The Kraken cryptocurrency exchange has made significant strides in expanding its European Union (EU) footprint. The company recently secured authorization from the Central Bank of Ireland as an E-Money Institution (EMI), and it has also registered with the Bank of Spain as a Virtual Asset Service Provider (VASP).

These developments underscore Kraken’s commitment to regulatory compliance and its European growth agenda.

Kraken Expands EU Presence

The EMI license, granted to Kraken’s Irish subsidiary, paves the way for the firm to broaden its Euro-based fiat services in collaboration with European banks.

This expansion will benefit clients across the 27 European Union member states. It also includes European Economic Area nations, signifying a crucial growth region for the company.

Kraken’s new VASP registration in Spain enables the company to offer cryptocurrency exchange and custodial wallet services to Spanish residents. This follows similar VASP registrations in Ireland and Italy, further highlighting Kraken’s dedication to European expansion.

Kraken’s Vice President of Global Operations, Curtis Ting, has expressed his optimism about the company’s growth in Europe. He attributes this success to the forward-looking regulation in Europe, which provides a robust foundation for crypto and enables confident growth. Ting stated:

“We see a firm foundation for crypto in Europe, which has forward-looking regulation that enables us to grow with confidence.”

Regulatory Pushback in the US

However, Kraken’s commitment to regulatory compliance isn’t without its challenges. The company is currently contesting a probe by the Internal Revenue Service (IRS) in the United States.

Kraken views this investigation as an “unjustified treasure hunt.” This echoes a broader sentiment among cryptocurrency exchanges, including Coinbase, who perceive regulatory pressure as unfair.

Read more: Kraken Review 2023: A Review of Its Security, Fees, and Features

The IRS has been intensifying its focus on the crypto market in recent years. Kraken’s resistance to the IRS’s scrutiny signals a trend of crypto companies in the United States standing up against what they consider excessive examination.

Despite these hurdles, Kraken continues to advance its offerings. Over the past year, the company has launched a new consumer web user experience, the Kraken Pro advanced trading interface, and its NFT marketplace.

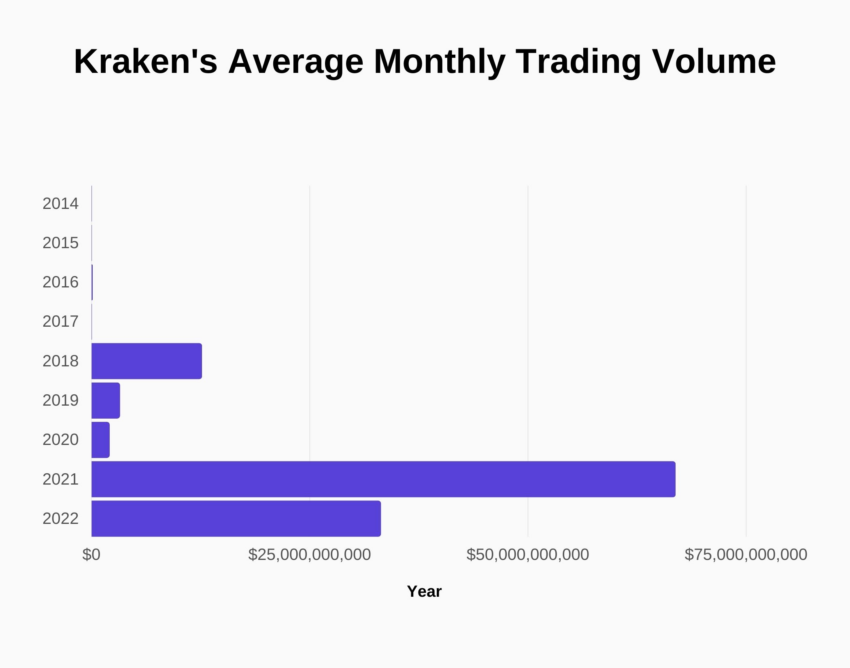

This continuous investment in its offering, coupled with a market-leading position in liquidity and volume for EUR crypto pairs, positions Kraken well for future growth in Europe.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.