China and Brazil shed large portions of their holdings, but the top financial centers loaded up.

By Wolf Richter for WOLF STREET.

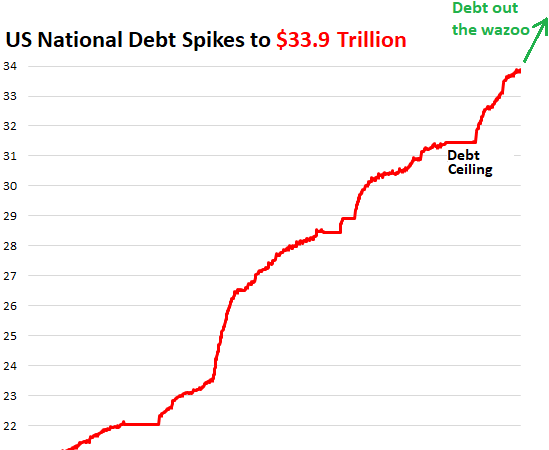

The total amount of Treasury securities outstanding has reached $33.89 trillion and is going to hit $34 trillion shortly. Every one of these securities must be sold to someone, and foreign holders play a huge but declining role:

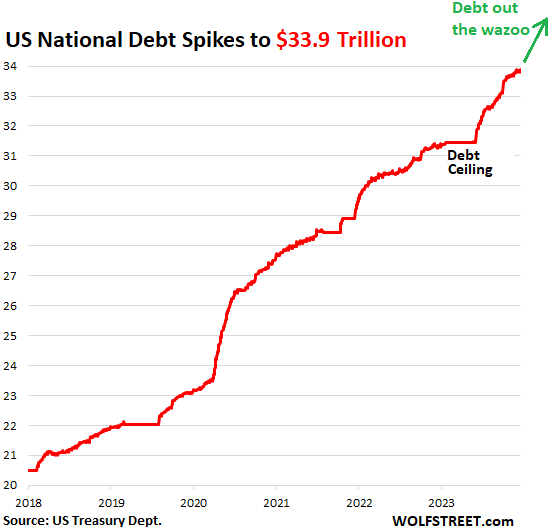

Foreign holders in aggregate have kept their holdings of US Treasury securities roughly stable for the past two years. In October, their holdings dipped to $7.56 trillion, up about 6% from a year ago, but the same as in June 2021, according to TIC data from the Treasury Department released Tuesday afternoon (red line in the chart below)

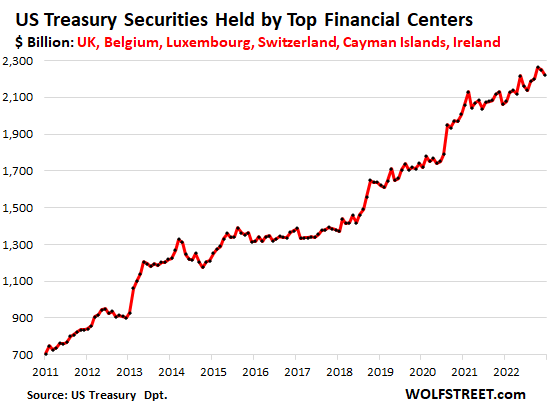

- The top six financial centers (London, Belgium, Luxembourg, Switzerland, Cayman Islands, Ireland) decreased their holdings to $2.22 trillion, down from the record in August (blue line):

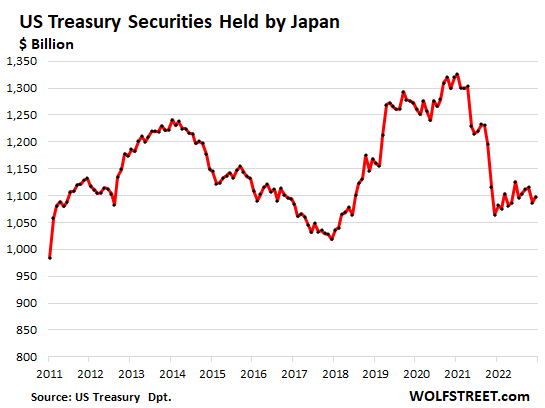

- Japan, #1 single US creditor, increased its holdings in October to $1.10 trillion (green), but that’s down from the $1.3 trillion range in 2021.

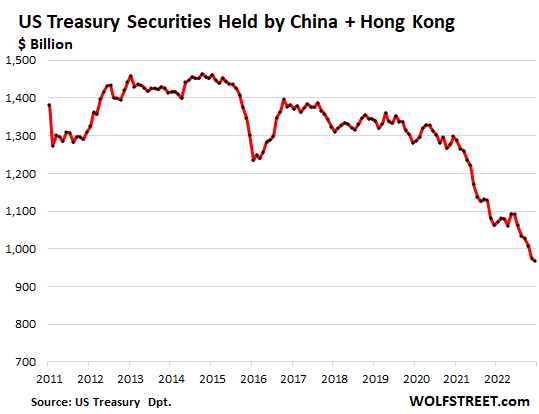

- China and Hong Kong combined further reduced their holdings to $969 billion (purple).

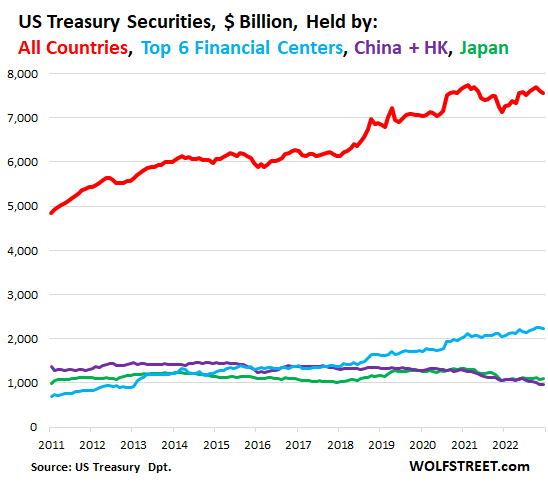

Foreign holders have not kept up buying the incredibly ballooning US government debt, and as a result, the share of their holdings has plunged to a share of 22.4%, from the range of around 33% in 2015. In other words, the US debt financing has become less dependent on foreign holders:

The six largest financial centers – the UK (actually the City of London), Belgium, Luxembourg, Switzerland, Cayman Islands, and Ireland – reduced their holdings a little in October, after the record in August, to $2.22 trillion

These countries specialize in handling and often obscuring the financial holdings of global companies, individuals, and governments. Ireland is a favorite for US companies to store their profits:

- UK: $693 billion

- Luxembourg: $345 billion

- Cayman Islands: $324 billion

- Ireland: $299 billion

- Belgium (home of Euroclear): $285 billion

- Switzerland: $276 billion.

Japan’s holdings, after dropping sharply last year, have zigzagged up again this year, and in October ticked up to $1.1 trillion, up by 3.2% from a year ago.

Late last year, the Ministry of Finance sold some US-dollar assets, presumably Treasury securities, or let T-bills mature without replacement, to get the dollar-cash, and then blew $68 billion in dollar-cash to buy yen in the foreign exchange market to prop up the yen after it had plunged to ¥150 to the dollar by October 2022.

China and Hong Kong combined have been unloading Treasuries for years. In October, their combined holdings of Treasuries fell to $969 billion, the lowest in the data going back to 2011 (red in the chart below), down by 8.9% from a year ago.

During the capital-flight panic in 2016, China sold Treasury securities to prop up the RMB. It then increased its holdings again. But since Covid, the combined holdings have plunged by 29%.

Other top foreign holders:

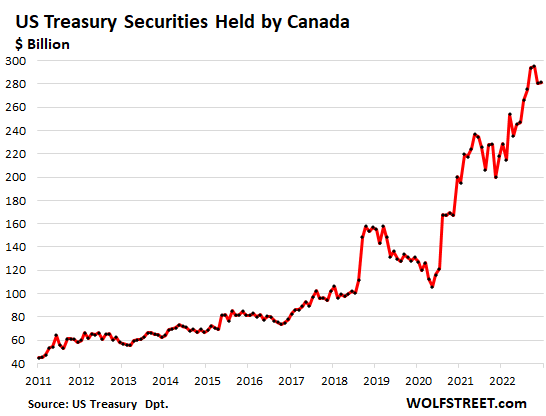

Canada’s holdings ticked up to $281 billion, up by 29% year-over-year, after having hit a record in August:

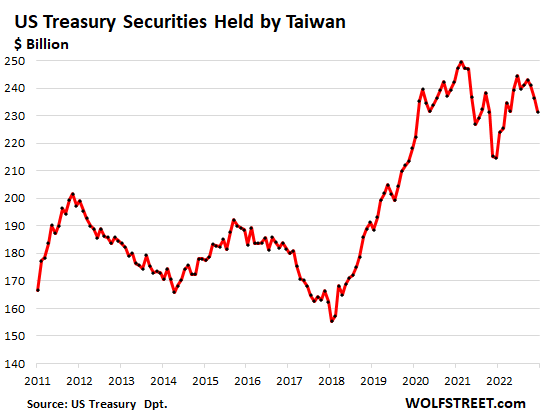

Taiwan’s holdings fell to $231 billion, but were up 7.8% year-over-year. They’d hit a record in December 2021, and holdings have gyrated up and down since then:

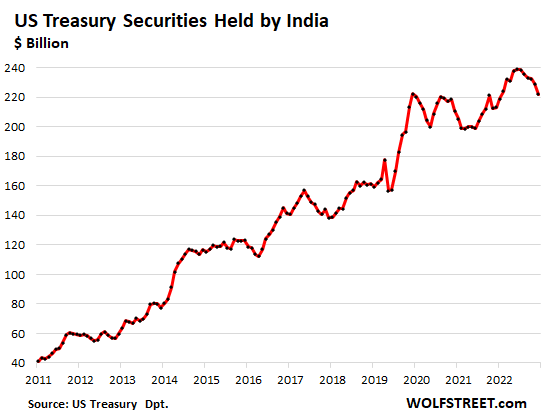

India’s holdings fell to $222 billion, first reached in October 2020, having declined every month since the peak in April, but were still up 4.2% year-over-year:

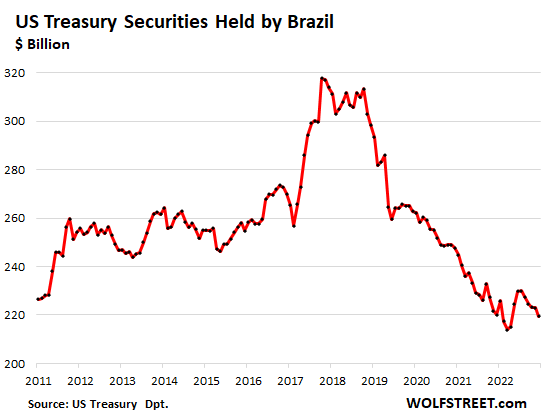

Brazil’s holdings fell to $219 billion, and were roughly flat year-over-year, after having spiraled down by about one-third since the peak in 2018.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()