The crypto market is up today as Bitcoin (BTC), Solana (SOL), Cardano (ADA), Chainlink (LINK) and numerous altcoins rallied higher. The price breakout resulted in the total market cap reaching a year-to-date high of $1.59 trillion on Dec. 8.

Let’s examine three major factors influencing today’s crypto market rally.

Risk assets respond to this week’s jobs data

The crypto market’s price gains in the past 24-hours follow the U.S. Bureau of Labor Statistics employment report. The report beat expectations, with the unemployment rate recording lower than the forecast of 3.9% by 0.2%.

The strong employment report has led analysts to push back the expectation of interest rate cuts.

JUST IN: Interest rate futures shift from showing rate cuts beginning in March 2024 to May 2024 after jobs report.

Prior to the November jobs report, markets saw a 60% chance of rate cuts beginning in March 2024.

Odds of rate cuts beginning in January 2024 fell from 16% to 6%.… pic.twitter.com/hFYFLVP5xv

— The Kobeissi Letter (@KobeissiLetter) December 8, 2023

The uncertainty in the market is potentially boosting sentiment for the crypto market, according to Austin Alexander the co-founder of LayerTwo Labs,

“It’s also important to put Bitcoin’s performance against the backdrop of a broader economic situation that feels less and less certain. There’s a tremendous amount of geopolitical uncertainty at the moment, and then there’s the issue of massive debts taken on by the United States and a number of other developed economies. As a result of these issues, Bitcoin increasingly is regarded as an alternative asset that offers a hedge. We saw evidence of this during the banking crisis that started in March when Bitcoin actually soared.”

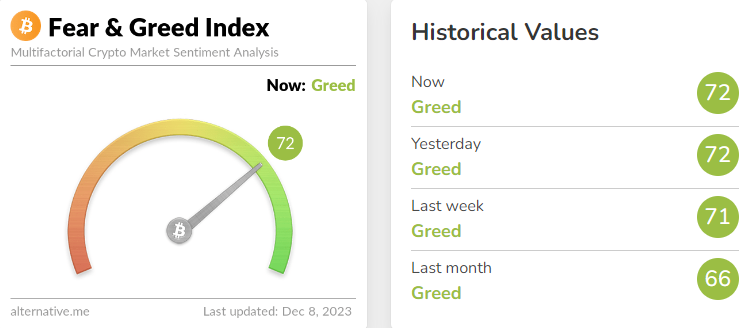

The improvement in sentiment is also reflected by the Bitcoin Fear and Greed Index, which shows ‘greed’ up 6 points, hitting a monthly high.

Institutional investor inflow to crypto hits a record high

The first sign of institutional interest in crypto outside of Bitcoin started on Nov. 9, when BlackRock’s plans for a spot Ether exchange-traded fund (ETF) were confirmed through a 19b-4 form filing submitted to the United States Securities and Exchange Commission (SEC). After the confirmation, Ether price surged 12.2%, outperforming Bitcoin for the first time in months.

On Dec. 8, VanEck predicted that quarter one of 2024 will see a U.S. recession at the same time as a spot ETF approval. While they do not believe Ether (ETH) will overtake Bitcoin price, this scenario may bring in over $2.4 billion in the first quarter alone.

The growing institutional investor interest is improving sentiment across the market. Institutional investor inflows into the crypto market suggest that Ether’s outperformance is not just a one-off event and could continue in the near term.

Despite the SEC continuing to delay spot ETF applications, they are actively discussing key technical details with applicants.

Related: HK game firm to buy $100M crypto for treasury, China/UAE CBDC deal: Asia Express

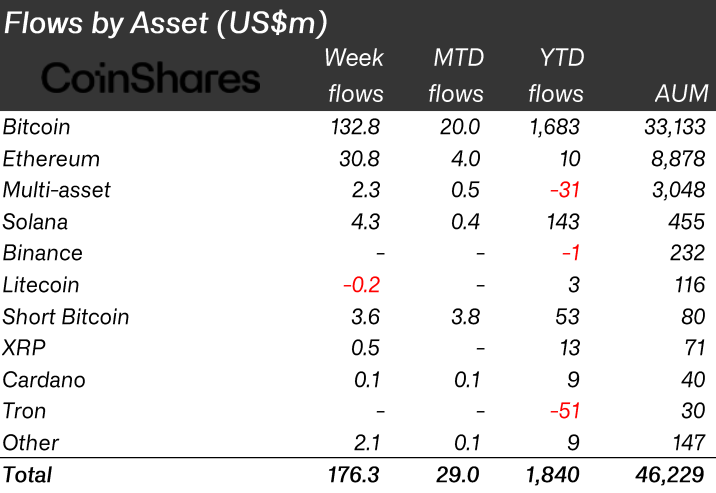

Over the last 10 weeks, there was a total of $1.76 billion in inflows, which is the highest on record since October 2021. The record inflows also produced net flows of Ether, hitting $10 million for the first time this year. The inflows are not limited to Bitcoin and Ether, with Solana seeing $143 million flow from institutional investors in 2023.

Total value locked and trading volumes spike

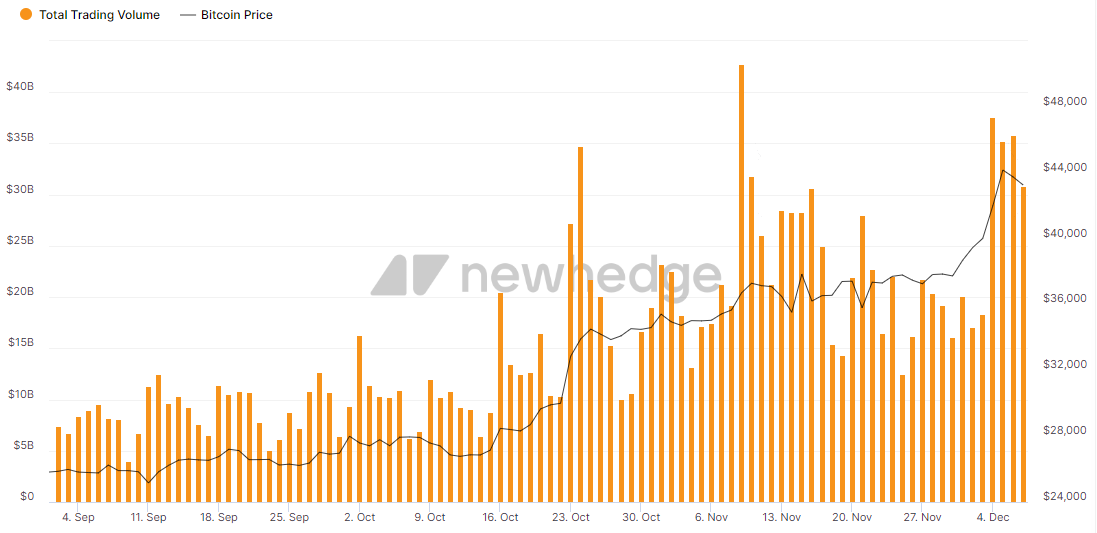

The positive sentiment in the crypto market is rippling throughout the ecosystem. Bitcoin and altcoin market trading volume reached $44.1 billion on Nov. 9. Although the high for daily trading volume in December was $37.6 billion on Dec. 6, it remains above September levels.

Trading volume is not the only metric that remains elevated. On Dec. 4, the total value locked (TVL) in DeFi platforms hit a multi-month high, reaching its highest level since June 3. The TVL increase to $52.35 billion marks a 3.53% increase over a 24-hour period.

Related: ‘Early bull market’ — Bitcoin price preps 1st ever weekly golden cross

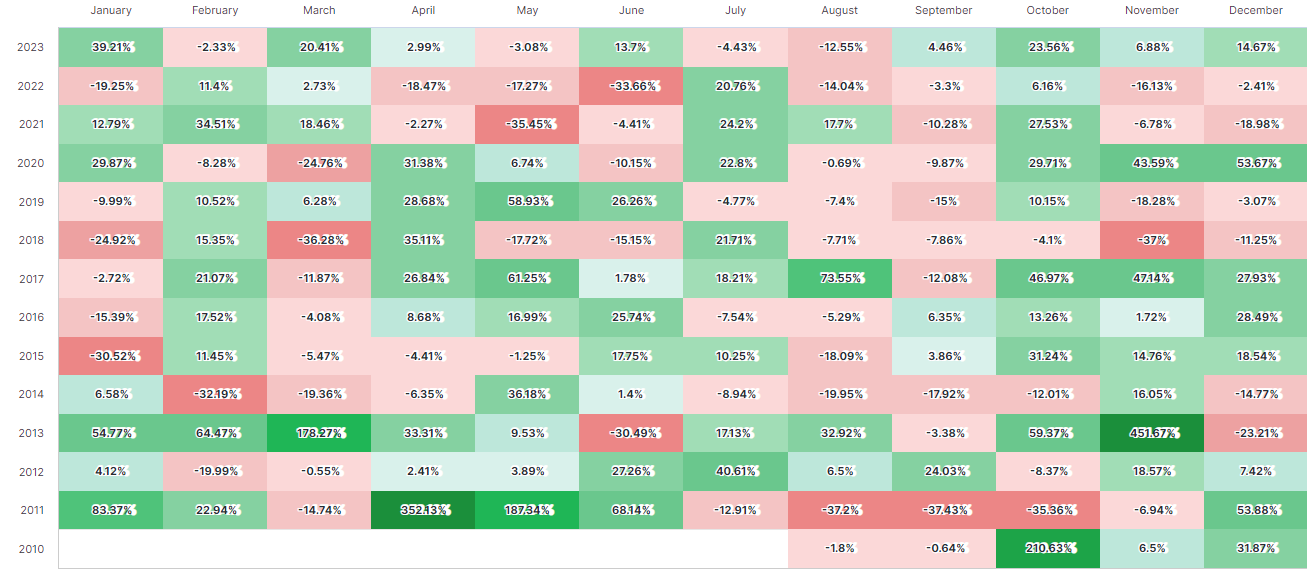

There is optimism surrounding the increase in volume and TVL, which helped break November’s 2-year losing streak. December has mirrored November’s performance since 2015 and is witnessing 14.67% gains on Dec. 8.

While Bitcoin and altcoins still have overhanging risk events that could impact the price, the increasing institutional interest and improved trading volumes are strong indications the bear market may have ended.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.