SEC Inaction on Spot Bitcoin ETF a ‘Complete and Utter Disaster,’ Says Cameron Winklevoss

Cameron Winklevoss slammed the Securities and Exchange Commission (SEC) for a history of failure on Saturday, noting that it has been ten years since the agency received what he called the first Bitcoin ETF application—and killed it.

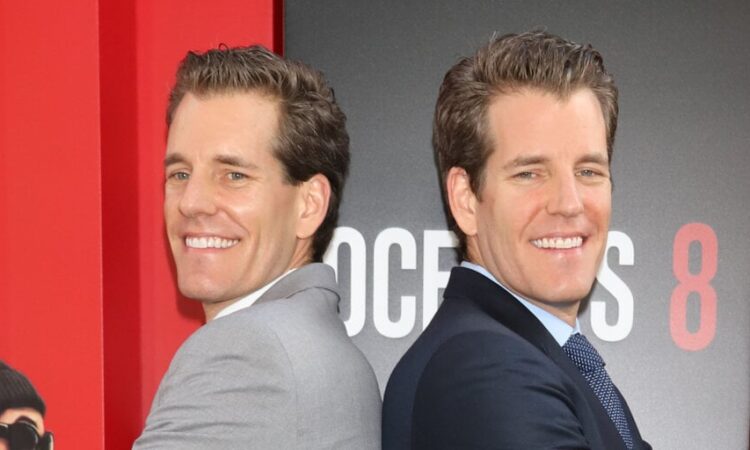

The Winklevoss twins, who cofounded crypto exchange Gemini, first filed for a spot Bitcoin ETF-like trust in July 2013, moving early to establish an investment vehicle that tracks the price of Bitcoin and trades similarly to stock on exchanges like the Nasdaq.

The Winklevoss’ initial filing, along with a second attempt in 2018, was ultimately rejected by the SEC. While futures-based Bitcoin ETFs have since gotten a regulatory green light in the U.S., the SEC claims that no spot ETF arrangement thus far proposed does enough to protect investors from “fraudulent and manipulative acts and practices.”

So, on the first filing’s 10-year anniversary, Winklevoss called out the agency for supposedly dragging its feet, recognizing every other application for a spot-based Bitcoin ETF has been stifled as well.

“The SEC’s refusal to approve these products for a decade has been a complete and utter disaster for U.S. investors,” he said, adding that the agency’s reluctance “demonstrates how the SEC is a failed regulator.”

These failures, according to Winklevoss, include cutting investors off from the best investment opportunity of the past decade. Or, as Winklevoss puts it, keeping investors “protected” from exposure to Bitcoin.

As the crypto market recoiled after the SEC’s bombshell lawsuits against Binance and Coinbase on June 5, BlackRock’s gambit to establish a spot Bitcoin ETF two weeks later reignited optimism on Crypto Twitter and pushed Bitcoin higher. Capping off a wave of Bitcoin ETF applications from other firms that followed—including Invesco, Wisdom Tree, and Valkyrie—Fidelity threw its hat back into the ring last week.

However, the SEC believes BlackRock and Fidelity’s recent Bitcoin ETF applications “aren’t sufficiently clear and comprehensive,” according to a report from the Wall Street Journal.

Winklevoss asserts that the complete lack of options for spot Bitcoin ETFs has “pushed” U.S. investors toward Grayscale’s Bitcoin Trust. Shares in Grayscale’s Bitcoin trust, launched in 2013, currently trade at a discount relative to its Bitcoin holdings due to shareholders’ inability to redeem their shares.

While Winklevoss called the product “toxic,” he didn’t mention that converting Grayscale’s Bitcoin Trust into an ETF would likely resolve this discount, and the firm is currently suing the SEC over repeated denials to do just that.

Winklevoss has joined a chorus of critics who say SEC Chair Gary Gensler is pushing innovation offshore, and said the agency meanwhile thrust “investors into the arms of FTX” and made them victim “to one of the largest financial frauds in modern history.”

Sam Bankman-Fried, the former CEO and founder of FTX, has pleaded not guilty to a litany of charges he faces for conduct at the collapsed exchange, including fraud.

Sending investors abroad in search of Bitcoin exposure has also led them to do business with “unlicensed and unregulated venues,” Winklevoss claimed.

Gemini and the SEC are not on friendly terms. The regulatory agency accused Gemini of violating securities laws in January, alleging that its “Gemini Earn” product constitutes an unregistered securities offering. Retail investors could previously loan their crypto to the now-bankrupt firm Genesis—which was also charged by the SEC—in exchange for interest on deposits.

Notably, Genesis and Grayscale are both owned by Digital Currency Group. And Genesis and Gemini have been engaged in a spat over a $900 million loan that Gemini extended to the crypto lender.

Winklevoss considered a lawsuit against DCG and company CEO Barry Silbert earlier this year, but Gemini, Genesis, and DCG reached an agreement “in principle” in February. However, Gemini said DCG missed a $630 million loan repayment this past month and risks defaulting on its obligations.

Winklevoss expressed hope that the SEC will “reflect on its dismal record” and focus on its stated duties, “instead of overstepping its statutory power and trying to act like the gatekeeper of economic life.”

Additionally, Winklevoss ended his post with accolades for “all those fighting the good fight to bring U.S. spot Bitcoin ETFs to life”—which, in practice, may preclude certain companies that have outstanding applications or lawsuits.