Tokens Will Represent Deposits In Popular Bond ETFs From Blackrock and PIMCO

New DeFi offerings are emerging to adapt to the changing macroeconomic climate, after baseline yields on stablecoins have fallen below low-risk instruments available in traditional finance.

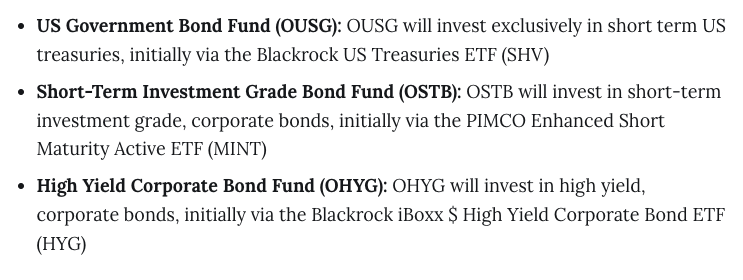

Enter Ondo Finance, which aims to develop tokenized investment funds — the firm revealed the imminent launch of three tokens representing deposits in popular ETFs managed by asset management behemoths Blackrock and PIMCO.

Of the three offerings, the US Government Bond Fund (OUSG) will have the lowest yield, which Ondo estimates to be 4.62%. The Short-Term Investment Grade Bond Fund (OSTB) is slightly higher at 5.45%, and the High Yield Corporate Bond Fund currently yields 8.02%.

Ondo will charge a management fee of 0.15%.

In April 2022, Ondo raised $20M in a Series A round led by Peter Thiel’s Founders Fund and Pantera Capital, the decade-old crypto investment fund.

While the smart contracts which interact with the funds will need to be pre-approved, Nathan Allman, the CEO and founder of Ondo, is excited to explore how protocols and tokenized securities mesh.

“We decided to launch these tokenized ETFs because we see them as an important building block for the next generation of DeFi protocols,” he told The Defiant.

Only qualified purchasers who go through Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures will be allowed to invest in the funds. The SEC defines a “qualified purchaser” as an individual or entity with at least $5M in investments.

Demand For Low-Risk Yield

Allman emphasized that there are over $100B of stablecoins on-chain which aren’t accruing any yield. He’s betting that some of that capital will jump at the chance to earn a low-risk yield without investors having to bring those assets back into the traditional financial system.

“Some investors, like hedge funds and market makers, want to be able to move between stablecoins and US Treasuries more quickly than they could traditionally,” Allman told The Defiant. “They are drawn to the daily liquidity of the vehicle and direct support for stablecoins.”

He says that startups and decentralized autonomous organizations (DAOs) are also interested in the ETF-backed tokens, as they will allow them to access reliable yield without needing to set up their own brokerage and custody accounts.

Given the astronomical yields that characterized DeFi’s early days, the rates of return offered by traditional financial products offered little attraction in 2020 and 2021. As interest rates rose and DeFi crashed, however, crypto has entered an environment where the yields on Treasuries and other savings products are above those found on lending protocols like Compound and Aave.

This has created a point of tension for DeFi.

With yields no longer pulling people into the space, other value-adds must be developed in order for DeFi to attract and retain capital. Offerings like Ondo’s tokenized funds may reawaken an old use case which has been around crypto since at least 2017 — security tokens, or tokens which represent real-world securities.

Security Tokens

“Security tokens have been around for a number of years but haven’t seen any meaningful traction,” Allman said, suggesting that the on-chain capital today doesn’t have an obvious home because of DeFi’s depleted yields. “I think the combination we have today of lots of on-chain capital, a lack of attractive on-chain investment opportunities, and robust on-chain financial infrastructure, finally creates a compelling reason for security tokens to exist.”

Projects like Polymath Network launched in 2017 with much fanfare, but have broadly fallen off the map as security token solutions have failed to gain traction. More generally, however, projects like Goldfinch Finance and collateralized lender MakerDAO have made progress in integrating real-world assets.

Moving forward, Ondo looks to be a part of a growing trend in crypto to use tokens to represent real-world assets rather than blockchain-native ones. The combination of an open set of blockchain-based protocols interacting with tokens representing real securities is undoubtedly a compelling vision.