At the tail end of last month, famed US venture capital firm — and active investor in crypto — Andreessen Horowitz (a16z) kicked off the third iteration of its Crypto Startup Accelerator.

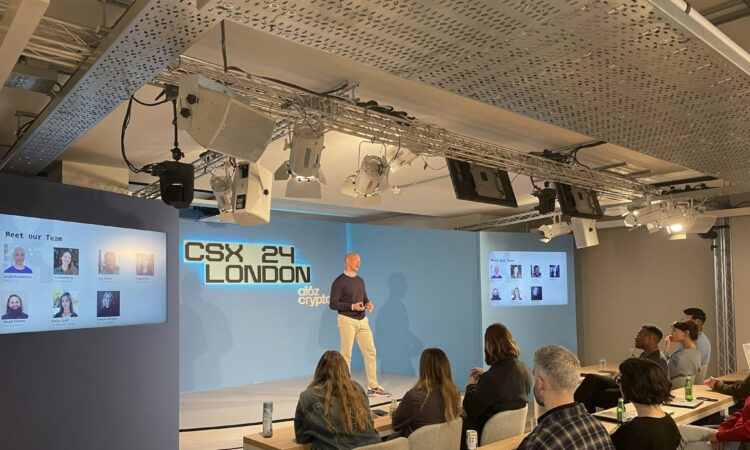

Hosted for the first time in London to inaugurate a16z’s new London office, the accelerator will run for 10 weeks culminating in a demo day. Andreessen takes a 7% equity cut in the participating startups; in exchange, they receive $500k, mentorship from expert founders in the sector and the networking boost that comes from associating with one of venture capital’s most famous firms.

All companies taking part in the accelerator are required to move to London for the duration of the programme. Jason Rosenthal, the partner running the accelerator, believes the UK can become “a centre for web3 innovation” — a feeling shared by fellow partner Sriram Krishnan who heads up the VC’s UK operations.

And while it may be a relatively new name compared to Y Combinator or Techstars, applicants still likely faced heavy competition to earn their place on the programme. Last year’s cohort saw only 26 companies accepted out of the 8000 that applied — that’s a less than 1% acceptance rate. A16z didn’t share this year’s application stats.

Even so, European founders make up a large part of the cohort. Sifted confirmed with a16z that Europe and UK-based founders are building 12 out of the 25 companies taking part in this year’s cohort.

“We have seen a strong showing from UK and European founders in the past, but now bringing the Crypto Startup Accelerator cohort to London most likely helps in attracting the best within the UK and across Europe,” says Rosenthal.

Those companies cover a wide range of areas including web3 gaming, infrastructure, consumer-focused crypto projects and decentralised finance (DeFi), a blockchain-powered financial system that aims to do away with intermediaries. Here’s what they’re working on.

Gaming

Playmint: Based in Brighton in the UK, Playmint is a games development startup building blockchain-based games. Its founding team are gaming industry veterans who’ve previously held positions at legacy gaming companies such as Electronic Arts, Unity and Epic Games.

Magicblock: It provides tools for developers to build games on the blockchain network Solana. Cofounders Andrea Fortugno and Gabriele Picco are based in London and Dublin respectively, according to LinkedIn.

Infrastructure

Sablier: The Sablier protocol enables decentralised projects and businesses to easily distribute payments in crypto to employees.

Valyu Network: Founded by a team of engineers and academics from University College London, the Valyu Network team uses machine learning, cryptography and smart contracts to enable the monetisation of datasets.

Zkpassport: With a team hailing from both the UK and Australia, Zkpassport is aiming to create an authentication platform for passports that incorporates a cryptographic technology named zero-knowledge proofs, which proves knowledge about a piece of data without revealing the data itself. Therefore, by scanning the NFC chips commonly issued in passports, the technology authenticates passport holders without revealing the entirety of the information it holds.

Hungry Cats Studio: Zurich-based Hungry Cats is leveraging cryptography to build a technology to verify the safety and trustworthiness of AI workflows.

Taralli Labs: It is creating a protocol for applications to easily produce their own zero-knowledge proofs. Currently, most projects have to depend on either centralised third parties or create their in-house infrastructure to produce them.

Consumer and web3

Tata Bazaar: Headed up by a former investment associate at crypto venture fund Multicoin Capital, Tata Bazaar is hoping to be a “social commerce platform” for both physical and digital fashion and beauty products.

Launcher: It is hoping to become the go-to social media platform for web3 enthusiasts. Registered users can submit projects on the network, which can then be upvoted similarly to Reddit posts. It’s built on top of the Farcaster Network, a decentralised social media network built on top of the Ethereum blockchain.

DeFi and finance

OpenTrade: London-HQ’d OpenTrade provides access to blockchain-based lending and yield products for financial institutions, treasurers and fintechs.

Compass Labs: While many crypto projects are built using the programming language Solidity, Compass Labs provides a DeFi interface on the more widely known language Python. With the technology, developers can build and simulate strategies before deployment.

Tranched.fi: London’s Tranched.fi creates a representation of loans on the blockchain, utilising the technology to automate all the necessary management and reporting of the transaction.