The cryptocurrency market has been volatile in recent weeks, with Bitcoin and Ethereum experiencing significant price swings. Traders and investors are closely monitoring the impact of macroeconomic data on digital asset prices. Today, all eyes are on the US Consumer Price Index (CPI) and Retail Sales figures, which are expected to provide insights into the strength of the US economy and inflationary pressures.

Crypto Market’s Fundamental Outlook

Bitcoin and Ethereum have experienced significant gains in recent weeks, with BTC reaching a nine-month high of over $26,000 and ETH breaking through a critical resistance level of $1,700. However, the reason for their upward rally could be attributed to mildly encouraging inflation data released earlier and the financial industry’s continued recovery from a near-catastrophic disaster.

The latest statistics show that US consumer inflation has decreased, but it still remains at high levels. This could prompt the Federal Reserve to maintain its hawkish stance. If macroeconomic factors continue to be favorable, Bitcoin may soon have the potential to reach the $30,000 mark.

Despite retracing some of its early gains, Bitcoin still remains 80% higher than its lowest point. Currently, Bitcoin and ETH are trading at $24,900 and $1,700, respectively. These bullish market movements suggest that the digital currency market is experiencing a positive sentiment.

Moreover, the rally in Bitcoin prices gained further momentum after the UK government expressed its support for Silicon Valley Bank. This news triggered a favorable sentiment among investors, leading to increased buying activity.

The rise in BTC’s value reflects a positive sentiment towards the digital currency industry. As such, investors should closely monitor market developments before making any significant investment decisions.

Impact of CPI on Bitcoin Prices

The recent release of the February 2023 Consumer Price Index (CPI) statistics by the US Department of Labor has had a considerable impact on Bitcoin prices.

The CPI measures the average change in consumer prices for a basket of goods and services, and it increased by 0.4% on a seasonally adjusted basis last month.

However, the all-items index of inflation rose by 6% over the previous year, which has raised concerns among investors.

Although the publication of CPI data caused turbulence in traditional markets, the cryptocurrency markets reacted positively, with Bitcoin and Ethereum experiencing price increases. This indicates that investors are turning to digital assets as a potential inflation hedge.

It’s worth noting that the CPI is a crucial tool for assessing economic performance, determining monetary policy, and adjusting salaries, benefits, and social security payments for inflation. Consequently, rising inflation may prompt the Federal Reserve to adopt a more hawkish stance.

As a result, traditional financial markets may be negatively impacted if the Fed decides to increase interest rates in response to growing inflation. Conversely, it may encourage more people to invest in Bitcoin and other cryptocurrencies as an alternative investment choice.

While the increase in inflation is undoubtedly concerning, it’s unclear how it will affect the global economy in the long term. Nevertheless, the rise in Bitcoin prices following the release of the CPI statistics suggests that digital assets are gaining acceptance as a viable inflation hedge in the short term.

Forecasts for US February Retail Sales Report and Its Potential Impact on Bitcoin Prices

The US Census Bureau is set to release the February Retail Sales report on March 15th. Economists and researchers from eight major banks have provided their forecasts for the upcoming data.

The US is expecting a 0.3% year-on-year decline in Retail Sales, which is a significant drop from January’s 3.0% growth. However, excluding autos, sales are projected to grow by 0.2% YoY, down from 2.3% in January. Additionally, the control group, used for GDP calculations, is anticipated to fall by 1.2% compared to a 1.7% increase in January.

It’s worth noting that the retail sales data is a crucial indicator of the health of the US economy, as consumer spending contributes a significant portion of GDP. Therefore, the expected decline in retail sales could indicate a slowdown in the US economy, potentially having a negative impact on traditional financial markets. However, cryptocurrencies like Bitcoin are likely to benefit as investors may seek alternative assets during times of economic uncertainty.

As a result, the impact of the retail sales data on BTC prices will depend on how investors interpret the news. A larger-than-expected decline in retail sales could increase BTC prices as investors seek safe-haven assets.

Conversely, better-than-expected sales figures could decrease BTC prices as investors shift their focus back to traditional assets. Overall, the upcoming release of retail sales data is expected to significantly impact financial markets and could influence the price of BTC in the short term.

Bitcoin Price

At the $24,850 level on Wednesday, the BTC/USD pair exhibited a bullish trend. Bitcoin may encounter immediate resistance at the $25,250 level on the upside. If this level is surpassed, there could be more opportunities for buying, with a potential move toward $26,700 .

However, if Bitcoin’s immediate support level at $24,000 is breached, it could result in further selling pressure, potentially pushing the price down to the $23,750 level. Traders may want to consider a buying trade if the price breaks above $25,225 today.

Ethereum Price

The current value of Ethereum is $1,700, and it is currently facing strong resistance near the $1,710 level, with the double top pattern extending this resistance. A breakout above this level could expose the ETH price towards the $1,800 mark.

On the lower side, Ethereum’s immediate support is at the $1,600 or $1,495 marks. Investors will be keeping a close eye on the US CPI and retail sales data today.

Top 15 Cryptocurrencies to Watch in 2023

Check out Cryptonews’ Industry Talk team’s curated list of the top 15 altcoins to watch in 2023. The list is frequently updated with new ICO projects and altcoins, so make sure to visit often for the latest updates.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

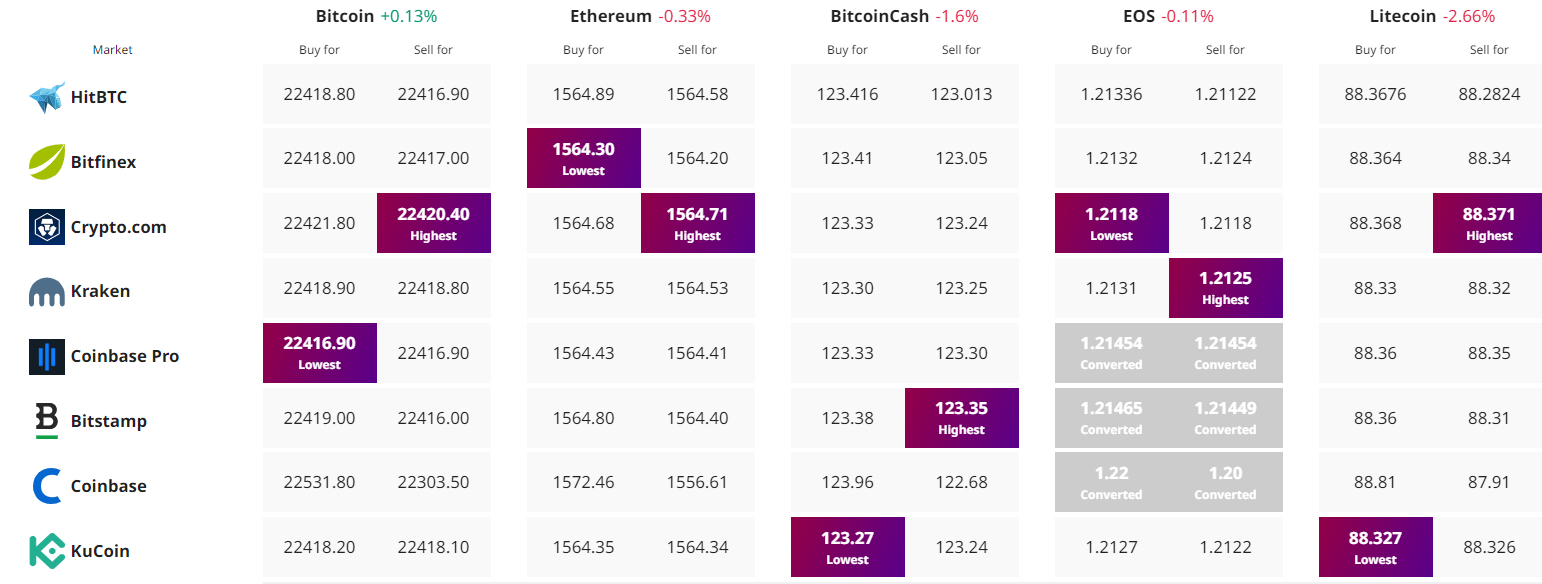

Find The Best Price to Buy/Sell Cryptocurrency