It’s not a matter of if, but when.

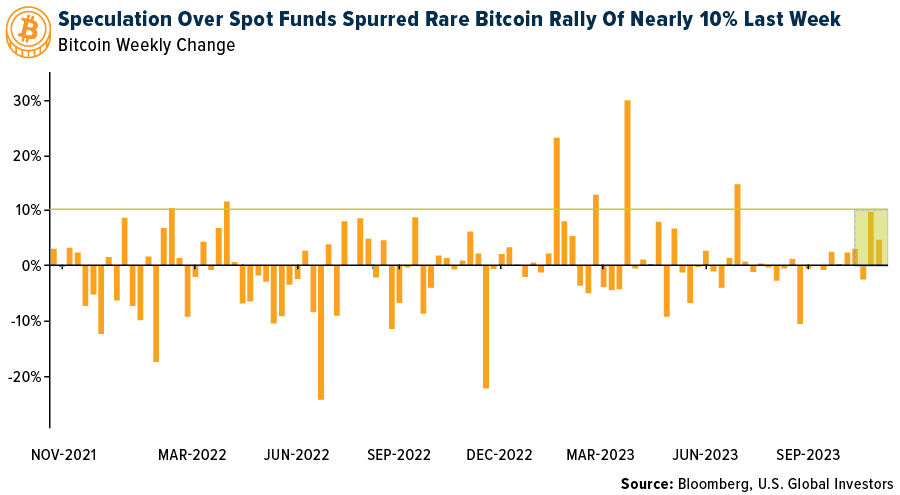

I’m talking, of course, about the long-awaited approval of a U.S.-based spot Bitcoin exchange-traded fund (ETF). Analysts at Bloomberg Intelligence now estimate there’s a 90% chance that the Securities and Exchange Commission (SEC) will give the go-ahead to such an investment product by January 10, 2024.

Many presenters at this week’s European Blockchain Convention (EBC) were even more optimistic, saying they believe a Bitcoin ETF will appear on the market by the end of this year.

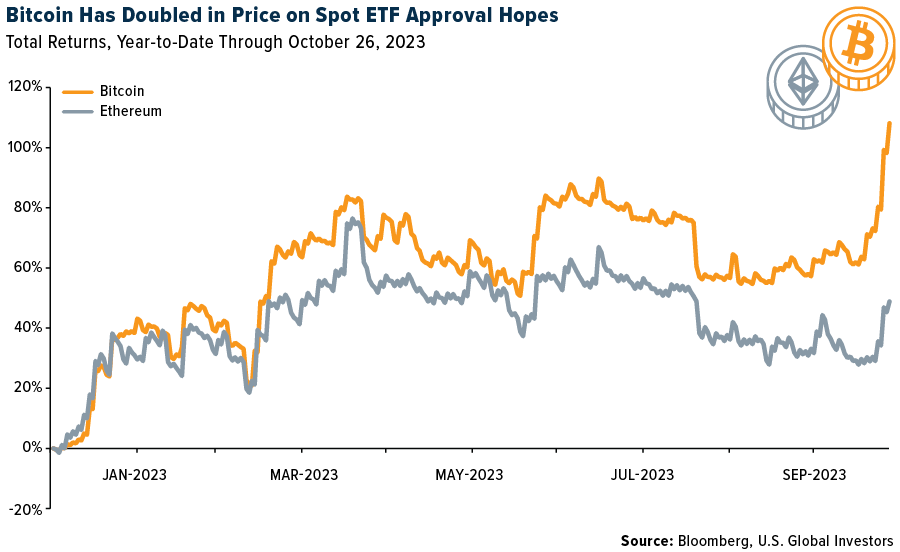

Mr. Market appears to agree. Responding to strong speculation that BlackRock, the world’s largest investment management firm, is preparing to “seed” its iShares Bitcoin ETF this month with an unknown amount of capital in anticipation of its imminent approval, investors bid up the price of the digital asset this week to more than $35,000, a price we haven’t seen in nearly a year and a half. That’s roughly double what Bitcoin started the year at. For comparison’s sake, Ether, the second largest digital token by market cap, is up around 50% year-to-date.

Investors Seeking Direct Access to Bitcoin

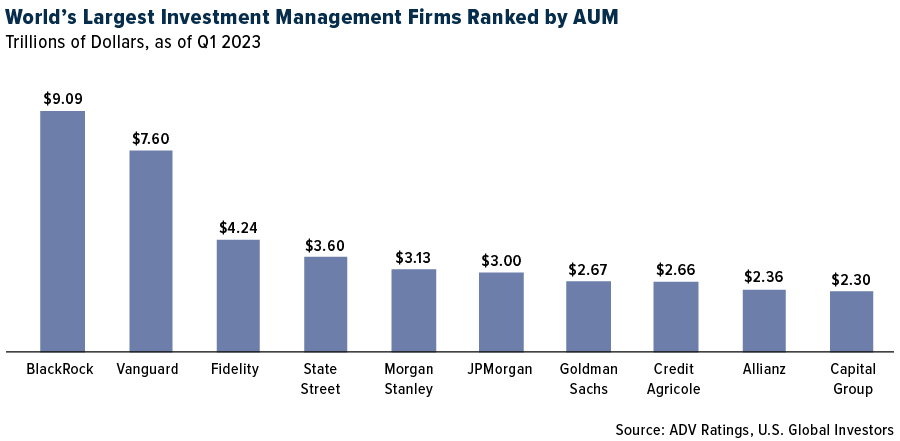

Spot Bitcoin ETFs are already available to certain investors. Canada has had them for years. Europe launched its first one in August. But even when combined, Canada and Europe are dwarfed by the size of the U.S. stock market, which accounts for close to 60% of the total global equity market value. Of the top 10 largest investment management firms, only two—France’s Credit Agricole and Germany’s Allianz—are non-American.

To date, the only way for U.S. investors to get exposure to Bitcoin—besides buying the asset outright—is through futures, options and other derivatives. The largest of these products, the Grayscale Bitcoin Trust (GBTC), has been trading publicly since 2015 and currently has over $21 billion in assets under management (AUM).

But trusts are unwieldy products compared to ETFs, which are traded on exchanges throughout the day and can be highly liquid.

Plus, investors want access to spot Bitcoin prices, just as they have access to spot gold prices with physical gold-backed ETFs.

Grayscale knows all of this, of course, which is why it’s filed to convert GBTC to an ETF. And now, like BlackRock and a number of other firms that have also submitted applications for a Bitcoin ETF—they include Fidelity, Invesco, Franklin Templeton, VanEck and WisdomTree—Grayscale must play the waiting game at a time when many market experts are concerned that the U.S. could be falling behind other jurisdictions when it comes to Bitcoin investment, not to mention regulation.

Some firms are choosing to act now. Cathie Wood’s ARK Invest, which also has a Bitcoin ETF in the pipeline, has begun selling shares of GBTC in anticipation of its successful conversion into an ETF.

Understanding the Impact of a U.S. Spot ETF

So what are the implications?

Assuming for the moment that the SEC is in fact ready to give its blessing to a BlackRock-issued Bitcoin ETF, it’s possible we may never see the token below $30,000 again. In such a scenario, the New York-based investment firm would likely become the world’s largest institutional holder of Bitcoin, creating a potential supply crunch. Remember, Bitcoin production is capped at 21 million, and the “halving”—when the reward for mining Bitcoin is cut in half—is coming up in around six months.

The availability of a Bitcoin ETF would also finally herald the arrival of institutional investors. For many financial advisors, fiduciaries and others, Bitcoin is not an approved wealth management strategy. A spot ETF, on the other hand, would be.

According to estimates made by blockchain and digital asset company Galaxy, a U.S.-based spot Bitcoin ETF would attract $14 billion in investor inflows in the first year alone. This would accelerate to $27 billion in the second year and, at the end of the third year following its launch, nearly $40 billion.

This is only an estimate, and no one can predict the future with absolute certainty. But for speculators, accumulating Bitcoin now—before an ETF hits the U.S. market—may end up being a very profitable decision.

Certainty in an Uncertain World

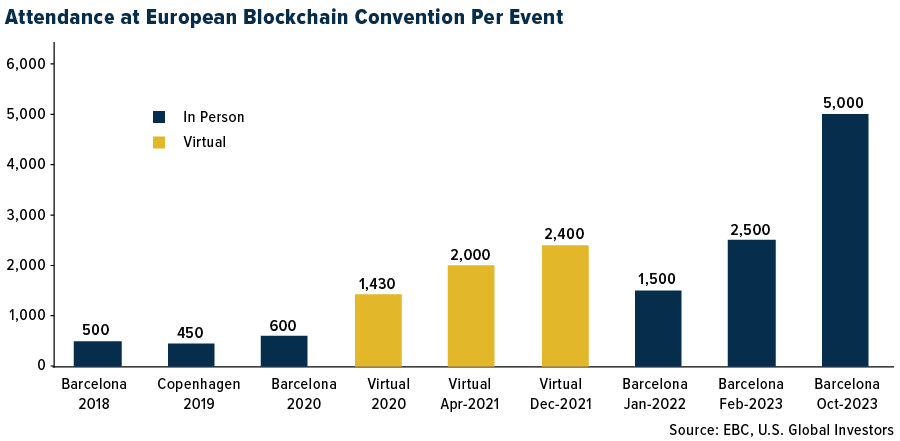

I’m pleased to report that enthusiasm was very high at the ECB, held in beautiful Barcelona. It was the most well-attended event in the conference’s history, with some 5,000 people in attendance—double the turnout from earlier this year.

Despite it being a blockchain/Web3/DeFi conference, Bitcoin was the $35,000 gorilla in the room. As a number of presenters said, the asset offers certainty in a highly uncertain world. This tracks with my recent comments that Bitcoin represents private property rights and, more broader, human rights.

With a spot ETF looking more and more likely, now could be an unprecedented opportunity to get exposure. Remember, however, to do your own due diligence and keep in mind that volatility is much greater than what you find in traditional investment instruments. For that reason, I recommend a weighting of no more than 2% of your total portfolio.

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost 2.14%. The S&P 500 Stock Index fell 2.67%, while the Nasdaq Composite fell 2.62%. The Russell 2000 small capitalization index lost2.76% this week.

- The Hang Seng Composite gained 1.49% this week; while Taiwan was down 1.86% and the KOSPI fell 3.04%.

- The 10-year Treasury bond yield fell 7 basis points to 4.837%.

Airlines and Shipping

Strengths

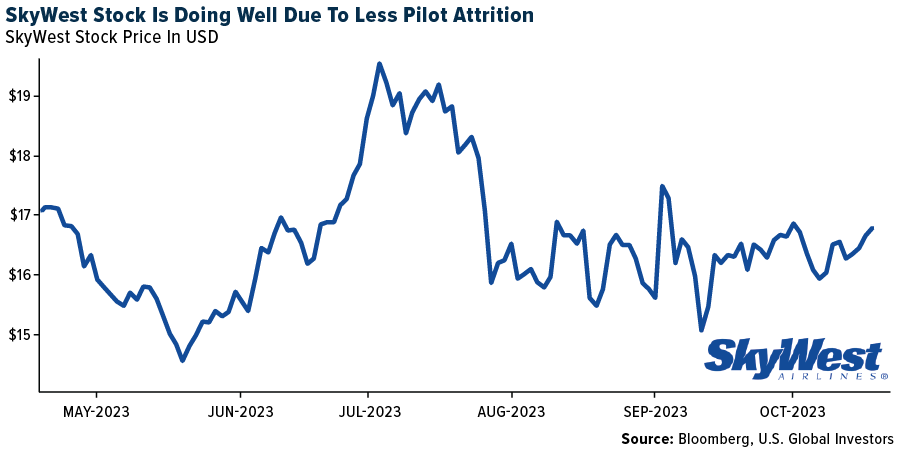

- The best performing airline stock for the week was SkyWest, up 13.1%. SkyWest reported earnings per share (EPS) of $0.55, better than Visible Alpha’s consensus of $0.39. The beat versus consensus was driven by better-than-expected revenue. The company introduced fourth quarter block hour production guidance of flat-to-down slightly sequentially or up 2% year-over-year. This implies fiscal year 2023 block hours down 9% year-over-year, ahead of prior expectations of down 11%.

- According to Bank of America, air cargo freight rates bottomed in early September and have sequentially moved higher, sustaining at 30%-35% above 2019 levels in the past month. The bank attributes the uptick to demand seasonality around the end-of-year peak as well as the imposition of fuel surcharges given rapid moves higher in jet fuel in the third quarter.

- IAG reported third quarter operating profit before the exceptional items of €1,745 million, 12% ahead of company consensus, which had been revised up following first half of the year results. The beat relative to consensus was driven by lower non-fuel unit costs (-3.5%) and better yields (up 2% year-over-year).

Weaknesses

- The worst performing airline stock for the week was Frontier, down 10.5%. Hawaiian Air reported an adjusted loss per share of ($1.06), worse than FactSet’s consensus of ($0.94). The miss versus consensus was driven by worse revenue and non-operating costs. Near-term revenue trends are being pressured by the negative impact of the Maui wildfires and accelerating industry capacity growth to Japan where demand is still recovering, while near-term unit cost growth is higher-than-expected due to an elevated number of aircraft on the ground.

- According to Morgan Stanley, weekly container spot rates confirm a downtrend while quarterly results from overseas firms also reveal guidance cuts and anticipated container losses. Consensus forecasts have not sufficiently factored in prospects of a net loss at Ocean Network Express (ONE), but expectations are falling.

- Volaris reported another challenging quarter, missing Bloomberg consensus estimates on the operating and bottom-line levels. The top line was at $848 million (up 10% year-over-year), nearly in line with consensus. Net income came in at -$39 million, below the Street at $2 million.

Opportunities

- According to UBS, the latest UBS Evidence Lab Global Travel Manager Survey sheds light on expected business behavior in 2024 and beyond and still suggests business traffic recovery. Most travel managers see budget increases next year with on-average travel budgets expected to increase by 10% year-over-year and most expect a full recovery of travel budgets back to 2019 in the next two years.

- According to Stifel, over the course of the past 30 years, after adjusting for inflation and operating costs, the cash-on-cash return of a one-year time charter contract relative to the price of a new ship was 10% for a VLCC and 11% for a Capesize vessel. Currently, newbuild prices are 23% higher than the 20-year average for VLCCs and 26% higher for Capesize vessels. For a scrubber fitted VLCC and Newcastlemax (slightly larger modern version of a Capesize) the adjusted returns are 11.5% and 6.5%. This implies fewer ships will be added in the future.

- Media is reporting that in response to increased fuel prices, Qantas is increasing fares by an average of 3.5%. Qantas Group had absorbed recent fuel hikes but according to a company spokesman, the current tensions in the Middle East, broader economic factors and a weaker Australian dollar means that fuel prices are expected to stay elevated for some time. Even after the adjustment, the fares are expected to remain below the peaks of last year.

Threats

- Morgan Stanley believes there is a mounting risk of weakening pricing in long haul markets such as the Atlantic and Europe-Middle East Africa next year, with capacity scheduled to accelerate materially in these markets through winter.

- According to Bank of America, air cargo supply continues to grow around 10% year-over-year with surging belly capacity on international flight restoration and limited supply discipline from freighters for now. The bank sees more pressure ahead from further restoration of passenger flights in the upcoming winter 2023-2024 season, while freighter supply discipline could remain elusive until rates turn loss-making, particularly with new freighters getting delivered.

- According to Morgan Stanley, Spirit Airlines had the highest percentage of cancelations occurring over the past week at 4.5% of scheduled flights (compared to 0.1% the prior week). Spirit saw a jump in cancelations due to “a necessary inspection of a small section of 25 of our aircraft,” which will be out of service for several days. The airline noted the inspection was due to an abundance of caution and expects the network will take several days to recover.

Luxury Goods and International Markets

Strengths

- Hermes reported a revenue increase of 16% in the third quarter. Sales in the United States and Europe were strong due to high demand for the costly Birkin and Kelly handbags. Growth in America topped estimates, while the performance in Asia Pacific, excluding Japan, was in line, reports Bloomberg.

- The U.S. continues to report solid economic data. The Manufacturing PMI and Service PMI came in stronger than expected. The Preliminary Manufacturing PMI for October was reported at 50 versus the expected 49.5. The Service PMI climbed to 50.9, above the expected 49.9. Annualized GDP for the third quarter was released at 4.9%, above the expected 4.5%.

- Deckers, a footwear designer and distributor, was the best performing S&P Global Luxury stock, gaining 15.7% in the past five days. Shares gained almost 20% on Friday after the company reported strong quarterly sales. Deckers reported $6.82 earnings per share in the quarter, compared with $3.80 a share, in the same period a year ago.

Weaknesses

- All Kering brands reported a revenue drop in the third quarter except eyewear. The company’s biggest brand, Gucci, reported a 7% decline in revenue, below the expected drop of 6.21%. Sales at Yves Saint Laurent slid 12% last quarter and sales at Balenciaga fell 15%, both missing estimates. The group sales declined 9%, missing estimates.

- The preliminary Eurozone Manufacturing PMI for October was reported at 43.0, below the expected reading of 43.7, and September’s 43.4. In the past 20 years, Manufacturing PMI dipped to the low 30 level twice: in 2020 due to the COVID-19 pandemic and in 2008 due to the global recession.

- Sleep Number, a U.S. mattress maker and wellness technology leader, was the worst performing S&P Global Luxury stock, losing 17.5% in the past five days. On Friday, shares closed at a 52-week low on a light news flow. The prior week, Sleep Number was the best performing name among the luxury index members.

Opportunities

- Bank of America’s luxury research team recommends selecting names within luxury sectors that are exposed to more affluent customer bases like Louis Vuitton, Hermes, Cucinelli, and Zegna. The super-rich are less affected by the economic downturn and will most likely continue to spend their wealth on luxury goods and services.

- China announced measures to support its economy this week. The government approved CNY 1 trillion ($139.3 billion) in additional government bond issuance for disaster relief and reparations. Proceeds are to be transferred to local governments with half to be used this year. In addition, China lifted its 2023 budget deficit to around 3.8% of gross domestic product from an originally set 3%. Economists expect rate cuts to follow.

- According to a report released by global consultancy firm Kearny and beauty e-commerce platform Luxasia, South Asia and India are poised to be the next “gold rush” markets for luxury beauty. The report estimated that the two regions together will increase in size from $4.5 billion in 2021 to $12.7 billion in 2031, growing at a CAGR (cumulative annual growth rate) of 11%, compared to the estimated global luxury beauty industry growth rate of 4-6%.

Threats

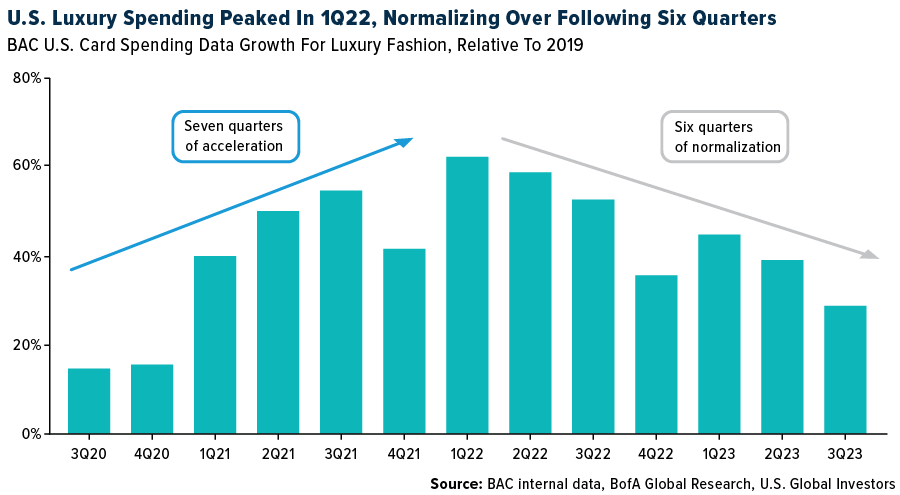

- According to Bank of America, in the United States, luxury spending relative to 2019 has peaked in the first quarter of 2022. The chart below shows seven quarters of acceleration in card spending, and so far, six quarters of corrections. BofA predicts luxury revenue growth to trough in the first quarter of 2024.

- The European Central Bank is determined to bring inflation lower to its target of 2%, but this week the bank has decided to keep rates on hold after 10 consecutive hikes. The pause follows a slowdown in euro-are prices, but concerns are mounting that a recession could be coming to the region. If the Israel-Hams conflict worsens, this could result in higher energy prices.

- Chris Watling, chief executive of financial advisory firm Longview Economics, warned that consumers are quickly running out of excess cash, while household savings are coming under pressure. Many strategists, asset managers, and CEOs remain concerned about the longer-term economic outlook, worrying about the United States falling into recession.

Energy and Natural Resources

Strengths

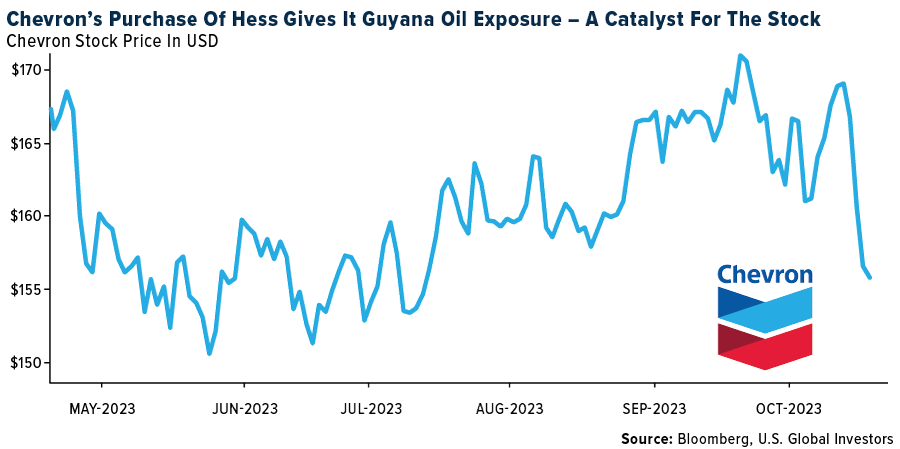

- The best performing commodity for the week was natural gas, rising 9.14%, partly on short covering prior to contract expiring at the end of the week and a slightly colder weather forecast. Chevron Corp. said it will no longer use put options to hedge the crude oil production it is acquiring from Hess Corp. once the deal is complete. Hess is one of a handful of major U.S. oil players that still participates in the options market to guarantee a minimum price for its barrels. In its most recent earnings report, published in July, the company had contracts in place that locked in $70 a barrel for about 80,000 barrels a day of WTI production, and $75 for about 50,000 barrels of Brent production for the rest of this year.

- According to RBC, uranium spot prices rebounded back near recent highs as activity picked up during the week, with a pick-up in financial/company buying and utility interest. On the news front, Euratom released its 2022 Annual Supply report which highlighted a projected moderate increase in uranium requirements and a decrease in inventories, while uranium requirements in the EU are generally covered by contracts through 2025.

- According to Bank of America, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) authorized transactions in Venezuela’s oil and gas sector including production, lifting, sale and exportation of oil and gas (including provision of related services and payment of invoices). The licenses authorizing such transactions are valid through April 2024. The authorizations follow agreements between the government and the opposition to hold free elections on the second half of 2024. The licenses will be renewed only if Venezuela meets its commitments under the electoral roadmap as well as other commitments with respect to those who are wrongfully detained.

Weaknesses

- The worst performing commodity for the week was crude oil, dropping 3.33%, likely in response to dropping oil sanctions on Venezuela. Oil also fell amid signs Israel is rethinking the scope of a potential invasion of Gaza, at least temporarily containing the conflict in the Middle East. West Texas Intermediate fell below $86 a barrel in a volatile session that saw prices swing in a more than $2 range. Israel appeared to hold off on its widely expected ground offensive into the Gaza Strip to buy time for the release of hostages held by Hamas.

- A federal judge has rejected an argument by 34 coal-fired power plant owners and operators that they were not aware of five patents for a mercury-removal process before Midwest Energy Emissions Corp. sued alleging infringement. Midwest says the defendants are liable for induced and contributory infringement of certain method claims of the asserted patents by manufacturing and selling refined coal to non-party power plants.

- According to UBS, steel prices in Europe have continued to fall in October, with steel prices down €15/ton to €645/ton in Germany (the lowest level since 2020). Confidence in EU demand strength remains low and ordering activity at domestic mills subdued, in part due to the arrival of large volumes of imported steel.

Opportunities

- China is planning to boost its strategic stockpiles of cobalt, according to people familiar with the matter, just three months after the government last bought the metal used in everything from electric-vehicle batteries to aerospace alloys. The National Food and Strategic Reserves Administration, which manages the state’s commodity stockpiles, has agreed to buy about 3,000 tons of cobalt, said the people, who are not authorized to speak publicly.

- China is planning to boost its strategic stockpiles of cobalt, according to people familiar with the matter, just three months after the government last bought the metal used in everything from electric-vehicle batteries to aerospace alloys. The National Food and Strategic Reserves Administration, which manages the state’s commodity stockpiles, has agreed to buy about 3,000 tons of cobalt, said the people, who are not authorized to speak publicly.

- SQM increased its bid for Azure Minerals to $3.52, ~A$1.6Bn, up 46% from its previous bid of $2.41. Azure stock was ~$1.70 prior to the original SQM bid in July. The current bid = +100% premium, where Azure was trading prior to the original approach. However, that bid may face some headwinds as Gina Rinehart’s Hancock Prospecting has acquired 18% of Azure. SQM can pull out of the proposed transaction if another shareholder acquires more than 19%. Albermale Corp. was trying to buy Liontown Resources Ltd. but Rinehart blocked that transaction too.

Threats

- Copper has gone from jump to slump this year as enthusiasm about China’s reopening gave way to concerns over demand, ballooning stockpiles, and pricing patterns that speak to abundant, near-term supply. Benchmark three-month futures on the LME just sank to the lowest since last November and, absent a run of micro-evidence suggesting conditions are bottoming out, the bias will remain for further weakness into the year-end. At present, cash metal trades well below futures, known as contango.

- According to Morgan Stanley, steel global output came in below its five-year average as production declined in China (-6% year-over-year), while it rose sequentially on day-adjusted basis due to Europe and Iran. Morgan Stanley sees further downside to production run-rates, largely driven by China’s seasonal slowdown and Europe’s accelerating capacity cuts.

- Russia’s oil flows are climbing steadily as Moscow’s adherence to a pact with Saudi Arabia to keep barrels off the global market shows signs of waning. About 3.53 million barrels a day of crude was shipped from Russian ports in the week to October 22, an increase of 20,000 barrels a day from the previous seven days, tanker-tracking data monitored by Bloomberg show. That lifted the less volatile four-week average to 3.5 million barrels a day, the highest since June, and up by about 610,000 barrels a day in the past two months.

Bitcoin and Digital Assets

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the best performer for the week was FLOKI, rising 84.97%.

- Bitcoin surged above $31,000 for the first time since July as a U.S. federal appeals court made final a ruling that effectively clears the way for the issuance of an exchange traded fund (ETF) that invests directly in the cryptocurrency, writes Bloomberg.

- Declining national fiat currencies and a generally unstable economy have helped propel Bitcoin to all-time high prices in Turkey and Nigeria, despite the asset trading 50% below its peak in U.S. dollar terms. Recent price surges have caused Bitcoin to cross price peaks against the Turkish lira and Nigerian naira, according to Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Bitcoin SV, down 13.40%.

- Bitcoin faces a reality check if ETFs spark a ‘sell-the-new’ pivot. Chart patterns hint that the Bitcoin rally has become stretched, and the founder of Venn Link Partners expects short-term selling if U.S. spot Bitcoin ETFs are approved, writes Bloomberg.

- Bitcoiners might be excited, but Grayscale’s proposal to turn its Bitcoin trust into an ETF still needs a green light from the SEC, and that is not a sure thing. SEC Chair Gary Gensler could still find a second reason to deny the proposal after choosing not to appeal a court ruling striking down his first one, writes Bloomberg.

Opportunities

- JPMorgan Chase’s digital token, JPM Coin, now handles $1 billion worth of transactions daily and the bank plans to continue widening its usage. JPM Coin enables wholesale clients to make dollar and euro-denominated payments through a private blockchain network, according to Bloomberg.

- Shares of Coinbase may move 9% higher after the company reports earnings, according to options data compiled by Bloomberg.

- Taiwan has officially proposed a draft crypto act for the first reading. The proposal to regulate crypto assets passed the first reading at the Legislative Yuan. It would require all crypto platforms operating in Taiwan to apply for a permit, writes Bloomberg.

Threats

- Sam Bankman-Fried will take the stand to defend his actions in the lead-up to the collapse of his digital asset empire. This comes after taking a beating from former colleagues who described him as the mastermind of a years long scheme to defraud FTX customers and investors, writes Bloomberg.

- Binance is experiencing technical issues with crypto withdrawals, it said in a post on X and withdrawals will be temporarily unavailable, writes Bloomberg.

- Crypto platform Gemini Trust is suing bankrupt crypto lender Genesis Global Holdco LLC in an attempt to determine who rightfully owns a slug of shares in the Grayscale Bitcoin Trust, now worth nearly $1.6 billion, writes Bloomberg.

Gold Market

This week gold futures closed at $2,016.20, up $21.80 per ounce, or 1.09%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 1.27%. The S&P/TSX Venture Index came in off just 0.04%. The U.S. Trade-Weighted Dollar rose 0.37%.

Strengths

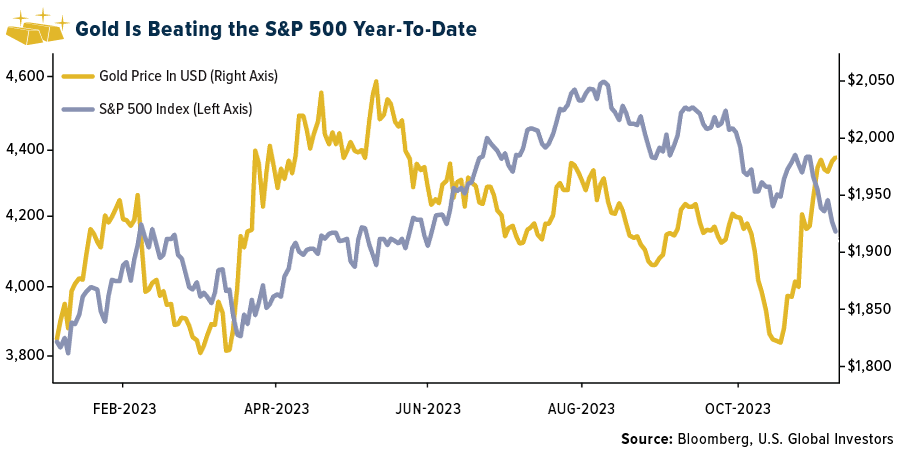

- The best performing precious metal for the week was palladium, up 1.78%. U.S. stocks are in their third monthly decline while underwhelming corporate earnings and yields climbing above 5% have investors pondering their choices. When other assets don’t look so safe, gold may find a more welcome buyer. As of Friday afternoon, gold is up more than 10% year-to-date and the S&P 500 is now up only 7%. Russia saw gold production drop 9.2% year-on-year and 4.1% month-on-month in September 2023, the Federal State Statistics Service (Rosstat) said in a statement. Despite the declining monthly data, the overall volume of domestic gold production rose 1.7% for the first nine months of this year.

- Eldorado Gold reported earnings per share (EPS) of $0.17, well above consensus of $0.04, partially driven by better-than-expected costs across the portfolio. Third quarter production of 121,000 ounces gold was pre-released, with higher quarter-over-quarter production, while consolidated AISC of $1,177 per ounce was 21% below consensus AISC of $1,486 per ounce.

- Alamos reported third quarter adjusted EPS of $0.14, above the consensus of $0.12. Production of 135,400 ounces at total cash costs of $835 per ounce and AISC (all-in sustaining costs) of $1,121 per ounce beat consensus by 12%, 4%, and 7% respectively, driven by continued outperformance at Mulatos. The company has increased its fiscal year 2023 production guidance from 480-520,000 ounces gold to 515-530,000 ounces gold and reiterated its cost guidance with AISC of $1,125-$1,175 per ounce.

Weaknesses

- The worst performing precious metal for the week was silver, down 1.34%. According to Morgan Stanley, gold ETF holdings are now at the lowest level since early 2020 with nearly continuous outflows since April 2022. This shows the challenge of gold as an investment when bond yields are rising, as it struggles to compete in portfolios as a non-yielding asset.

- Gold edged lower as benchmark Treasury yields hit the highest since 2007 while fears of a spiraling conflict in the Middle East receded. The yield on 10-year U.S. bonds topped 5% on Monday for the first time in 16 years, driven by expectations the Federal Reserve will keep monetary policy tight for a long period. That is typically negative for bullion, which bears no interest.

- OceanaGold reported third quarter production of 99.0 k ounces gold, below the 104.1 k ounce consensus and AISC of $1,911 per ounce gold above the $1,757 per ounce consensus. Adjusted EPS for the quarter was $0.00, missing the consensus estimate of $0.03. Concurrently, OceanaGold updated its fiscal year 2023 cost guidance, increasing forecasted cash cost by $50 per ounce to a range of $850 – $950 per ounce, while AISC by $125 per ounce to a range of $1,550 – $1,650 per ounce, reflecting the impact of lower production from Haile.

Opportunities

- Gold priced in Swiss francs shows that the precious metal could sustain its upward momentum should geopolitical tensions persist. The Swiss franc and gold have seen a surge in demand as haven assets amid the turmoil in the Middle East. Gold has gained more than 8% against the dollar so far in 2023, while the Swiss franc has appreciated by more than 3%, solidifying its position as the leading performer among G-10 currencies.

- According to recent data from the U.S. Treasury, Chinese investors sold $21.2 billion of U.S. assets in the month of August. Chinese investors may be among the first to direct their funds to gold markets. There are two main theories about the reasons of China’s rapid selling of U.S. assets. First, the Asian nation needs to support the local currency. The second potential reason for China’s activity lies in the realm of geopolitics.

- Wheaton Precious Metals has entered into a definitive Precious Metal Purchase Agreement with Waterton Copper Corp. on its 100% owned Mineral Park Mine located in Arizona, USA. Wheaton will pay Waterton total upfront cash consideration of $115M in four payments during construction (three installments of $25M and a final installment of $40M) with construction to be completed by the end of the first quarter of 2025. Under the stream, Wheaton will purchase 100% of the payable silver from the project for the life of the mine.

Threats

- Bitcoin continues to gain ground, taking bullish cues from traditional rate-sensitive assets like gold. Prices are up 14% for the month, with gold registering a much lesser 6.7% gain. Gold, however, picked up a bid a week before Bitcoin, as the outbreak of tensions between Israel and Hamas, alongside continued speculation about the end of the Fed tightening cycle, signaled an inflationary regime ahead.

- Panama’s labor unrest surrounding First Quantum’s new contract to operate its copper and gold mine is still facing challenges. Protests have broken out and now Panama’s Supreme Court noted it will consider a lawsuit which alleges the nation’s contract violates their constitution. Frano-Nevada Corp. has the most exposure to First Quantum through its royalty on the gold production. Regardless of the outcome, Panama makes itself look unsuitable for new mining investment currently.

- Sibanye Stillwater Ltd. said it will enter talks with labor unions over the possible restructuring at some of its South African platinum group mines that could affect more than 4,000 workers. The consultations will concern four shafts – two of which have reached the end of their producing lives – at the company’s Rustenburg, Marikana and Kroondal projects, the Johannesburg- based firm said in a statement.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication. Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (09/30/2023):

Hawaiian Holdings

Qantas Airways

Hermes

Kering

Eldorado Gold

Alamos Gold

Wheaton Precious Metals

OceanaGold

Franco-Nevada Corp.

Sibanye Stillwater

*The above-mentioned indices are not total returns. These returns reflect simple appreciation only and do not reflect dividend reinvestment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks. The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months. The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange. The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500. The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period. The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500. The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500. The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500. The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. Gross domestic product (GDP) is the monetary value of all the finished goods and services produced within a country’s borders in a specific time period, though GDP is usually calculated on an annual basis. It includes all private and public consumption, government outlays, investments and exports less imports that occur within a defined territory.

The S&P Global Luxury Index is comprised of 80 of the largest publicly traded companies engaged in the production or distribution of luxury goods or the provision of luxury services that meet specific investibility requirements.