The bitcoin halving, occurring approximately every four years, involves a reduction in the number of bitcoins rewarded to miners, creating scarcity and potentially impacting the cryptocurrency’s price.

This week’s episode of Yahoo Finance Future Focus delves into the reasons behind the bitcoin halving and examines the potential impact this event will have on the price of the largest digital asset by market capitalisation.

Read more: Crypto live prices

Bitcoin (BTC-USD) has already surged by over 45% since the beginning of the year, and many analysts believe that the supply crunch caused by the halving, combined with increased demand through spot bitcoin exchange-traded funds (ETFs), could further propel the price even further. For instance, in a Bernstein research report from March, the asset manager factored in the impact of the halving and raised its year-end bitcoin price forecast to $90,000 (£72,315).

Understanding the bitcoin halving

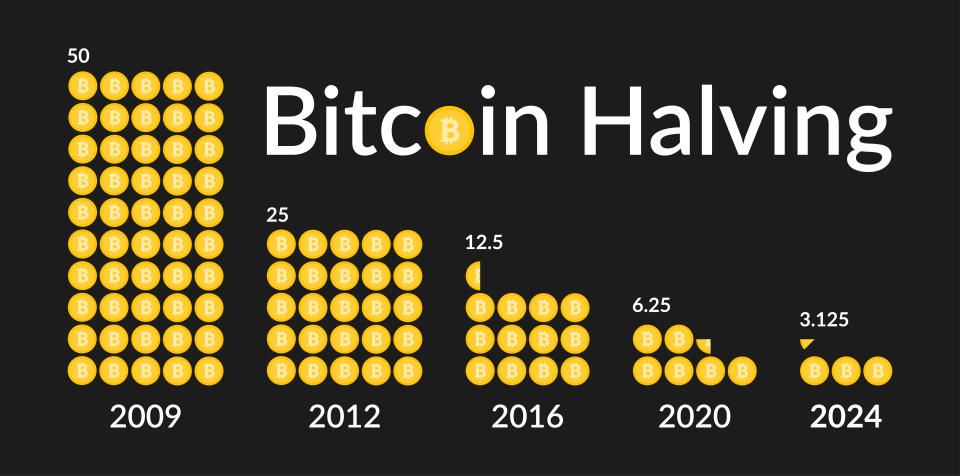

Bitcoin mining operates on a decentralised network where validators verify transactions and are rewarded with newly minted bitcoins. For every 210,000 blocks made, however, which takes roughly four years, the number of bitcoins rewarded to miners is halved. This reduction in block rewards is programmed into the bitcoin network’s core code by its pseudonymous creator, Satoshi Nakamoto, as a means to create scarcity over time.

Read more: What is a spot bitcoin ETF and why it has sparked a crypto rally?

Saturday’s halving sees the block reward drop from 6.25 to 3.125 BTC per block. This reduction has far-reaching implications. It affects the potential profitability of mining and it impacts bitcoin’s overall supply dynamics.

The impact on bitcoin’s price

One of the most closely watched aspects of the bitcoin halving is its potential impact on the cryptocurrency’s price. The theory suggests that as the supply of newly minted bitcoins diminishes, while demand remains constant or even increases, the price of bitcoin could appreciate.

Past halving events have provided some insight into this phenomenon. The first halving in November 2012 marked the beginning of a sustained upward trajectory for bitcoin’s price. Similarly, the halving in July 2016 preceded a significant bull run in 2017, with bitcoin reaching an all-time high of over $19,000 (£15,266) by year-end. The halving in May 2020 also saw a substantial increase in bitcoin’s price over the following year.

Read more: Bitcoin ETFs poised for US pension plan inflows, Standard Chartered analyst says

So, with the block reward falling to 3.125 BTC, how might the bitcoin price be affected by Saturday’s halving? According to a recent Deutsche Bank Research report, for forecasts regarding the digital asset’s post-halving price trajectory, it is useful to compare with April’s Bitcoin Cash halving event, which is a modified version of bitcoin.

After completing its last halving on April 3, Bitcoin Cash surged 12% in 24 hours. “Bitcoin Cash can be seen as a proxy for bitcoin, and its positive price performance following its halving event bodes well for the main bitcoin network,” the Deutsche Bank report added.

Bitcoin has a finite supply

The halving process will only conclude once the number of bitcoins in circulation reaches its programmed limit of 21 million, which is expected to occur in 2140. After this point, crypto miners will only earn profit from transaction fees, which are determined by the size of the transaction and the amount of data involved. Currently, there are 19.7 million bitcoins in circulation.

Read more: Bitcoin price falls ahead of halving as ETF inflows slow

The bitcoin halving is not merely a speculative event driven by price speculation; it underscores the fundamental principles of scarcity and decentralisation that underpin the cryptocurrency. As bitcoin continues to evolve, the halving serves as a reminder that bitcoin is a finite monetary system, which can also act as a store of value in high inflationary environments.

It is worth remembering, that while the halving may present opportunities for investors, it’s essential to conduct thorough research and exercise caution when navigating the volatile world of cryptocurrencies, as past performance is not indicative of future results.

Watch: What is a spot bitcoin ETF and why it has sparked a crypto rally? | Future Focus

Download the Yahoo Finance app, available for Apple and Android.