The recent XRP price crash has attracted attention from investors and analysts alike, raising questions about the future of Ripple and its native cryptocurrency.

There are key factors behind the price volatility and Ripple’s growth prospects in the European market. These may shed light on the potential for Ripple’s continued success despite short-term market turbulence.

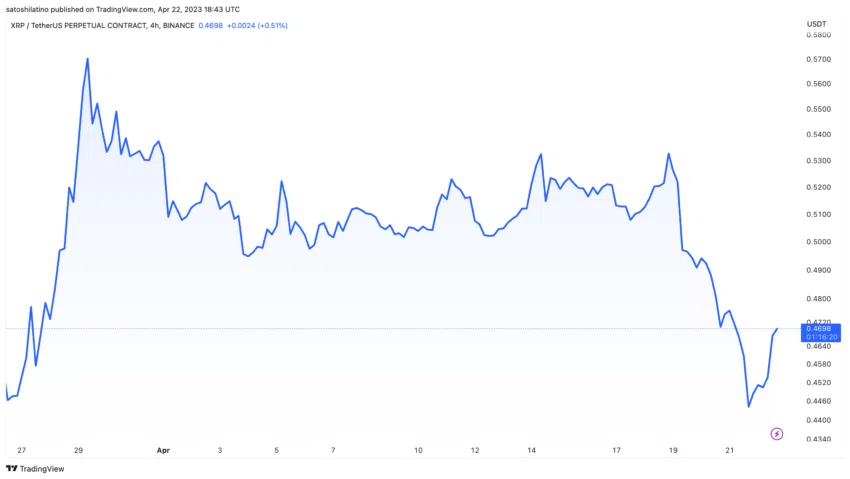

XRP Price Volatility

XRP, like other cryptocurrencies, has experienced significant price fluctuations over the last few days. The recent XRP price crash can be attributed to factors such as low trading volumes in the crypto market and regulatory pressure.

The rising regulatory pressure in the crypto market has seen trading volumes in the world’s largest crypto exchange, Binance, commensurate with a bear market.

XRP price has also been significantly impacted by the prevailing bearish sentiment in the broader market. This has been fueled by regulatory ambiguity following the Securities and Exchange Commission (SEC) Chairman’s inability to address congressional inquiries.

As SEC Chair Gary Gensler leaves the cryptocurrency community uncertain, Ripple is actively seeking opportunities beyond its current landscape.

Ripple Growth in the European Market

Europe represents a massive market opportunity for Ripple, with a growing number of financial institutions adopting its technology.

Some factors contributing to Ripple’s growth in Europe include:

- The region’s progressive regulatory environment.

- High demand for cross-border payment solutions.

- Strategic partnerships with key financial players.

These factors position Ripple well to capitalize on the European market’s potential, offsetting any short-term challenges posed by XRP price volatility.

Strategic Partnerships and Collaborations

Ripple’s success in Europe can be largely attributed to its strategic partnerships with leading financial institutions and technology providers. Some notable collaborations include:

- Santander, one of the largest banks in Europe, uses Ripple’s technology for its international payment services.

- Swiss-based Finastra, a global fintech company, integrates Ripple’s blockchain technology into its solutions.

- Currencycloud, a UK-based payments platform, is partnering with Ripple to enhance cross-border transactions.

These partnerships increase Ripple’s visibility in the European market and strengthen its position as a leading provider of cross-border payment solutions.

Regulatory Landscape in Europe

Europe’s progressive regulatory landscape has played a critical role in fostering the adoption of Ripple’s technology. The European Union (EU) has been proactive in developing a comprehensive regulatory framework for digital assets, such as:

These regulatory developments provide a supportive environment for Ripple to grow and expand its services in the European market.

Future Prospects for XRP and Ripple

Despite the recent XRP price crash, XRP and Ripple have a promising future in the European market thanks to the following:

- Continuous technological innovation and development.

- Growing adoption of Ripple’s payment solutions by financial institutions.

- The supportive regulatory landscape in Europe.

- Strategic partnerships with industry leaders.

These factors collectively contribute to a strong foundation for Ripple’s sustained growth and potential to overcome short-term market volatility.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.