In a recent study conducted by SIX, a leading operator of the Swiss stock exchange, professional investors worldwide have expressed a positive outlook on digital assets and environmental, social, and governance (ESG) investments. The study, titled “Cornerstones for Growth,” surveyed 300 portfolio managers, asset managers, and hedge fund managers from Europe, Asia, and the United States, shedding light on their perspectives regarding digital assets and ESG.

Growing Confidence in the Crypto Space

The key survey findings collated by the Crypto Valley Journal indicate a notable shift in sentiment among international buy-side firms towards the adoption of crypto assets. Approximately 70% of the surveyed asset managers plan to incorporate digital assets into their portfolios within the next 12 months.

In Asia, this figure is even more significant, with 83% of asset managers expressing their intention to include cryptocurrencies. Currently, 11% of respondents already hold digital assets, with the United States leading the way at 29%.

Driving Factors for Increased Confidence

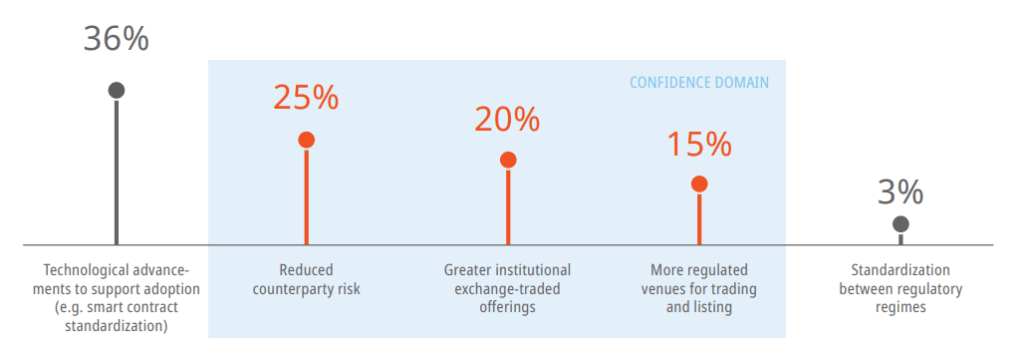

The primary driver for the increased confidence in the crypto space, as revealed by the study, is the perception of a safer trading environment. Professional investors believe that advancements in technology, such as the standardization of smart contracts, will contribute to creating a more secure and regulated marketplace.

The respondents did not emphasize the importance of uniform policies across national borders though. Instead, they focused on the need for comprehensive institutional expertise in the digital asset sector.

Barriers to Adoption

Despite the growing interest in crypto assets, professional investors identified several barriers that hinder their broader adoption. One of the major concerns that they highlighted was the lack of availability of institutional platforms and regulated marketplaces.

The findings tell that in order to foster increased participation from institutional investors, it is crucial to provide transparent, secure, and liquid trading platforms that adhere to robust risk management practices. Moreover, mitigating counterparty risk was also deemed significant by a substantial portion of the respondents.

The Role of Infrastructure Providers

The study sheds light on the challenges faced by conventional exchanges in the crypto market. Transparency emerged as a critical factor for professional investors, with 42% emphasizing its importance.

Additionally, 32% of respondents believed that regulated crypto exchanges should actively contribute to enhancing the growth potential of the market. Trust in the industry can be strengthened by trading platforms that offer transparency, security, and liquidity.

Furthermore, the study highlights the need for institutional platforms with meaningful governance, regulatory oversight, and strong risk management practices to facilitate the development of the digital asset market.

Final Thoughts

The SIX study illustrates the increasing optimism among professional investors regarding digital assets and ESG investments. With a significant percentage of asset managers planning to include cryptocurrencies in their portfolios, the demand for comprehensive institutional expertise in the digital asset sector continues to grow.

On the other hand, the lack of availability of institutional platforms and regulated marketplaces poses a significant barrier to adoption. Therefore, by addressing these concerns and focusing on technological advancements, standardization of smart contracts, and robust risk management, the financial industry can be molded to foster a safer and more trustworthy environment for digital asset trading.

Giancarlo is an economist and researcher by profession. Prior to his addition to Blockzeit’s dynamic team, he was handling several crypto projects for both the government and private sectors as a Project Manager of a consultancy firm.