Police in the United States and in the EU arrested five people and seized their globally operating Hong Kong-registered cryptocurrency exchange Bitzlato because it allegedly facilitated the laundering of large sums of illicit profits and converted them into Russian rubles, a Europol statement said on Monday.

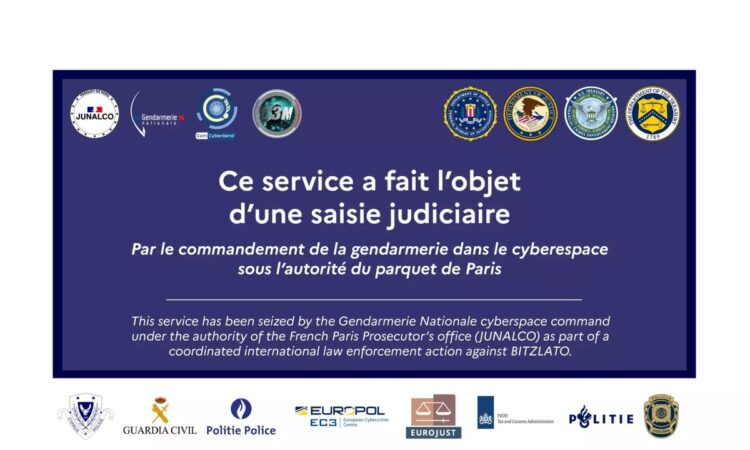

Globally operating crypto money exchange Bitzlato is suspected of aiding Russian criminals to launder money. (Photo: Europol, License)Authorities shut down the digital infrastructure of the crypto exchange that was located in France, conducted eight house searches in Spain, Cyprus, Portugal and the U.S., interrogated one person in Portugal and arrested one in the U.S., three in Spain and one in Cyprus, the European Union Agency for Law Enforcement Cooperation said.

Globally operating crypto money exchange Bitzlato is suspected of aiding Russian criminals to launder money. (Photo: Europol, License)Authorities shut down the digital infrastructure of the crypto exchange that was located in France, conducted eight house searches in Spain, Cyprus, Portugal and the U.S., interrogated one person in Portugal and arrested one in the U.S., three in Spain and one in Cyprus, the European Union Agency for Law Enforcement Cooperation said.

“Bitzlato allowed the rapid conversion of various crypto-assets such as bitcoin, ethereum, litecoin, bitcoin cash, dash, dogecoin and USDT into Russian rubles,” the statement read. It is estimated that the crypto exchange platform has received a total of assets worth 2.1 billion euro (US$2.28 billion).

Europol noted that while converting crypto-assets into fiat currency is not prohibited, investigations into cybercriminal operators revealed that huge amounts of criminal assets were passing through the Bitzlato platform.

About 46% of those assets – or about US$1 billion – were linked to entities sanctioned by the Office of Foreign Assets Control (OFAC) or to cyber scams, money laundering, ransomware and child abuse material, the agency said.

While the EU law enforcement agency said that Bizalto’s CEO as well as Financial Manager and Marketing Manager were arrested in Spain, U.S. authorities reported last week that they have arrested its major owner and cofounder, accusing him of crypto crime and circumvention of the U.S. anti-money laundering rules.

The U.S. Department of Justice (DOJ) confirmed that a federal court in Brooklyn charged Russian national Anatoly Legkodymov, also known as “Gandalf” and “Tolik”, with “conducting a money transmitting business that transported and transmitted illicit funds and that failed to meet U.S. regulatory safeguards, including anti-money laundering requirements.”

Legkodymov was arrested in Miami and according to the court, he knowingly permitted Bitzlato to become a “haven for criminal proceeds and funds intended for use in criminal activity,” processing more than US$700 million in that way.

Hydra Market, the world’s largest and longest-running darknet market for drugs, stolen financial information, false identification documents, and money laundering services, was Bitzlato’s largest counterpart in cryptocurrency transactions.

“Hydra Market users exchanged more than $700 million in cryptocurrency with Bitzlato, either directly or through intermediaries, until Hydra Market was shuttered by U.S. and German law enforcement in April 2022,” read the statement.

Apart from that, Bitzlato made more than $15 million from ransomware proceeds.

According to court documents, the platform was know for requiring little identification from its users, stating that “neither selfies nor passports [are] required.”

Even when the company required direct users to provide identifying information, it would allow them to submit “information belonging to ‘straw man’ registrants,” – people to whom title to property or a business interest is transferred for the sole purpose of concealing the actual owner.

“As alleged, Bitzlato sold itself to criminals as a no-questions-asked cryptocurrency exchange, and reaped hundreds of millions of dollars’ worth of deposits as a result,” U.S. Attorney Breon Peace said.

Legkodymov risks a maximum sentence of five years in jail if convicted of operating an illegal money transmitting business, according to the DOJ.

Simultaneously with the court action and Legkodymov’s arrest, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) issued an order identifying the virtual currency exchange Bitzlato Limited as a “primary money laundering concern” in connection with Russian illicit finance.

FinCEN found that Bitzlato functioned as a financial institution operating outside of the U.S., primarily dealing with money laundering in “connection with Russian illicit finance.”

The Treasury Department’s bureau said that Bitzlato played a critical role in laundering Convertible Virtual Currency (CVC) by enabling transactions for ransomware perpetrators operating in Russia, such as Conti – a Ransomware-as-a-Service business with ties to the Russian government.

Bitzlato posed a global threat “by allowing Russian cybercriminals and ransomware actors to launder the proceeds of their theft,” FinCEN Acting Director Himamauli Das said.