E.U.’s MiCA shall be fully effective from December 30, 2024. What do these European Crypto Regulations mean for the global crypto industry? After major events like the FTX-saga and Terra Ecosystem collapse, major jurisdictions sped up the preparation for a regulatory framework for the crypto industry. E.U. is winning this race, as the regulation is already partially implemented.

Market in Crypto Asset (MiCA) and Its Global Significance

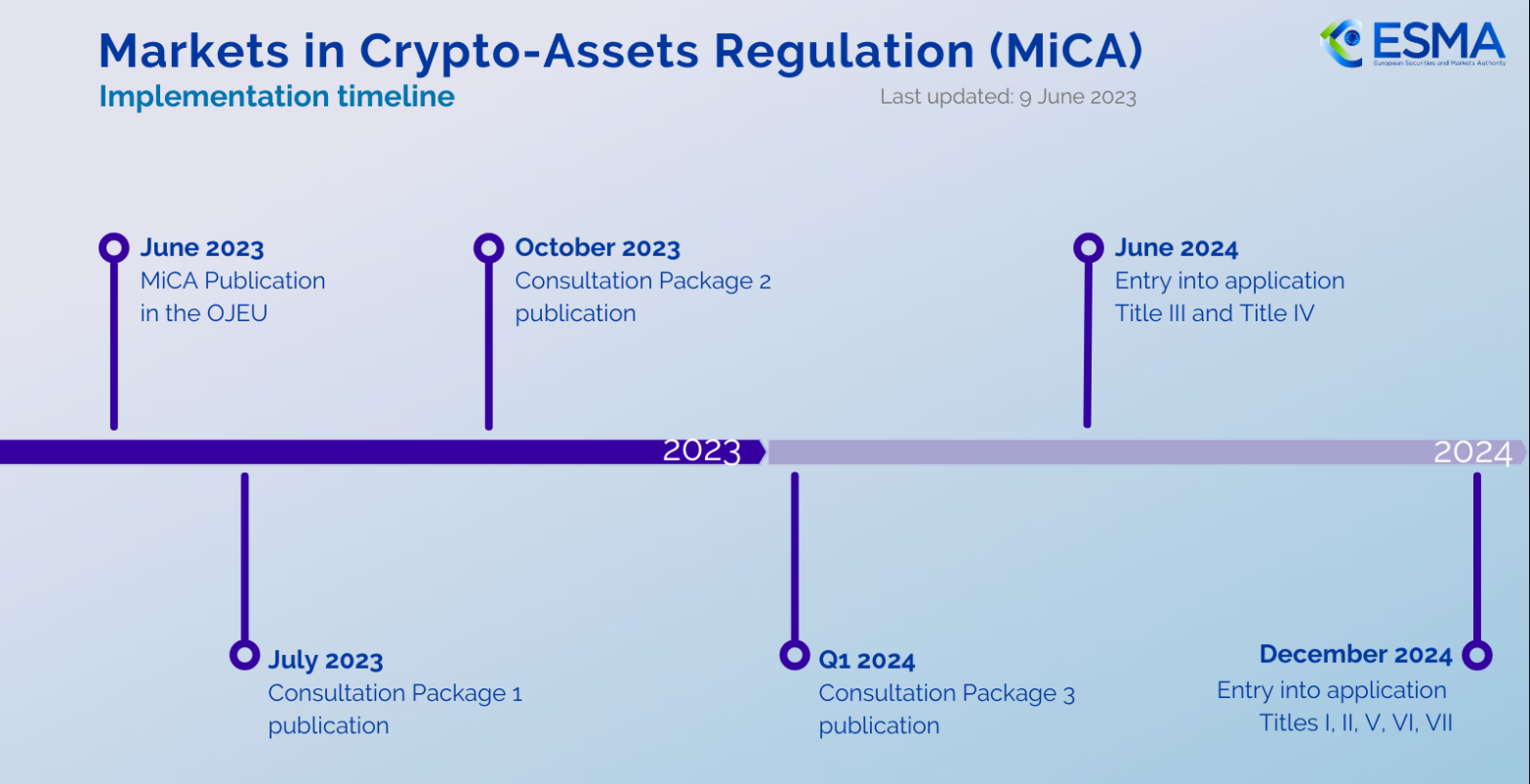

MiCA took around 5 years to prepare and is believed to be a pioneer in comprehensive regulatory framework surrounding crypto assets. On June 9, 2023, MiCA was published in the Official Journal of the European Union (OJEU), and after a window of 20 days on June 29, it was partially implemented.

United States on the other hand, is taking a contrasting approach, inspite of providing a regulatory framework, they are going through regulation by enforcement. The recent crackdown on the crypto industry by U.S. authorities has surged significantly. However, the Responsible Financial Innovation Act (RFIA) presented in the U.S. House of Representatives is believed to solve the issue.

MiCA requires the crypto business wishing to operate in the European Union to meet strict standards of consumer protection, segregation of funds, and proper address of consumer complaints. These businesses will fall under crypto asset service providers (CASPs). It also divides cryptocurrency into three categories, each with specific rules.

It has recently been going through a multilevel consultation procedure since July 2023. Suppose any crypto firm procures a license from any member country. In that case, it can perform business across the E.U. Janet Ho, head of policy for Chainalysis in Europe, detailed the timeline for registration under MiCA.

Crypto companies must first apply with the authority in the country of their choice. Within 25 days, the authorities shall notify citizens about any missing documents. If the procedure is duly followed, the authorities will notify them about the acceptance or rejection status within 60 days. Janet urges the companies to be proactive because the waiting time could jump to five months after December 2024.

Though the final date for implementation is slated on December 30, 2024, some underlying problems must be addressed first. Taking the consent of all 27 member countries to agree on MiCA regulation would be a mammoth task. Even if they cannot deny its acceptance, they can delay the process. Hence, each member of the country is expected to have its quirks with varied competency levels.

What the World Can Learn from MiCA?

Every major nation tries to regulate crypto as best as possible but fails to strike a balance between regulation and innovation. MiCA can be a reference point or guide rails to prepare or amend their crypto regulatory framework. The five years of work put in by the European experts can be put to good use by other countries.

Crypto emerged as an alternative to global finance. It can be agreed upon that every nation can have some unique requirement to regulate crypto, but the broader segment remains the same. Anti-money laundering (AML), fund segregation, etc., can be addressed per MiCA while keeping different rules for other requirements.

However, it’s more than a year for the MiCA to be fully implemented and a few months more to assess its credibility. At present, it is a comprehensive regulatory framework that the industry requires. Smaller nations with limited resources can base their regulations on MiCA, others can apply selected rules.

Whatever the case, it does provide a ground zero to build upon, or a blueprint to lay the groundwork, or can be considered a Legoset that can be used to craft the regulatory factor best fit for the country.