(Bloomberg) — Investors who took out long positions in the euro could be in for some respite, even as a shaky outlook for the economy continues to stalk the common currency.

Most Read from Bloomberg

Slowing inflation and fading optimism about the region’s growth sent the euro to its worst month since April 2022. Short-term bets against the euro using currencies other than the dollar are growing in popularity.

Yet despite the headwinds, investors increasingly view fresh euro weakness against the greenback as a chance to buy, citing diverging interest-rate trajectories on either side of the Atlantic.

“Selling euros is no longer a slam dunk as it was a month or two ago,” said Geoff Yu, senior currency strategist at Bank of New York Mellon Corp. “The peak in momentum has already happened.”

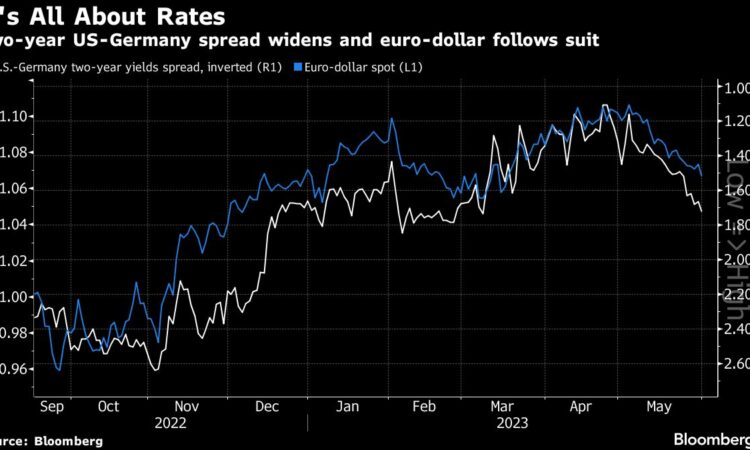

Traders are betting on the US Federal Reserve finishing its hikes by the end of July. Meanwhile, the European Central Bank is expected to only switch to cuts later next year, after hiking and holding rates at their highest in more than two decades — making the European common currency an appealing longer-term bet.

“It’s a case of buying on the dips rather than selling on the rallies,” said Sam Lynton-Brown, head of global macro strategy at BNP Paribas. “A year from now, we see it above 1.10 and we don’t see credible scenarios where it goes below 1.05 and stays there.”

The euro sank 3% in May, taking it from a one-year high, buying just less than $1.11 at the start of the month, to below $1.07 where it’s been hovering since. The selloff came after hawkish noises from the ECB and an improved growth outlook had encouraged investors to build up wagers on a stronger euro to their highest levels since September 2020.

Despite near-term pressures, there’s room for the euro to gain as more bonds in Europe shake off their negative yields, damping the comparative appeal of dollar-denominated assets, Lynton-Brown said.

Traders in Europe say a safety net is forming for the currency, making a big drop below 1.05 unlikely given the interest from hedge funds and interbank desks to buy if it falls below that. Demand for options that pay out should the euro weaken below that level was almost non-existent earlier this week, according to one trader who asked not to be identified because they’re not authorized to speak publicly.

The outlook for the euro is brighter than this time a year ago. Negative yields, recession risks and spiraling concerns about an energy supply crunch during the early days of Russia’s invasion of Ukraine pushed the euro below par against the dollar for the first time ever.

But to be sure, fears of another European energy crisis or overly aggressive ECB rate hikes that trigger a slump in growth could stymie the bullish predictions. Danske Bank cites these in its prediction that the common currency will fall to 1.03 in 12 months’ time. Others warn that a fresh wave of turbulence in the US banking system or a global recession could knock the euro lower in the coming months.

“If the energy crisis flares up again, then it would leave the euro much more exposed than the US dollar,” said Jens Naervig Pederson, director of FX and rates strategy at Danske Bank in Copenhagen. “That’s one reason we’ve kept this negative bias on the euro versus the dollar.”

For now, the euro’s path in the coming months will be largely driven by how much US interest rates start to fall. At the moment, traders are betting on a roughly 80% possibility that the Fed will cut rates by 25 basis points by December, after raising them to 5.5% by July.

The euro could push above 1.10 in the second half of the year as markets get a clearer view that US rate cuts are coming, according to Samy Chaar, chief economist at Lombard Odier Group in Geneva.

While both the ECB and Fed will have scope to lower rates as inflation continues to slow, the Fed has “more room to cut,” he said.

–With assistance from Vassilis Karamanis and Alice Atkins.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.