UK 30-year borrowing costs hit highest since 1998 as bond market sell-off grips markets – as it happened | Business

UK 30-year borrowing costs hit highest since 1998

Britain’s long-term cost of borrowing has hit its highest level since 1998 this morning, as the sell-off in the bond market continues.

The yield, or interest rate, on 30-year UK government bonds has hit 5.115% this morning, Refinitiv data shows.

That is above the levels seen a year ago in the panic after Liz Truss’s mini-budget.

UK 30-YEAR GILT YIELD RISES TO HIGHEST SINCE SEPT 1998 IN EARLY TRADE AT 5.115% – REFINITIV DATA

— First Squawk (@FirstSquawk) October 4, 2023

This rise in yields comes as the price of 30-year UK government bonds falls again, as investors anticipate that global interest rates will remain higher for longer than hoped.

Traders are now thinking inflation will be more sticky, so even if rates don’t rise much higher, base rate cuts will happen less quickly.

30-year gilt yield rises this morning to highest level since 1998.

Unlike a year ago, this move truly is global – big rout going on across bond markets. pic.twitter.com/nU0CXCtH0J

— Andy Bruce (@BruceReuters) October 4, 2023

Shorter-dated UK government bond prices are also weakening, with the yield on 10-year gilts hitting its highest since August this morning, at 4.669%.

These rising borrowing costs will give chancellor Jeremy Hunt less room for spending rises or tax cuts in his autumn statement, as they reflect the cost of issuing new government debt.

Big Breaking

UK 30-year gilt yield rose to its highest level since September 1998, reaching 5.115%.: Refinitiv

This is a significant increase from the yield of around 3.75% at the beginning of September, and it reflects the growing concerns among investors about the UK economy… https://t.co/6Eeaz6ePj6 pic.twitter.com/oGtJ4dRlcw

— QuickUpdate (@BigBreakingWire) October 4, 2023

This surge in UK borrowing costs comes amid a global selloff this week, with US Treasury yields hitting their highest since 2007 and German borrowing costs the highest since 2011 this morning (see here).

As explained in this morning’s introduction, traders fear the central banks such as the US Federal Reserve will keep borrowing costs painfully high for longer than hoped as they try to crush inflationary pressures, potentially creating a recession.

Susannah Streeter, head of money and markets at Hargreaves Lansdown, explains:

The bond sell off has been bedding in with the yield on 30-year Treasuries shooting to levels not seen for 16 years.

This is already pushing fresh Federal borrowing into ‘ouch territory’ and there are concerns yields could inch even higher.

The sell off in long-term government bonds has been spreading in Europe too. Yields on 30-year gilts have headed above 5%, with investors demanding more interest to buy in, giving ministers less wiggle room to ease cost-of-living pain through tax cuts or public sector pay offers, particularly given the UK government’s self-imposed borrowing rules.

Key events

Closing post

Time to wrap up….

A rout in the global bond market appears to have cooled this afternoon, after government borrowing costs hit multiyear highs.

UK 30-year gilt yields (the interest rate on the bond) soared to levels last seen in 1998, trading above 5.1%, as anxiety grew that central banks will leave interest rates high for longer than hoped.

US 10-year Treasury bill yields hit their highest level in 16 years, while Germany’s borrowing costs were the highest since 2011.

But the slump in bond prices has reversed in late trading, after unexpectedly weak jobs data showed fewer new hires than expected last month.

This has pulled the UK 30-year bond yield back to around 5% tonight.

The oil price has also weakened, after Opec+ indicated it will leave its output targets unchanged while Saudi Arabia and Russia reaffirmed their commitment to additional cuts until the end of the year.

Here’s the rest of today’s stories:

Larry Elliott

Central banks risk tipping a stalling global economy into a full-blown recession unless they relax their 2% inflation targets and adopt a more pro-growth stance, the economic arm of the UN has warned.

Pointing to evidence of a looming debt crisis in poor countries, the UN said the sharp rises in interest rates from the major central banks since 2021 had increased inequality and reduced investment but proved a blunt anti-inflation weapon.

The annual report from the Geneva-based UN Conference on Trade and Development (Unctad) said global growth was set to slow from 3% in 2022 to 2.4% in 2023, with little sign of a rebound next year.

Richard Kozul-Wright, the director of Unctad’s globalisation and development strategies division, said:

“The global economy is stalling, with Europe teetering on the edge of recession, China facing strong headwinds and financial stresses are reappearing in the United States.

Here’s an explainer about the drama in the bond markets:

FTSE 100 closes in the red

Britain’s FTSE 100 index has ended the day at its lowest closing level since the end of August.

The blue-chip index has closed 57 points lower at 7,412 points, down 0.77% today.

Hotel operator Whitbread (-3.77%), gambling group Entain (-3.7%) and weapons maker BAE Systems (-3.6%) led the fallers.

Oil companies also dropped, tracking the falling crude price, while the drop in tobacco company shares also weighed on the FTSE.

Michael Hewson of CMC Markets explains:

Imperial Brands and British American Tobacco have come under pressure on today’s announcement that the UK will raise the legal smoking age over time, although it can’t have been too much of a surprise to see it confirmed given recent briefings. There will also be restrictions on the purchase of vaping products to children, looking at flavours, packaging as well as disposability, meaning that the industry is likely to feel the pressure on both side of its business, on traditional as well as NGP revenue streams.

The defence sector is also feeling the heat on concerns over future US spending, after a commitment to spend another $6bn for future Ukraine aid was left out of the latest US government funding plan, with BAE Systems sliding to 5-week lows

New orders for U.S.-made goods increased more than expected in August and shipments accelerated, new data shows.

It could support hopes that US economic growth strengthened in the third quarter, despite persistent worries about a recession that have rocked the bond markets.

Factory orders rebounded 1.2% after falling 2.1% in July, the Commerce Department said on Wednesday. Economists polled by Reuters had forecast a rise of 0.2%.

On an annual basis, orders rose 0.5% in August.

The wider stock market is having a rough day too, with the FTSE 100 index down around 1% in late trading.

Back in the City, shares in tobacco firms are sliding after Rishi Sunak announced he plans to introduce a new law banning tobacco sales to anybody born on or after January 1 2009.

Imperial Brands, which makes Davidoff, West and Gauloises cigarettes, Golden Virginia and Drum tobacco and Rizla rolling paper, are now down 3.6%, knocking around £500m off its market value.

Larger rival British American Tobacco are down 1.8%, knocking around £1bn off its value.

Also in New York, Sam Bankman-Fried’s cryptocurrency fraud trial has entered its second day – we’re live-blogging events here:

After a rough day yesterday, Wall Street has opened a little higher.

The S&P 500 index of US stocks has gained 0.25%, or 10 points, to 4,240 points, as the weaker-than-expected ADP Payroll report calms some fears over high interest rates.

The dollar is weakening, after the weak ADP Payroll report on US job creation last month (see earlier post).

This has pushed the pound up to $1.216, away from the six-month low of $1.2035 hit this morning.

Bond yields slip back after weak US payroll report

Newflash: Some calm is returning to the bond markets, after a new survey showed much fewer jobs were created at US companies last month than expected.

Payroll operator ADP has reported that private sector employment across the US increased by 89,000 jobs in September, a long way shy of the 153,000 increase which Wall Street economists expected.

This may be a sign that America’s labor market cooled last month – we get the official non-farm payroll report on the jobs market on Friday.

In response, US bond yields have slipped back, as traders grasp onto hopes that a weaker jobs market could lead to lower interest rates.

This has pulled US Treasury yields away from the 16-year highs set this morning.

2- and 10-year yields are down 10 and 15bps, respectively, this morning. A downside surprise in the ADP Private jobs number is contributing (89k vs est of 150k and prior 180k). Official payrolls number comes on Friday. pic.twitter.com/Uoy4zPazw5

— Liz Young (@LizYoungStrat) October 4, 2023

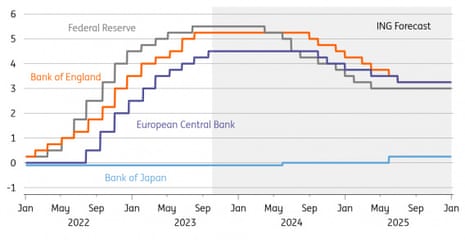

ING have released their latest forecasts for interest rates, which reckon the big four central banks will not raise borrowing costs higher.

They predict:

-

Federal Reserve: No further rate hikes with cuts starting from Spring 2024

-

European Central Bank: No further rate hikes and the first rate cut in summer 2024

-

Bank of England: No more rate hikes and the first rate cuts from summer 2024

-

Bank of Japan: Another tweak to the Yield Curve Control (YCC) policy but no change in the policy rate until the second quarter of 2024

Analysts are concerned that the sharp moves in the bond markets in recent days are likely to inflict damage on parts of the financial system.

“No one knows when this is going to stop,” said Chris Turner, global head of markets at ING, via the Financial Times.

“It feels like something is going to snap but I’m not quite sure what.”

Full story: UK long-term borrowing costs hit 25-year high

Phillip Inman

Britain’s long-term cost of borrowing has hit its highest level since 1998, as political instability in the US and fears of sustained high levels of inflation triggered a sell-off in global bond markets.

The yield, or interest rate, on 30-year UK government bonds hit 5.115% in morning trading, according to financial data provider Refinitiv.

The rise, which takes the UK’s borrowing costs above the level seen a year ago in the crisis after Liz Truss’s mini-budget, follows growing concerns that central banks will keep interest rates at the high levels through 2024 and possibly into 2025.

With most governments borrowing huge sums throughout the pandemic and to cushion the blow over the last year from high energy prices, traders expect countries with high levels of debt to struggle financially.

A surge in US government borrowing and political instability after the removal of US House speaker Kevin McCarthy on Tuesday pushed Treasury yields to a 16-year high.

Germany has also found itself in traders’ sight lines amid reports of strains within its ruling coalition, pushing the 10-year German yield to its highest level in 12 years. The interest rate on the country’s benchmark 10-year debt rose above 3% for the first time since 2011, while its 30-year yield also hit a 12-year high.

The surge in bond yields is cooling America’s housing market.

New data this morning shows that total mortgage demand in the US fell by 6% compared with the previous week.

Applications weakened as US mortgage rates hit 7.5% for the first since November 2000, as the jump in US government bond yields drove up borrowing costs.

Higher rates weighed further on mortgage activity during the week ending Sep. 29…

Mortgage applications declined -6% w/w (sa) according to the MBA Weekly Applications Survey, leaving the index down -19% year-over-year and down -60% compared with pre-pandemic levels (i.e., the… pic.twitter.com/wXKVHOkavf

— Parker Ross (@Econ_Parker) October 4, 2023

Rishi Sunak scraps HS2 leg to Manchester

It’s official, the rest of the HS2 rail project is being scrapped.

Prime minister Rishi Sunak has just told the Conservative Party conference that he is ending the “long-running saga” of the high-speed rail line, saying:

I am cancelling the rest of the HS2 project, and in its place we will reinvest every single penny, £36bn, in hundreds of new transport projects in the North and the Midlands, across the country.

Sunak explains that the line from Birmingham to London Euston will be completed (rather than terminating in Old Oak Common in the capital’s western suburbs, as had been rumoured).

HS2 trains will still run to Manchester, he adds (but not on new high-speed lines).

Andrew Sparrow’s Politics Live blog has all the action:

This is despite Britain’s biggest HS2 contractors launching an 11th-hour effort to convince Rishi Sunak not to cancel the high-speed rail line to Manchester…..

… and the news that the Conservative mayor for the West Midlands is considering quitting over Rishi Sunak’s decision to cancel the high-speed train line between Birmingham and Manchester.