Cryptocurrency is an extremely high-risk and complex investment. Don’t invest unless you’re prepared to lose all the money you invest. You are unlikely to be protected if something goes wrong. Forbes Advisor has provided this content for educational reasons only and not to help you decide whether or not to invest in Cryptocurrency. Should you decide to invest in Cryptocurrency or in any other investment, you should always obtain appropriate financial advice and only invest what you can afford to lose.

Top cryptocurrency statistics

- By the end of 2021, it is estimated that nearly 300 million people worldwide owned some kind of cryptocurrency (crypto.com)

- Crypto’s worldwide market capitalisation was estimated at £621bn in 2022 (Grand View Research)

- By 2030, the worldwide market is expected to grow by 12.5% in compound annual growth rate (CAGR) (Grand View Research)

- A survey by Forbes Advisor shows that 65% of the investing public has money in cryptocurrency

- When it comes to the UK population at large, a separate Forbes Advisor survey found that 9% currently have money in cryptocurrency

- This is consistent with research from the FCA stating that nearly 4.97 million people in the UK hold some form of crypto asset, nearly 10% of the population.

- Estimates show the UK crypto user base is expected to increase to 22.23 million by 2027 (Statista)

- According to a survey by Forbes Advisor, those aged 18-34 are twice as likely to own a type of cryptocurrency than those aged 35-54

Crypto exchanges

According to Statista, trading volume in the entire cryptocurrency market reached a peak of $500 billion on 19 May 2021.

Cryptocurrency awareness

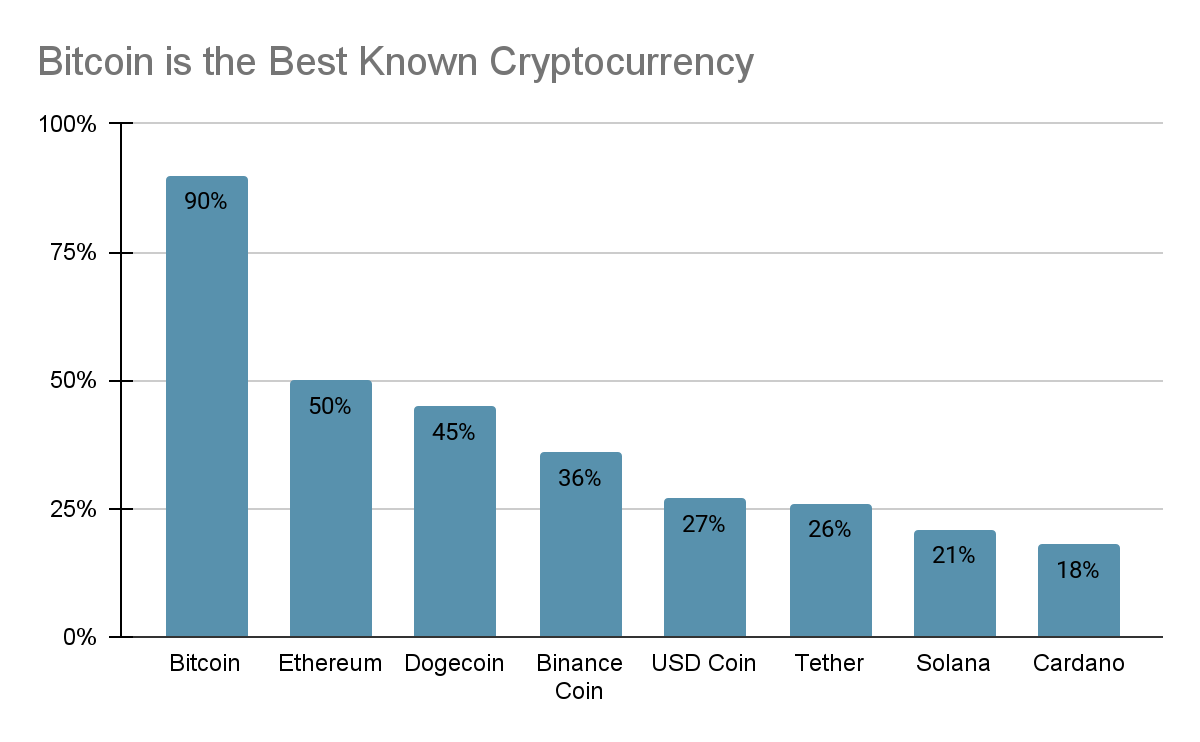

According to a Forbes Advisor survey, 90% of respondents had heard of Bitcoin making it the most well-known cryptocurrency. Other familiar coins included:

- Bitcoin – 90%

- Ethereum – 50%

- Dogecoin – 45%

- Binance Coin – 36%

- USD Coin – 27%

- Tether – 26%

- Solana – 21%

- Cardano – 18%

Legitimacy of cryptocurrency

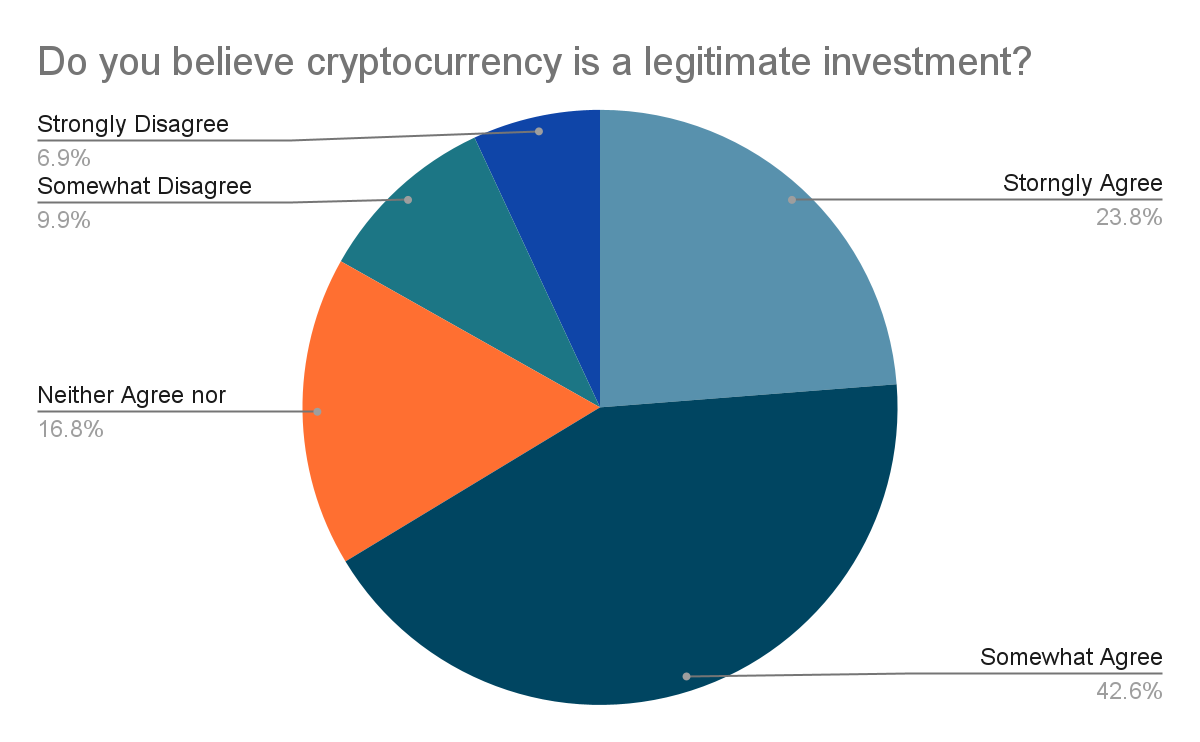

According to a Forbes Advisor survey:

- 67% % agree that cryptocurrency is a legitimate form of investment.

- 17% neither agree nor disagree with that statement

- 27% disagree that cryptocurrency is as legitimate investment

- 24% of those who invest in cryptocurrency say they trust it more than traditional investments

- 60% of crypto holders said that they were happy to trade in the cryptocurrency market despite it being unregulated (FCA)

Why do people invest in cryptocurrency?

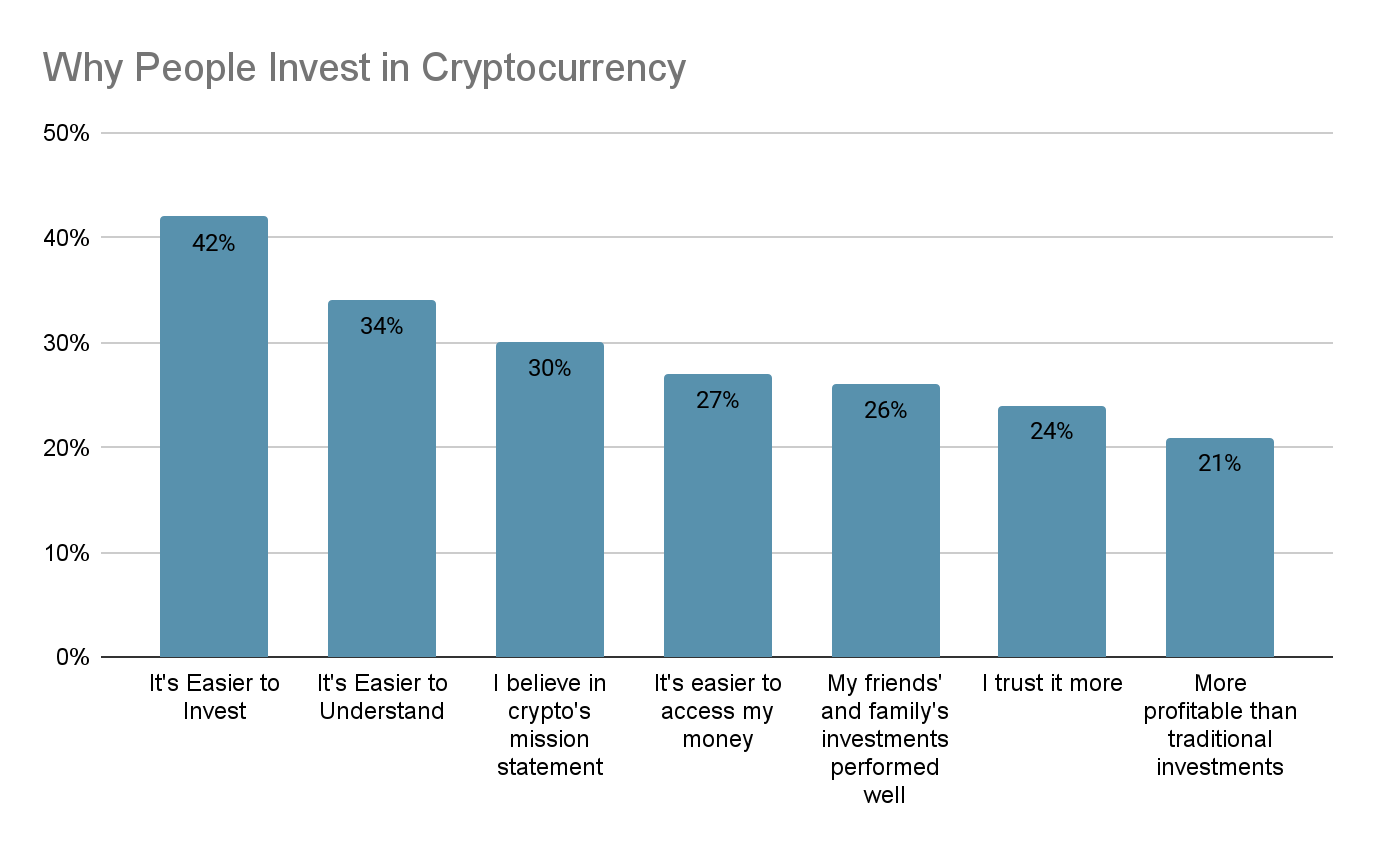

According to the Forbes Advisor survey, there are a range of reasons why people invest in cryptocurrency:

- It’s an easier way to start investing through an app (42%)

- It is easier to understand than conventional investments (34%)

- The investors believe in the message and mission statement behind cryptocurrency (30%)

- The investors have easier access to money when it is invested in cryptocurrency (27%)

- The investors saw their friend or family member’s investment performing well (26%)

- The investors trust it more than traditional investments (24%)

- The investor has made more money through crypto than through traditional investments (21%)

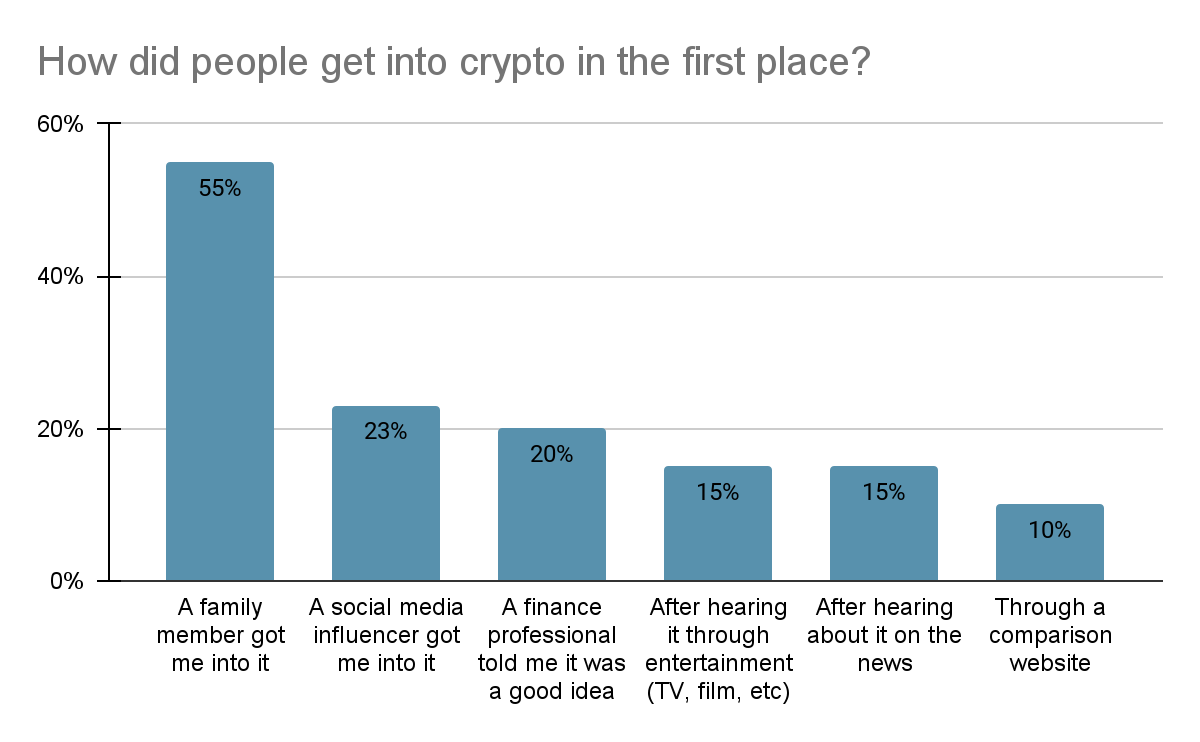

These are the reasons people got into crypto investing in the first place:

- 55% said a friend or family recommended it

- 23% said an influencer on social media get them into it

- 20% said a finance professional told them it was a good idea

- 15% heard about it through film, television, or other entertainment

- 15% heard about it on the news

- 10% got into crypto through a comparison website

Why do people not invest in cryptocurrency?

According to the Forbes Advisor survey, there are also a range of reasons why people have decided not to invest in cryptocurrency.

- 58% have stated that they do not trust it

- 34% do not understand the technology

- 21% believe that it performs badly as an investment

- 14% don’t invest due to environmental concerns

- 12% would like to begin investing in cryptocurrency, but are unsure where to start

- 9% do not have the spare income to invest

- 9% have seen a friend of family members investment perform poorly

Crypto payment firm Triple A’s survey indicates that 70% do not invest in cryptocurrency due to a lack of knowledge (Triple A)

This is supported by IW Capital’s survey in 2018, which revealed that only 38% of the UK population has any understanding of cryptocurrency (BNC)

Individual investment in cryptocurrency

According to a Forbes Advisor survey, just over a quarter of respondents (27%) said they had cryptocurrency holdings to £500. Just under a quarter (24%) said their exposure to the sector was between £501 and £1,000. More broadly, this is how crypto holdings were split across the entire universe of responses:

- £0-£500: 27%

- £501-£1000: 24%

- £1001-£1500: 20%

- £1501-£2000: 12%

- £2001+: 15%

- 2% of crypto holders are not sure how much they currently have invested in cryptocurrency.

78% paid with their own disposable income (FCA)

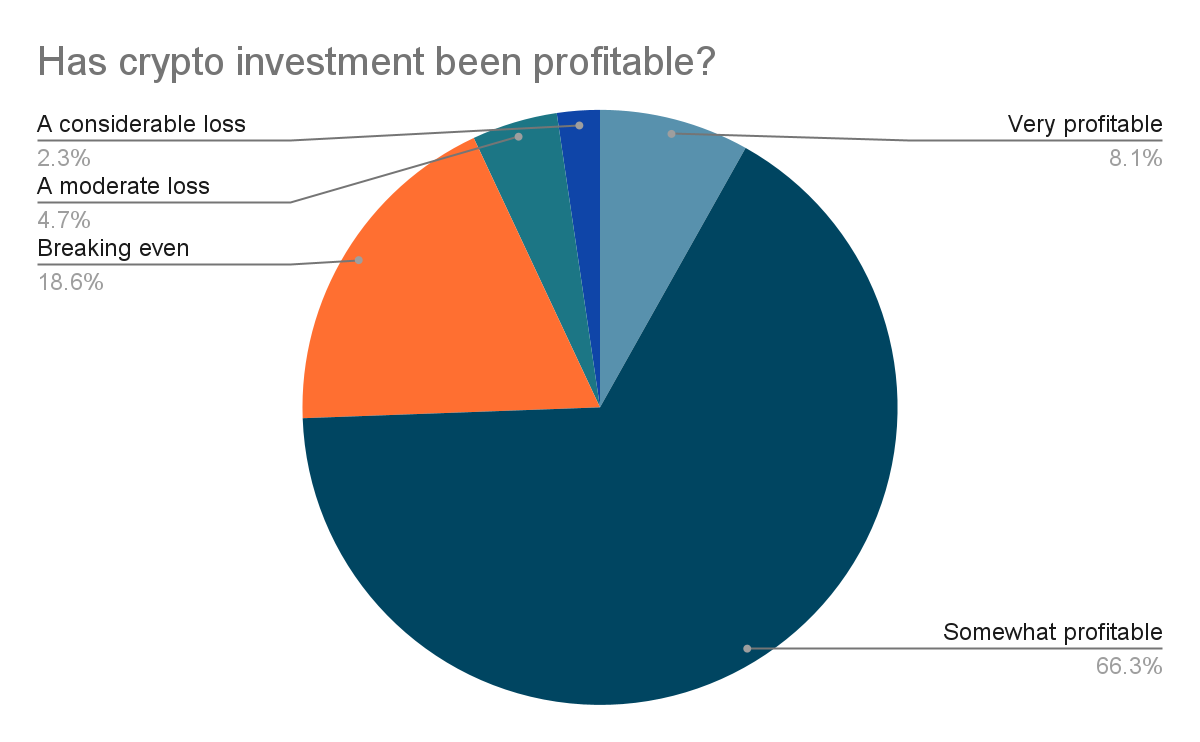

Profits made/lost investing in cryptocurrency

The Forbes Advisor’s survey also asked investors how their crypo investments had performed in the last year:

- 57% made money from investing in cryptocurrency

- 16% feel as if they have neither made nor lost money.

- 14% have lost money.

- Only 7% feel as if they made a lot of money.

- In 2021, 53% of UK investors said that they had a positive experience and were likely to invest more (FCA)

- This is an increase from 2018, where a study run by IW Capital revealed that only 5% of British crypto investors realise profit (BNC)

Have the crashes in cryptocurrency affected investments?

Forbes Advisor asked to what extent the recent cryptocurrency crashes have made people look at cryptocurrency in a more negative light:

- 58% agree that it has

- 28% neither agree nor disagree

- 13% disagree

Despite this, 38% Triple A’s survey of UK crypto adult crypto holders shows participants are looking to increase their cryptocurrency holdings in the next year (Triple A).

Resources: