US stocks ended Friday’s trading session in the red, as the benchmark 10-year Treasury yield hovered just below 5% in the wake of comments by Federal Reserve Chair Jerome Powell.

The Dow Jones Industrial Average (^DJI) fell 0.9% or 270 points, while the S&P 500 (^GSPC) shed 1.3%. The tech-heavy Nasdaq Composite (^IXIC) dropped about 1.5%. All three major indexes posted weekly losses.

Stocks lost ground after Powell signaled the Fed is committed to its “higher for longer” rates stance, which spurred gains in Treasury yields. The benchmark 10-year yield (^TNX) rose briefly to 5% late on Thursday, a closely watched level not seen since July 2007.

“The underlying message is ‘don’t be looking for a bailout from the Fed anytime soon,’” Greg Whiteley, a portfolio manager at DoubleLine, told Reuters. “That gives people the go-ahead to take rates above 5%.”

On Friday afternoon, the yield on the 10-year retreated from that key level, dropping to around 4.91%, as part of a broader recovery in fixed-income assets. But the “pain trade” in bonds could have further to run, even after weeks of putting pressure on stocks.

Investors looking to earnings to lift the downbeat mood have yet to find relief, despite strong financial reports.

Also still weighing on shaky markets is the risk of the Israel-Hamas war turning into a wider Middle East conflict, after Israel’s defense chief hinted at a ground assault on Gaza at the weekend.

-

Stocks slump in a losing week

Wall Street ended the day and the week in the red, as volatility in the bond market pulled stocks lower.

The S&P 500 (^GSPC) lost 1.3%, while the Dow Jones Industrial Average (^DJI) shed 0.9% or roughly 300 points.The tech-heavy Nasdaq Composite (^IXIC) lost 1.5%. All the major indexes ended the week lower than where they started.

-

A look at the week ahead

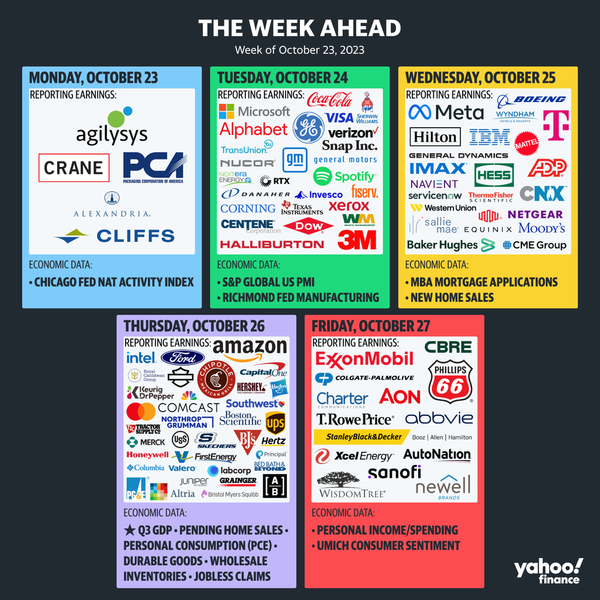

The largest and most influential tech companies are reporting earnings next week, providing a key perspective on the health of the economy and the impacts of the Fed’s tightening campaign. Amazon, Meta, Alphabet and Microsoft are among the dozens of companies reporting during the final full week of October.

Investors will also get a fresh look at the central bank’s preferred inflation gauge, alongside another survey on the mood of the American consumer.

How the Israel-Hamas conflict unfolds will also be top of mind for policymakers and investors. Market watchers will also continue tracking the surge in bond yields as they hover just under 5%.

Yahoo Finance’s Brent Sanchez has a graphical breakdown of what to watch next week:

-

Middle East tensions spark potential for energy shocks

Policymakers in Washington are closely watching the situation in Gaza, which risks expanding into a regional conflict and carries implications for the energy market.

Fed Chair Jerome Powell said in a speech Thursday that the central bank is monitoring the developments for economic implications. “Geopolitical tensions are highly elevated and pose important risks to global economic activity,” he said.

The potential for energy shocks comes from the region’s role in the oil market, specifically how Iran will respond as the violence escalates. Earlier this week Iran’s foreign minister called for an embargo against Israel, as the Israel-Hamas war approaches its second week.

“Iran’s involvement is the key focus for the crude market and this is essentially because they are a huge crude producer,” Rebecca Babin, CIBC Private Wealth energy trader, told Yahoo Finance Live.

The turmoil could continue to push oil prices higher, injecting even more volatility into an energy market that has been at the forefront of the debate surrounding inflation. Higher prices would further complicate the Fed’s mission to bring down inflation. And similar to the Russian invasion of Ukraine, dealing with the potential of a Middle East energy shock would fall outside of the control of the central bank, even as the Fed would have to contend with the fallout.

-

Expectations are front and center in the Fed’s inflation fight

In the Fed’s struggle to bring inflation back down to 2%, Americans’ expectations of where inflation is heading plays a crucial role.

Fed Chair Powell keeps saying inflation is too high, and it’s not just because the numbers say so. It’s also an attempt to set expectations. Where inflation is concerned, what Americans think will happen has a way of becoming what happens, just as the Fed’s threats of more rate hikes are meant to foreshadow a future course of monetary policy.

“Doing too little could allow above-target inflation to become entrenched and ultimately require monetary policy to wring more persistent inflation from the economy at a high cost to employment,” Powell said in a speech Thursday before the Economic Club of New York.

The Fed’s forward guidance and its use of public communications to steer policy can look and sound a lot like wishful thinking. But it does have real impacts. The threat of a hike can almost function like another phantom rate hike. And part of getting that desired outcome is repeating again and again that it will happen until it does.

-

Stocks trending in afternoon trading

Here are some of the stocks leading Yahoo Finance’s trending tickers page in afternoon trading on Friday:

Bitcoin (BTC-USD): The leading cryptocurrency briefly surged above $30,000 Friday after the Securities and Exchange Commission dropped legal charges against two cryptocurrency executives from Ripple Labs, another victory for the industry as it fights regulatory threats on several fronts.

ARM (ARM): Shares of the chipmaker fell more than 2% following KeyBanc analysts initiating coverage starting with an “Overweight” rating.

SolarEdge Technologies (SEDG): Shares plummeted more than 25% after a a brutal earnings report from the solar equipment maker. The company said it experienced “substantial unexpected cancellations” from its European distributors triggering a sell-off among solar-based stocks. Deutsche Bank downgraded a trio of solar stocks — Sunnova Energy (NOVA), Sunrun (RUN), and SolarEdge to “Hold” from “Buy,” amid slowing demand in the United States and Europe.

Regions Financial Corp (RF): Shares dropped over 11%, after the lender said on Friday it expects its fourth-quarter net interest income to decline.

Knight-Swift Transportation (KNX): The trucker’s shares surged 10%. Knight-Swift reported quarterly earnings of $0.41 per share on Thursday, beating analysts’ estimates.

-

Stocks slide in afternoon trading

Wall Street’s sour mood continued into the afternoon trading session as the stock market faced pressure from rising bond yields.

The S&P 500 (^GSPC) lost 0.7%, while the Dow Jones Industrial Average (^DJI) gave up 0.3% or roughly 100 points. The tech-heavy Nasdaq Composite (^IXIC) fell by 1%.

-

Stocks trending in morning trading

Here are some of the stocks leading Yahoo Finance’s trending tickers page in morning trading on Friday:

Enphase Energy (ENPH): The energy-focused technology company fell 10% Friday morning, following a brutal earnings report from solar equipment maker SolarEdge Technologies (SEDG), which experienced “substantial unexpected cancellations” from its European distributors triggering a sell-off among solar-based stocks.

Intuitive Surgical (ISRG): The healthcare robotics company shed 5% Friday after the company’s third-quarter revenue missed expectations.

Regions Financial Corp (RF): Shares dropped over 15%, after the lender said on Friday it expects its fourth-quarter net interest income to decline.

Knight-Swift Transportation (KNX): The trucker’s shares surged 10%. Knight-Swift reported quarterly earnings of $0.41 per share on Thursday, beating analysts’ estimates.

-

Stocks open lower as investors grapple with bond market surge

Wall Street rang in the day with pessimism as investors looked past strong corporate earnings this week and focused on the rise in 10-year Treasury yields, , which briefly crossed 5% Thursday.

The S&P 500 (^GSPC) edged lower by about 0.1%, while the Dow Jones Industrial Average (^DJI) slipped just under the flat line, falling 0.04% or roughly 12 points. The tech-heavy Nasdaq Composite (^IXIC) lost 0.4%.

-

AmEx, Regions Financial, and Knight-Swift: Stocks trending in premarket trading

Here are some of the leaders on Yahoo Finance’s trending tickers page ahead of Friday’s market open:

American Express (AXP): The credit card giant’s shares fell about 1% after it reported third-quarter profit that beat expectations on Friday.

Regions Financial Corp (RF): Shares in Regions fell over 7%, after the lender said on Friday it expects its fourth-quarter net interest income to decline.

Knight-Swift Transportation (KNX): The trucker’s shares surged 12%. Knight-Swift reported quarterly earnings of $0.41 per share on Thursday, beating analysts’ estimates.

Bitcoin (BTC-USD): The leading cryptocurrency rose above $30,000 to its highest level since July on Friday.

— by Jenny McCall

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance