As part of its international expansion plans, Robinhood Markets, Inc. HOOD is finally rolling out brokerage services in the U.K. At the beginning of last month, HOOD announced its plans to start brokerage operations in the U.K. soon, along with its intention to start cryptocurrency trading in the European Union (“EU”).

In its third-quarter earnings release, HOOD stated, “With an experienced team in place, we will soon launch brokerage operations in the U.K. As another step in global expansion, we are also planning to launch crypto trading in the EU following our U.K. launch.”

Notably, this will be the stock-trading platform’s third attempt to enter the U.K. market.

Making its debut in the U.K. markets, HOOD is starting by offering its commission-free trading platform to selected customers. A full rollout is expected in early 2024.

At launch, users of Robinhood in the U.K. will be offered more than 6,000 United States-listed stocks and American depositary receipts without any foreign exchange fees, trading outside of U.S. market hours with the Robinhood 24 Hour Market, and no-account minimums.

Moreover, customers will be able to build a portfolio for as little as $1. They will have access to a 5% annual equivalent rate for any cash holdings but there will be no initial support for U.K. stocks.

Jordan Sinclair, the president of Robinhood U.K., stated, “For too long, U.K. investors have incurred high fees to invest in the U.S. markets and earned low returns on their uninvested cash. This is just the beginning for Robinhood U.K. and our global ambitions.”

Vlad Tenev, the CEO and co-founder of Robinhood, considers Britain to be the ideal place for HOOD to launch its first international brokerage product.

Tenev said, “Since we launched Robinhood a decade ago, it’s always been our vision to expand internationally. As a hub for innovation, global finance and top tech talent, the United Kingdom is an ideal place for us to launch our first international brokerage product. We look forward to continuing to engage with customers and policymakers as we expand our offerings in the UK.”

The first time HOOD attempted to expand in the U.K. market was in 2019. However, back then, the company scrapped its attempt despite having thousands of investors on a waiting list.

In 2022, HOOD made a second attempt to enter the U.K. market with the announcement of the buyout of U.K. crypto firm Ziglu. However, this deal was canceled later on.

Notably, Robinhood’s latest attempt to expand in the U.K. markets comes almost a month after the country’s Financial Conduct Authority (“FCA”) established new guidelines for strengthening consumer protection.

Effective Oct 8, 2023, new promotion rules have been implemented in the U.K. The FCA has established new guidelines for marketing crypto assets to consumers, which is a significant step toward establishing a regulatory framework in the U.K.

Thus, now, consumers in the U.K. have greater protection as crypto asset firms’ marketing is required to be clear, fair and not misleading, and labeled with prominent risk warnings.

HOOD’s expansion into the U.K. markets marks a milestone in the company’s journey to democratize finance around the globe and increase access to the markets for all.

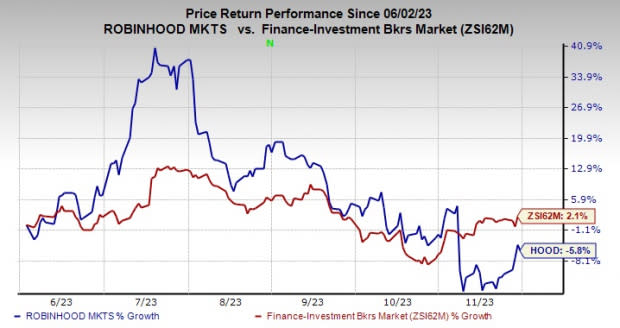

Over the past six months, shares of Robinhood have lost 5.8% against 2.1% growth of the industry.

Image Source: Zacks Investment Research

Currently, HOOD carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

While HOOD is seeking to start cryptocurrency trading in the EU, JPMorgan’s JPM digital retail bank, Chase, in the U.K., has decided to restrict customers’ access to cryptocurrency-related transactions. JPM said that from Oct 16, 2023, there would be a limit on the ability of its customers to engage in crypto transactions in the U.K.

A JPMorgan spokesperson stated, “We’ve seen an increase in the number of crypto scams targeting UK consumers, so we have taken the decision to prevent the purchase of crypto assets on a Chase debit card or by transferring money to a crypto site from a Chase account.”

Chase is not the first bank to block or restrict crypto transactions. Earlier this year, banks like NatWest Group plc NWG and Banco Santander SAN imposed tighter restrictions on U.K. customers looking to use crypto.

In order to protect its customers from crypto-related scams, NatWest imposed new limits on the daily and monthly amount consumers can send to crypto exchanges. NWG customers can only send a maximum of £1,000 per day and £5,000 over a 30-day period to crypto exchanges.

Similarly, Spain’s Santander said that it would block U.K. customers from sending real-time payments to crypto exchanges. While SAN prohibits payments from a customer’s account to Binance, customers can transfer funds to their accounts from Binance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Banco Santander, S.A. (SAN) : Free Stock Analysis Report

NatWest Group plc (NWG) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report