- Six countries from the region were in the list of the top 50 countries in grassroots adoption.

- The UK remained a crypto powerhouse, leading the region in transaction value.

Cryptocurrencies and blockchain technology became a global phenomenon in the last decade, driving people of all nationalities and ethnicities to incorporate them into their financial lives.

Analyzing growth of cryptos in CNWE region

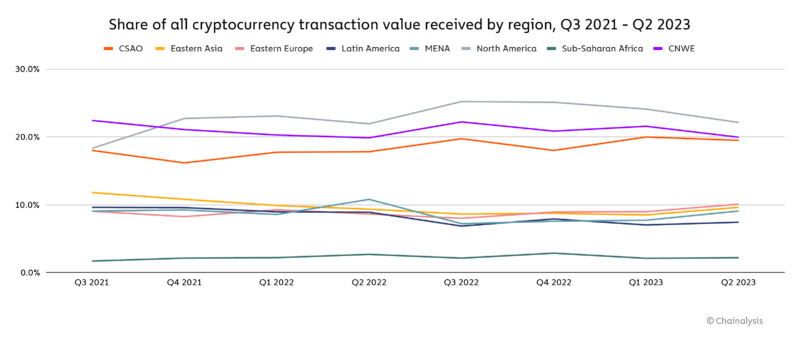

One of the most prosperous regions in the world, Central, Northern, and Western Europe (CNWE), wasn’t aloof to the expanding horizons of digital assets either. In fact, it was the second-largest crypto economy in 2023 according to blockchain analysis firm Chainalysis, surpassed only by North America.

For the period between July 2o22 and June 2o23, CNWE region accounted for 17.6% of global transaction volume

Source: Chainalysis

Moreover, about six countries of the region, including the United Kingdom, Spain, France, Germany, Italy, and the Netherlands were amongst the top 50 countries in grassroots crypto adoption, according to a report published earlier in the year.

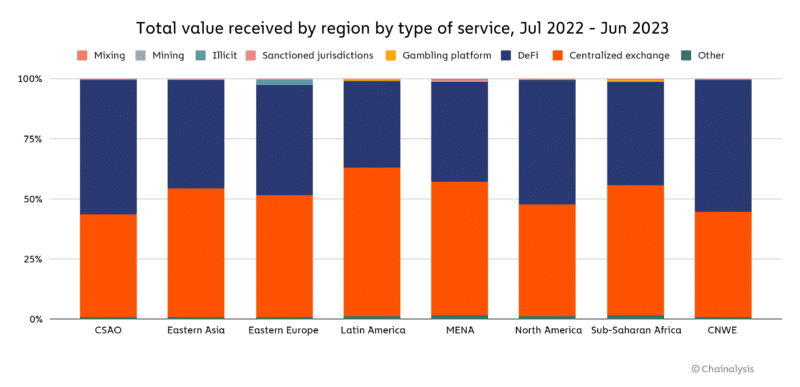

Interestingly, the region had a significant penetration of decentralized finance (DeFi), accounting for more than 50% of total cryptocurrency transaction value. The report stated that decentralized exchanges (DEXes) played an important role in bolstering crypto adoption in the region.

This was in sharp contrast to the adoption trends of Latin America, wherein centralized exchanges (CEXes) were the most favored platforms for crypto trading.

UK: The European Crypto Hub

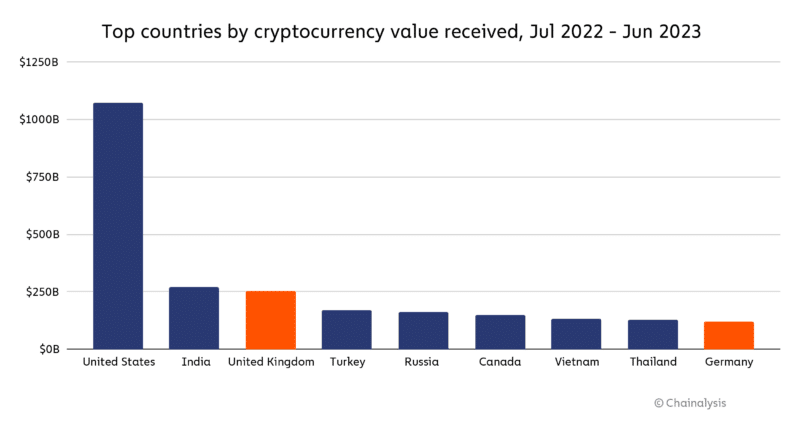

The United Kingdom remained a global crypto hotspot, ranking third behind the U.S. and India in transaction volume. The country recorded crypto trade worth $252 billion last year.

Source: Chainalysis

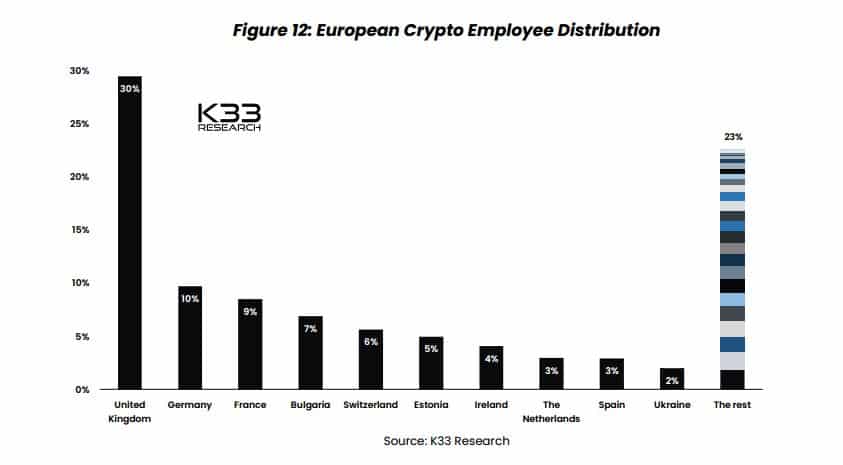

But that’s not all. The UK was the second-largest crypto employer in the world, according to digital assets analysis firm K33 Research. Nearly 13,000 employees served companies based in the country, second only to the U.S.

Additionally, nearly a third of all crypto employment in Europe was concentrated in the UK.

Source: K33 Research

The crypto dominance of the UK followed a logical progression from it being the European financial powerhouse. Indeed, the city of London is one of the biggest centers for international finance and technology. This solid base enabled considerable institutional investments in blockchains.

“UK’s institutional crypto growth is not surprising, given the country’s reliable and connected banking sector, and its history of relatively low inflation, until recently,” CEO of local crypto exchange Solidi Jamie McNaught said and Chainalysis quoted.

Mcnaught also stated that people in the UK saw cryptos, especially Bitcoin [BTC] and Ethereum [ETH] as attractive bets over underperforming instruments of traditional finance.

Recognizing the well-developed ecosystem and scope for future growth, the government created a regulatory framework for cryptos and stablecoins. The Financial Services and Markets Act 2023 outlined provisions concerning the regulation of digital assets with a view to spur mainstream adoption while at the same time protecting investors’ interests.

Notably, UK Treasury minister Andrew Griffith had earlier expressed intentions to turn the UK into a crypto hub.

It hasn’t been a smooth ride since the passage of the legislation though. Payments giant PayPal suspended crypto transactions in the country until early 2024. This was done to allow time for the necessary improvements to be made to comply with the new rules.

Richard Gardner, CEO of trading technology developer Modulus told AMB Crypto,

“While regulatory changes often cause a lot of bellyaching at the time of implementation, over the long-term, they actually help the industry grow as long — as they are not stifling. The UK is realizing the upside of an industry that’s starting to grow up, and I think that should be the goal for nations across the globe.”

How EU plans to grow through MiCA

Outside of the UK, the European Union (EU) also enacted the Markets in Crypto-Assets (MiCA) earlier in the year to make the region more welcoming to crypto activities. Reportedly, MiCA would have a single licensing regime to overlook all entities operating within the EU jurisdiction.

France welcomed the concept of MiCA and laid out additional supportive guidelines. As per experts cited in the report, France’s attitude towards crypto regulation had always been liberal, and the friendlier climate has been the main driver of growth.

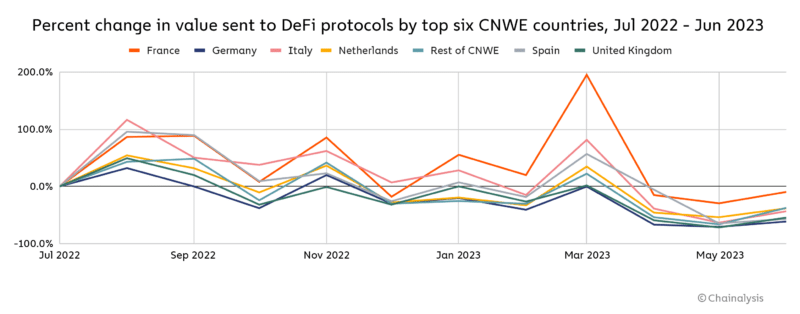

France, like the UK, had a larger share of crypto activity via DeFi rather than centralized exchanges. In fact, during turbulent phases like FTX exchange downfall and U.S. banking crisis, French customers were quicker to move to DeFi than their European counterparts.

Source: Chainalysis

![How To Use Binance.US Exchange To Buy Bitcoin and Crypto [2022]](https://moneylowdown.com/wp-content/uploads/2023/10/5d84e131aaa10-300x169.png)