As our previous edition explored the mergers and acquisitions market in Europe, today we turn our attention to the US.

As we examine the regtech and IDV sectors in the US, it becomes apparent that there are several key characteristics worth noting.

One notable observation is that in the Americas there has been a reduction in regtech and IDV amounts per funding round in 2022 compared to the previous year. As reported previously, 2021 saw some big amounts poured into identity verification and regtech players such as Socure, which raised USD 450 million, Canada’s unicorn, Trulioo, which got USD 394 million, and San Francisco-based Incode Technologies which raised USD 220 million Series B funding round, giving the company a USD 1.25 billion valuation.

Nevertheless, the need for faster transactions and their monitoring will drive the growth of the regtech market. Traditional cross-border payment systems faced various issues in recent years, including extra processing fees, fraud risks, security breaches, and multiple intermediaries, resulting in a complex and time-consuming transaction process. Blockchain-based payment systems offer a faster, more secure, and cheaper alternative by streamlining transactions and storing them in a secure distributed ledger. In response, prominent players are launching blockchain-based compliance solutions to facilitate faster transactions. For example, in 2022, Sopra Steria (France) partnered with Chainalysis (the US) to offer leading blockchain compliance solutions to customers in Europe.

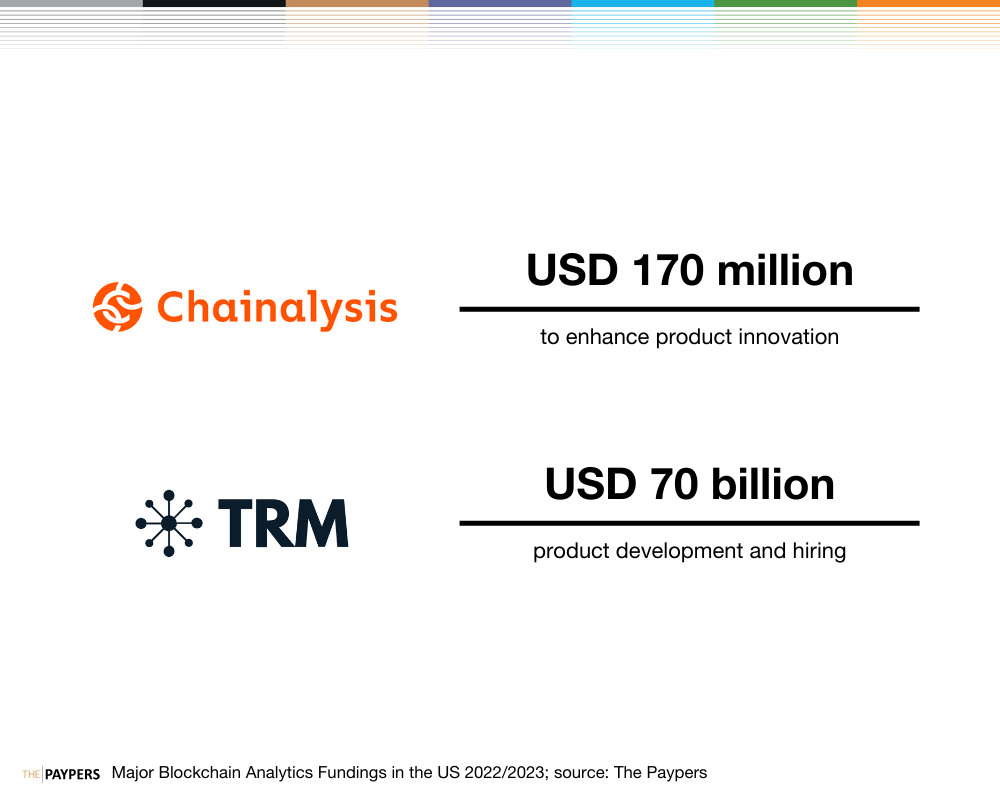

In contrast to Europe, the US regtech sector has seen the emergence of numerous blockchain analytics companies that have received funding to expand their businesses and develop new products. The growing interest in blockchain analytics has been driven by various major scandals, downfalls, and hacks in the crypto industry in 2022, highlighting the need to monitor and track digital assets. For example, the FTX scandal and the Terra downfall have further sparked interest in these solutions.

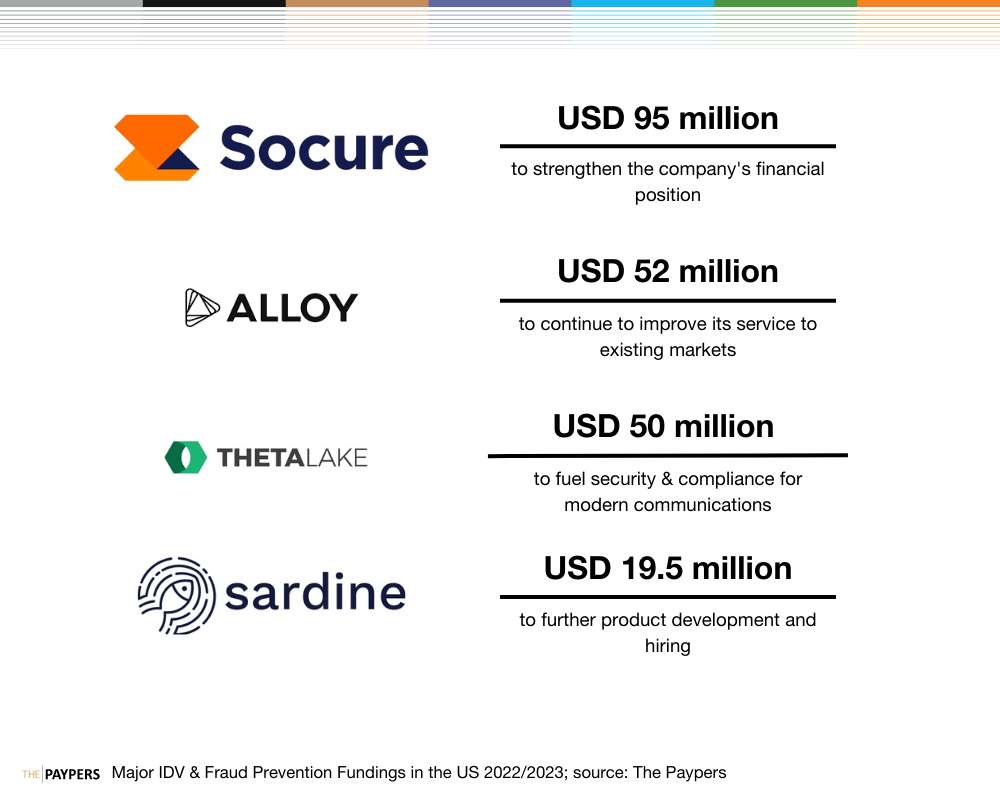

Another trend driving the demand for advanced fraud prevention solutions is the rising incidents of identity fraud and cyberattacks in the US. In 2021, an estimated 15 million Americans fell victim to identity theft, but most cases remained unreported. Meanwhile, data breaches and cyberattacks continued to increase, with 1802 cases reported in 2022 alone. This has prompted several fraud prevention companies to receive funding for developing tech solutions that address various use cases, including ACH and card funding fraud, card issuing fraud, payment fraud, identity fraud, and social engineering, among others, to help FIs mitigate these risks.

Several other reasons why companies in the identity verification (IDV) and regtech sectors are receiving funding, forming partnerships, and undergoing acquisitions include the development of all-in-one identity platforms that can streamline onboarding processes through a unified system. In some cases, IDV companies that receive funding are investing in new and existing products while scaling their teams to keep pace with the growing demand for authentication and verification solutions. Meanwhile, large investors like Thoma Bravo, a US-based private equity and growth capital firm with USD 122 billion in assets under management, are leveraging the current market conditions to make strategic investments. Finally, companies are partnering looking to expand and diversify their product offerings to meet the evolving needs of their customers.

Money poured into blockchain analytics companies and KYB

Blockchain analytics involves using data analysis tools to extract valuable insights from blockchain data, making it an attractive option for FIs looking to enhance their identity verification, fraud prevention, and regulatory compliance efforts. In May 2022, Chainalysis became one of the largest enterprise SaaS companies in the cryptocurrency industry with a valuation of USD 8.6 billion after raising USD 170 million from investors such as BNY Mellon and Emergence Capital. TRM Labs, which offers blockchain intelligence solutions to law enforcement agencies, regulators, banks, and private companies, raised USD 70 million from Thoma Bravo in November 2022. The company plans to use the funding to accelerate expansion, enhance innovation, and automate the onboarding process for regulated industries.

In June 2022, Middesk, a US-based identity platform that automates business verification and underwriting decisions, raised USD 57 million in funding. Unlike the blockchain analytics approach, Middesk uses APIs to automate Know Your Business (KYB) processes. The funding will be used to enhance Middesk’s products, expand its team, and raise awareness of business identity. The company was founded in 2019.

Fundings in IDV and fraud prevention for FIs companies

The demand for identity verification tools has increased due to the need for financial institutions to identify and prevent fraudulent activity. In September 2022, Alloy raised USD 52 million, bringing its valuation to USD 1.55 billion, just 11 months after raising USD 100 million at a valuation of USD 1.35 billion. Alloy doubled its annual recurring revenue (ARR) in 2021 with over 300 customers, including Ally Bank, HMBradley, Gemini, Ramp, Evolve Bank & Trust, Brex, and Petal. Their API-based product connects to 160+ data sources and processes over one million decisions per day. Alloy helps its customers build secure fintech products and grow their customer base. Also, US-based mobile authentication platform Incognia raised USD 15.5 million to support growth and counter identity fraud, and Footprint, a US-based company that allows companies to securely onboard users, raised USD 6 million.

In early 2022, several US-based companies in the security and compliance space attracted substantial funding. Theta Lake received USD 50 million to help organisations manage the challenges posed by the new video, voice, chat, and document platforms that have replaced traditional technologies like email and in-person meetings. Meanwhile, Sardine raised USD 19.5 million to provide fraud and compliance services to fintech and crypto customers. Finally, Allure Security secured USD 6.8 million to develop its AI-powered platform, which detects and eliminates brand impersonation scams across multiple digital platforms.

At the beginning of 2023, Socure entered into a USD 95 million, three-year credit facility with JP Morgan, Silicon Valley Bank, and KeyBanc Capital Markets and Quantifind bagged USD 23 million to help banks and financial institutions combat money laundering and fraud. These investments are indicative of the growing demand for advanced security and compliance solutions, particularly in industries such as fintech and crypto, where fraud is prevalent, and transactions are irreversible.

Major buys in IDV and regtech

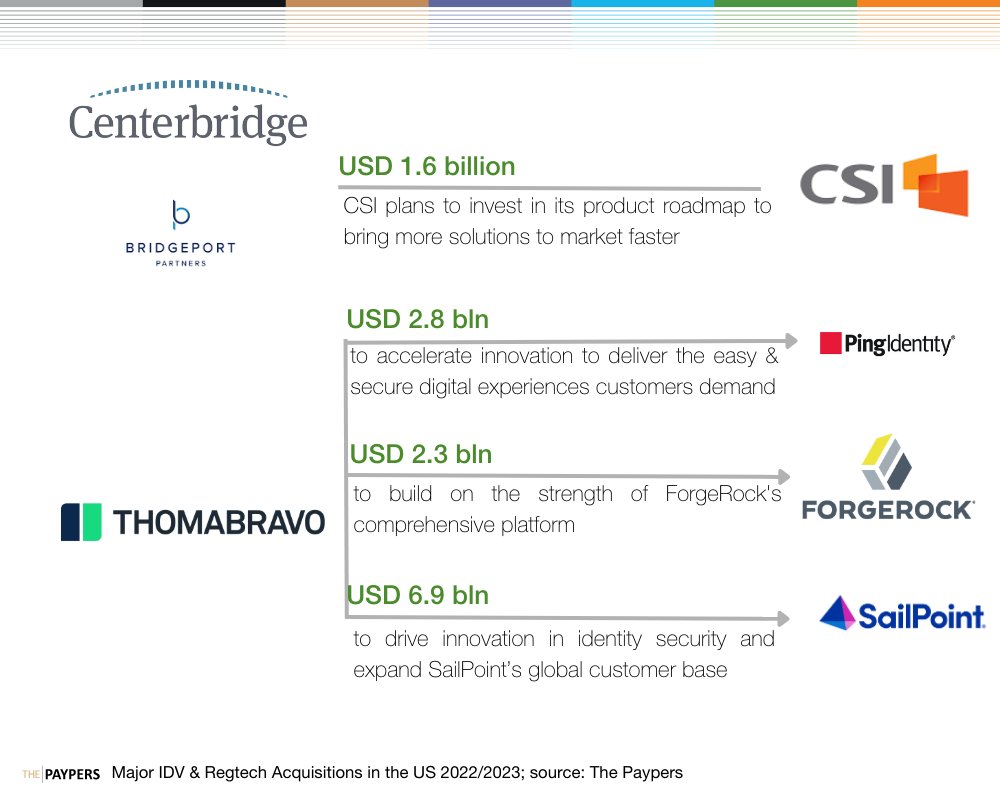

Thoma Bravo, a US-based private equity and growth capital firm, had a significant impact on the digital identity management space in 2022 with several major acquisitions. Firstly, they acquired Ping Identity, an identity management company, for USD 2.8 billion, and later went on to acquire another digital identity provider, ForgeRock, for USD 2.3 billion. These acquisitions followed the purchases of SailPoint for USD 6.9 billion in April. Overall, Thoma Bravo invested a total of USD 12 billion in building a software category for digital identity providers.

Thoma Bravo’s acquisitions have been driven by the current market conditions, which have made it easier for private equity firms to acquire struggling technology companies. Thoma Bravo has been targeting companies that have faced challenges in the public markets, struggled to raise money in later-stage rounds, or were unable to go public due to market conditions and a lack of interest in IPOs. By investing in these promising tech companies, the fintech can provide them with the resources needed to grow and scale their businesses. Another important amount was poured into fintech and regtech solutions provider Computer Services by investment firms Centerbridge Partners and Bridgeport Partners. The acquisition will take place in an all-cash transaction valued at approximately USD 1.6 billion.

Several other companies involved in identity verification, security, and digital onboarding have been acquired in 2022. Trulioo, a Canada-based identity verification company, acquired HelloFlow, a no-code builder of client onboarding, monitoring, and digital workflow solutions in February. In March, Mitek, a US-based provider of ID verification and fraud prevention, acquired UK-based KYC technology provider, HooYu in a GBP 98 million deal. The acquisition will assist businesses in verifying the identity of their customers by connecting biometric verification with real-time bureau and sanction database checks. In May 2022, LexisNexis Risk Solutions, part of RELX, acquired BehavioSec, a behavioural biometrics technology provider.

In June, Entrust, a US-based security software provider, acquired Netherlands-based Evidos, a platform for cloud-based electronic signatures and identity verification solutions. The acquisition will enable Entrust to provide end-to-end, cloud-based electronic signature solutions that include basic, advanced, and certified electronic signatures, ensuring signer identity and document integrity with an eIDAS-aligned procedure. Finally, in July, Germany-based security tech group Giesecke+Devrient (G+D) acquired the payment and identity solutions business of Valid USA.

Conclusion

In the US, the rising incidents of identity fraud and cyberattacks are driving the demand for advanced fraud prevention solutions, with several companies receiving funding to develop tech solutions that address various use cases. Furthermore, the regtech sector has seen the emergence of numerous blockchain analytics companies receiving funding to develop new products, driven by major scandals and hacks in the crypto industry. Finally, the need for faster and more secure cross-border payment systems is driving the growth of the regtech, IDV, and fraud prevention market, with blockchain-based solutions being increasingly adopted.

Overall, the US market presents an incredible opportunity for businesses in the regtech and IDV space, despite the recent slowdown in investments. We invite you to share your thoughts on the regtech kings we might have missed by contacting us at mirelac@thepaypers.com or editor@thepaypers.com. And don’t forget to stay tuned for our upcoming installment, where we explore the exciting hot deals and investments in regtech and IDV in Asia, LATAM, and Africa in 2022/2023!

About Mirela Ciobanu

Mirela Ciobanu is Lead Editor at The Paypers, specialising in the Banking and Fintech domain. With a keen eye for industry trends, she is constantly on the lookout for the latest developments in digital assets, regtech, payment innovation, and fraud prevention. Mirela is particularly passionate about crypto, blockchain, DeFi, and fincrime investigations, and is a strong advocate for online data privacy and protection. As a skilled writer, Mirela strives to deliver accurate and informative insights to her readers, always in pursuit of the most compelling version of the truth. Connect with Mirela on LinkedIn or reach out via email at mirelac@thepaypers.com.

Mirela Ciobanu is Lead Editor at The Paypers, specialising in the Banking and Fintech domain. With a keen eye for industry trends, she is constantly on the lookout for the latest developments in digital assets, regtech, payment innovation, and fraud prevention. Mirela is particularly passionate about crypto, blockchain, DeFi, and fincrime investigations, and is a strong advocate for online data privacy and protection. As a skilled writer, Mirela strives to deliver accurate and informative insights to her readers, always in pursuit of the most compelling version of the truth. Connect with Mirela on LinkedIn or reach out via email at mirelac@thepaypers.com.