Kraken, one of the leading cryptocurrency platforms, has just stepped into the world of the US elections by listing new PoliFi tokens on its Kraken Pro platform. These cryptocurrencies, inspired by political memes, now offer US residents a new way to speculate on the winner of the presidential elections in the US. We talk about it in Cryptic Analysis, after this week’s essential news.

Block 1: Essential news

Changpeng Zhao begins his stay behind bars

According to CNCB, Changpeng Zhao, the former CEO of Binance, has begun serving a 4-month prison sentence in Lompoc, California, after pleading guilty to money laundering. As a reminder, he had resigned from his position in November 2023 as part of an agreement with the DOJ. Although sentenced to less than the required 36 months, Binance also paid a fine of $4.3 billion. Zhao, who retains a 90% stake in Binance, expressed remorse at his hearing, notably acknowledging mistakes in the fight against money laundering.

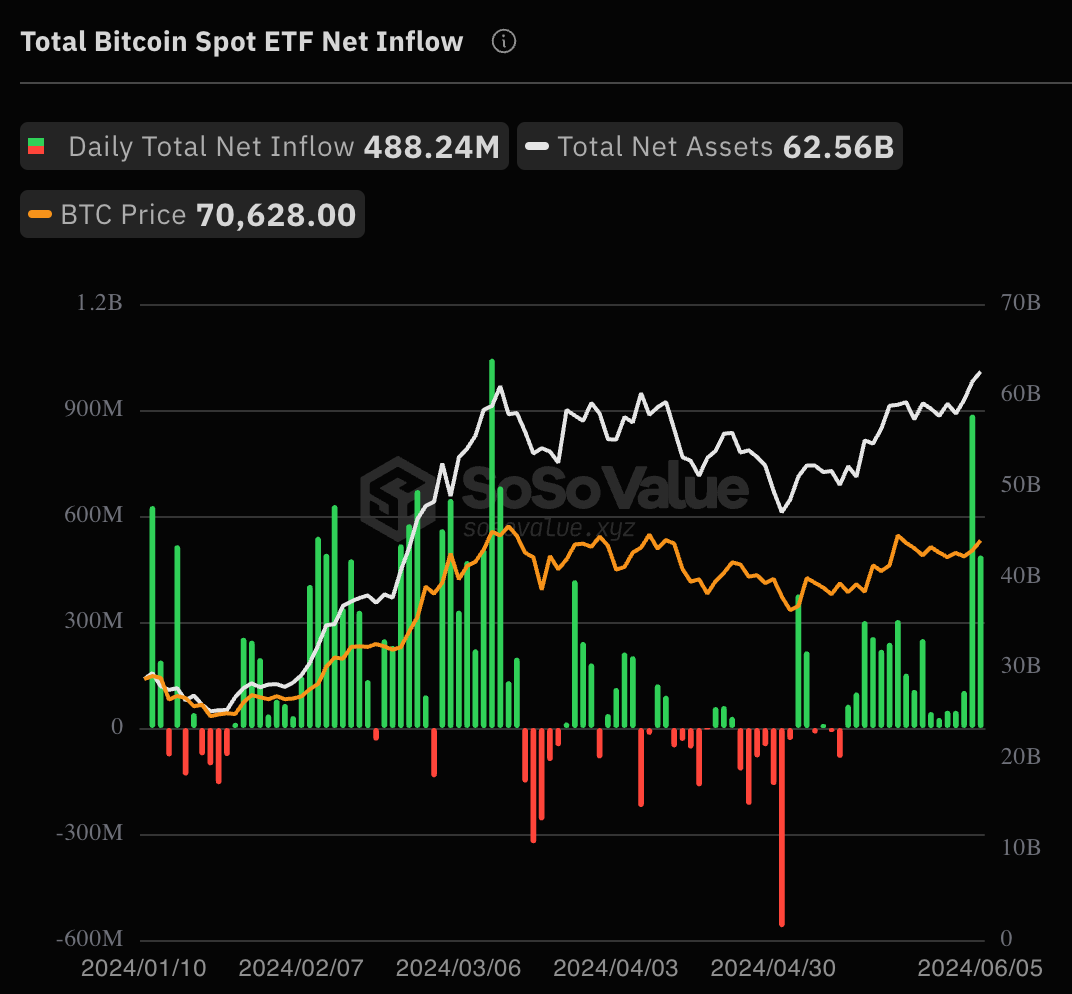

Bitcoin Spot ETFs soar

Bitcoin Spot ETFs in the United States recorded more than $880 million in inflows on Tuesday, according to data released on Wednesday. This was the best day of inflows since March and the second highest since 11 bitcoin ETFs were launched in January. Bitcoin is now trading at around $71,000.

Inflows and outflows on Bitcoin Spot ETFs

SoSol Value

Launch of Bitcoin Spot ETFs in Australia

On Tuesday June 4, Australia’s first Bitcoin Spot ETF was launched at the opening of trading. This week, Monochrome Asset Management’s Bitcoin ETF (IBTC) begins trading on the Cboe Australia exchange. Trading under the symbol IBTC, the ETF carries a management fee of 0.98%. This announcement in Australia naturally follows the successful launch of Bitcoin spot ETFs in the US earlier this year.

Mastercard launches peer-to-peer (P2P) crypto service

Mastercard has announced the launch of a peer-to-peer (P2P) crypto transaction service via various partnerships, enabling users to exchange cryptocurrencies using “Mastercard Crypto Credential” credentials instead of complex blockchain addresses. Focused on security and simplicity, the service is particularly targeted at Latin America, facilitating transactions between this region and Europe. Initial partners include Bit2Me, Lirium, and Mercado Bitcoin, and cover several Latin American and European countries. Although Mastercard talks about P2P, exchanges are still made via a centralized entity, in compliance with regulations such as the “Travel rule”.

Block 2: Crypto Analysis of the Week

It’s the latest fad among cryptosphere speculators: tokens linked to the US presidential elections, a category that now goes by the name of “PoliFi”, which is a clever fusion of the words “politics” and “DeFi” (decentralized finance).

For those who are not yet familiar with them, which is undoubtedly the case, PoliFi tokens are tokens without any fundamental value, but which are a means on paper, for some, of showing support for a favorite candidate. It’s all about speculation. Those who dabble in this type of token are primarily in it to make money by speculating on the upside or downside.

And the day before yesterday, Kraken caused a stir by adding the PoliFi “BODEN” and “TREMP” tokens to its Kraken Pro platform. The tokens, which feature cartoonish images of the candidates, gained popularity when deployed on the Solana blockchain. The token representing Joe Biden is called Jeo Boden (Ticker: BODEN), while the coin featuring Donald Trump is called Doland Tremp (Ticker: TREMP).

This makes Kraken the first major platform available to US residents to list these famous PoliFi tokens. US residents can now trade these two PoliFi tokens on a leading exchange – until now, they were only available on offshore centralized exchanges or decentralized exchanges.

According to CoinGecko, the Joe Biden token jumped over 13% immediately after the listing was announced, before stabilizing. Over the past 24 hours, BODEN has gained 35%, compared with 27% for TREMP. Currently, BODEN has a transaction volume of around $18 million, compared with TREMP’s $27 million, according to CoinGecko, which has not yet integrated Kraken’s transaction volumes. However, since their launch, BODEN has posted a 300,000% increase since March 6, and TREMP a 230,000% increase since February 28.

More generally, the success of BODEN and TREMP is not an isolated incident, but rather a reflection of the wider memecoin craze that has taken hold of the Solana blockchain in recent weeks. As a reminder, a memecoin is a cryptocurrency created primarily for fun and often based on popular internet memes, rather than any serious technological or financial project.

While the rapid price appreciation of these tokens can be alluring, investors should remember the inherent volatility and risks associated with memecoins. As the 2024 US presidential election approaches, speculation around BODEN and TREMP is likely to intensify. But the potential for market manipulation and distortion of political discourse are all valid concerns that need to be carefully weighed before any investment. BODEN and TREMP have soared, but like most memecoins, they will eventually become worthless.

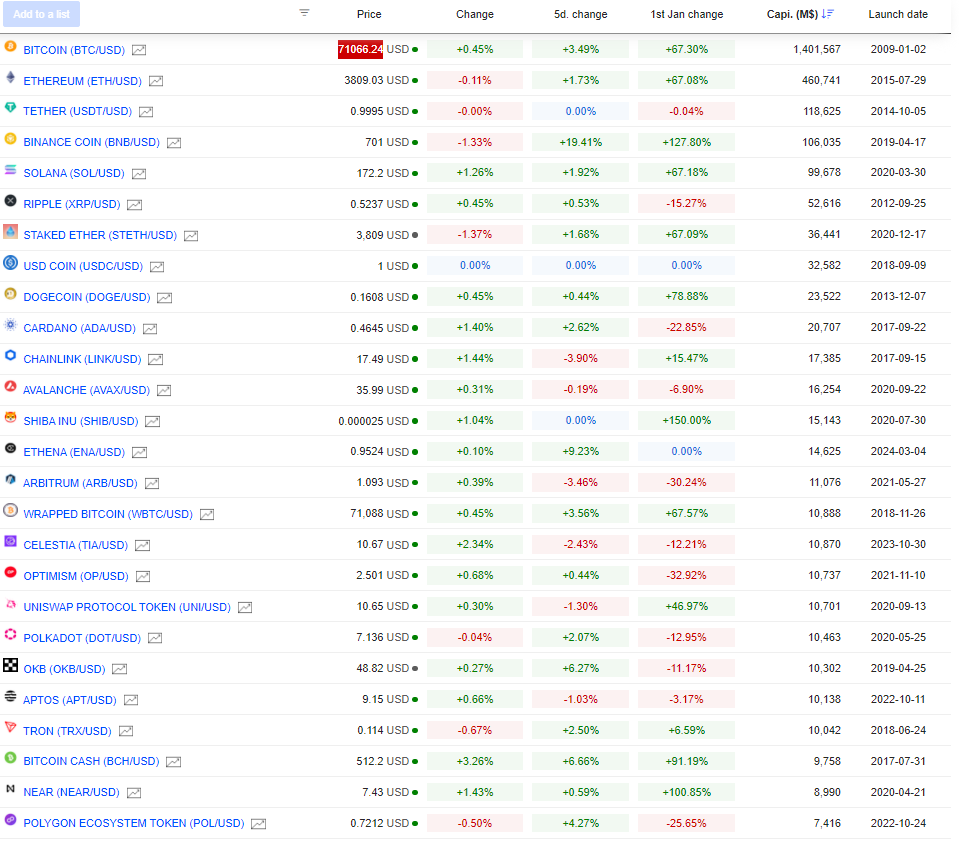

Block 3: Gainers & Losers

Crypto chart (Click to enlarge)

MarketScreener

Block 4 : This week’s reads

Naira in crisis but cryptocurrency not to blame – Nigeria needs a coherent policy (Wired)

EigenLayer ups the ante for Ethereum (Financial Times)

Red versus blue: The Bitcoin Ordinals war game (Bitcoin Magazine)