(Bloomberg) — Ukraine’s crop exports are being threatened again, with Black Sea shipments halting just as some of its European Union neighbors stop allowing cargoes to pass through them.

Most Read from Bloomberg

Kyiv on Monday said Russia has blocked inspections of vessels under a key safe-passage deal, the second time in a week that the corridor has ground to a halt. That’s happening as Poland, Hungary and Slovakia in recent days banned imports of Ukrainian grain over concerns the supplies are hurting their domestic markets.

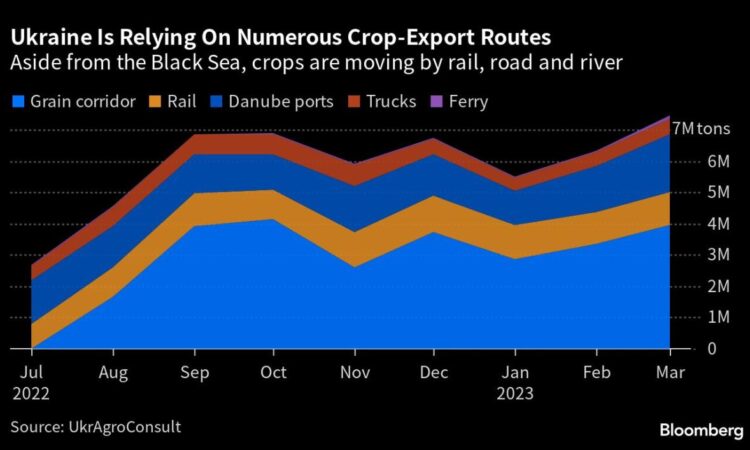

It’s a setback for Ukraine, which when faced with difficulties shipping by sea in the wake of Russia’s invasion had been sending some cargoes by rail, truck and river through its EU neighbors. If the issues persist, it would make it much harder for Ukraine to supply developing nations and get vital foreign currency income, while also threatening to push up global crop prices.

For now, traders don’t appear to be hugely concerned. Benchmark wheat futures traded in Chicago rose 0.5%, reversing earlier losses but remaining within recent weeks’ trading range.

The import bans by the three eastern EU nations underscore splinters in the bloc’s efforts to support Ukraine. Member states have voiced dissent over issues including arming Kyiv, banning Russian energy imports and helping the war-ravaged country to export food that helps feed millions in developing nations.

Poland and other neighboring nations had agreed to help Ukraine — a crucial grain supplier — to move its cargoes through their territory after Moscow’s invasion temporarily blocked Black Sea exports last year. But part of that supply is now piling up in eastern Europe. That’s adding pressure on local farmers as global grain prices have slumped from last year’s peak.

A Grain Glut Is Straining the Goodwill That Ukraine Badly Needs

The import restrictions “would however increase the glut in Ukraine and make them even more reliant on the corridor, therefore increasing the potential market impact should the corridor cease as Russia has threatened,” said James Bolesworth, managing director at CRM AgriCommodities.

The EU at the weekend slammed the decisions by Poland and Hungary to ban imports from Ukraine, saying “unilateral actions” were unacceptable and a potential breach of the bloc’s trade policy. The governments of Hungary and Poland have blamed the EU for allegedly being slow to address the plight of farmers there.

Ukrainian Deputy Prime Minister Yulia Svyrydenko will join a government delegation that’s due to arrive in Warsaw on Monday for talks to resolve the grain glut, Polish private radio RMF FM reported on its website, without saying where it got the information.

Inspections Halted

Ukraine’s infrastructure ministry said Russian inspectors in Istanbul “unilaterally stopped registering vessels that Ukrainian ports submit to form an inspection plan” for Black Sea cargoes. That means that an inspection plan hasn’t been drawn up, the ministry said.

Inspections were also briefly halted last week, and Russia has indicated it may quit the initiative if its issues aren’t resolved by mid-May. The threat underscores uncertainty over the export deal that has been crucial for bringing down global food-commodity costs from records reached after Russia’s invasion.

The Joint Coordination Centre in Istanbul, which oversees inspections and hosts teams from Ukraine, Russia, Turkey and the United Nations, didn’t immediately respond to a request for comment. The UN last week said differing views had arisen over Ukraine submitting lists of vessels to be checked.

The “grain initiative is under threat of shutdown,” Ukraine Infrastructure Minister Oleksandr Kubrakov said. “This is another Russian attempt to dictate its policies to the world, endanger food security, and use food as a weapon.”

For Ukraine’s cargoes moving through the EU, Kyiv expects that agreements will be made to restore transit, according to Denys Marchuk, deputy chair of the Ukrainian Agrarian Council.

“Our farmers work in the most terrible conditions and agriculture is almost the only area that allows the country to earn foreign currency income,” Marchuk said.

In other Chicago crop markets, soybean futures rose 0.5% and corn was steady.

–With assistance from Michael Winfrey, Olesia Safronova and Piotr Skolimowski.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.