Good evening. EU leaders have raised the alarm that Chinese suppliers provide an astonishing 98 percent of the regional body’s rare earth demand. But the EU’s reliance on China for such a critical supply chain is even worse than that figure suggests, since the EU is increasingly importing many of the key components and finished products rare earths are used for, including permanent magnets, batteries and electric vehicles. Our cover story this week looks at the EU’s attempt to reshore rare earths. Elsewhere, we have infographics on Hong Kong’s new crypto creditor; an interview with Yao Yang on why China and the U.S. need to talk; a reported piece on Canada’s China conundrum; and an op-ed about small business owners wanting a bigger voice on China. If you’re not already a paid subscriber to The Wire, please sign up here.

Want this emailed directly to your inbox? Sign up to receive our free newsletter.

Rare Earth Reshore

The EU desperately wants to ‘de-risk’ its reliance on China, especially for rare earths — the critical minerals that are essential for today’s technologies. But to accomplish that, the EU has to do a lot more than simply dig these minerals out of the ground. As Luke Patey reports this week, to turn its green aspirations into an industrial reality, the EU faces the meticulous task of building out all nodes of a long and complicated supply chain.

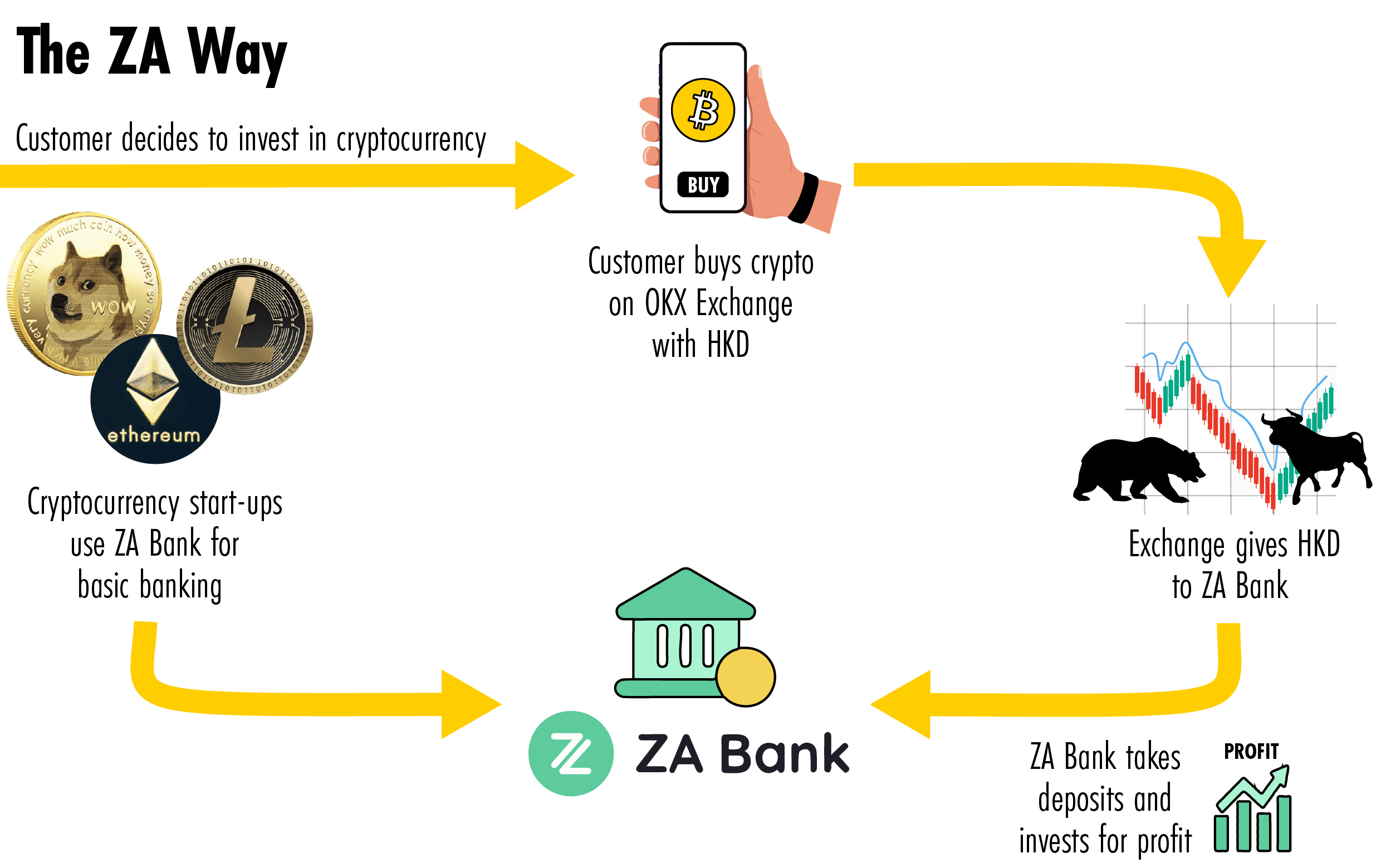

The Big Picture: Hong Kong’s New Crypto Creditor

Despite Beijing’s long-held wariness of all things crypto, it has given ZA Bank permission to operate as a settlement bank for crypto start-ups in Hong Kong. This week’s infographics by Grady McGregor look at the firm’s ties to Chinese online insurer Zhongan Insurance, potential parallels with Silvergate Bank and what Hong Kong’s crypto openness says about Beijing’s stance on crypto.

A Q&A with Yao Yang

Yao Yang is one of China’s leading economists. Long seen as an economic reformer, Yao got his PhD at the University of Wisconsin at Madison and participates in so-called “Track Two” talks between academics and former government officials in the U.S. and China aimed at trying to improve relations between the two countries. In this week’s Q&A with Bob Davis, he talks about why a prosperous China is good for the U.S.; recent changes in the Chinese leadership; and how Beijing sees relations with Russia, the U.S. and Europe.

Yao Yang

Illustration by Lauren Crow

Canada’s China Conundrum

Allegations of Chinese meddling in domestic politics have sparked a crisis in Canada involving Prime Minister Justin Trudeau’s family and his ruling Liberal party, while again raising questions about the flow of Chinese money into Western democratic processes. But as Eliot Chen reports this week, few see any easy answers.

Small Business Wants A Bigger Voice on China

Owners of thousands of companies across America are dismayed at the path of relations with China. As Doug Barry argues in this week’s op-ed, small business owners seek a middle way where there is a deliberate avoidance of extreme positions: neither simply tolerating China, nor treating it like an existential adversary.

Subscribe today for unlimited access, starting at only $19 a month.