‘dovish’ aspects of the Monetary Policy Report, which includes a subdued growth forecast, implying the economy will flatline through to early 2025. “GDP is expected to be broadly flat in the first half of the forecast period and growth is projected to remain well below historical averages in the medium term. That reflects the significant increase in Bank Rate since the start of this tightening cycle, subdued potential supply growth, and a waning boost from fiscal policy,” read the Bank’s MPR.

Above: GBPUSD (top) and GBPEUR at three-minute intervals showing action following the release of the November MPC decision and MPR. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered

Two-year bond yields rose but soon gave back the gains, suggesting the market is looking through the guidance and is not convinced that UK interest rates will likely remain at 5.25% for an extended period.

“We are sticking with our forecast that the MPC will reduce Bank Rate by 75bp next year, with the first 25bp cut coming in May,” says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics. “The MPC is currently reactive and backward-looking, and its stance will shift—potentially quickly—as the economic data change.”

Tombs says the labour market already has loosened considerably—the unemployment rate now matches the MPC’s estimate of its equilibrium rate—and the timeliest evidence points to a further loosening to come.

Above: CPI inflation projection based on market interest rate expectations, other policy measures as announced

Another handbrake for the Pound is that one of the Bank’s two main forecast models sees inflation at just 1.6% in three years.

This second model differs from the already-mentioned model (chart above), which forecasts inflation to reach 1.9% in three years. The second model assumes interest rates will remain constant at 5.25%, giving a more ‘dovish’ outcome from a financial markets perspective.

“Bank of England Governor Andrew Bailey is wrong to say that it is much too early to be thinking about rate cuts. Economic activity and inflation have both been weaker than the Bank had expected, money and credit growth have collapsed, and business surveys are already signalling recession,” says Julian Jessop, Economics Fellow at the Institute of Economic Affairs.

The Pound’s decline following the initial decision suggests the market is in agreement.

Above: GDP growth projection based on market interest rate expectations, other policy measures as announced.

Nevertheless, we are seeing a number of analysts and economists suggesting that the Bank of England has done enough to push back on market expectations for rate cuts, which is, on balance, supportive of Sterling.

Concerning the growth outlook, the Bank says the balance of risks to their flat forecast profile is two-way, i.e. it’s 50/50 as to whether growth turns out better or worse.

This contrasts with previous MPR rounds (notably last August), where the Bank was resolute in saying the balance of risks is to the downside.

This pessimism provided a context for a sizeable selloff in Sterling exchange rates in the second half of 2022.

“The Bank seems to disagree with the widely held view that the UK economy is creaking badly. While it notes some gloomy data from the most recent PMIs and evidence that labour markets are softening, it does not think the UK is on the edge of a dangerous economic reverse. In fact, three members of the committee voted to raise rates further – clearly suggesting the Bank sees more risk in inflation than in recession,” says Nicholas Hyett, Investment Manager at Wealth Club.

Although the Pound’s initial price action will disappoint those wanting higher exchange rates, it will take a day or two for a final verdict to be reflected in the currency.