Coinbase COIN recently inked a deal with the Justice Department’s U.S. Marshals Service to provide custody and trading of its digital assets worth $32.5 million. Per a report published in The Street, the U.S. government is the largest holder of crypto at the nation-state level, holding over $13.8 billion in cryptocurrency, according to Arkham Intelligence.

COIN, America’s largest registered crypto exchange, provides financial infrastructure and technology for the crypto economy in the United States and internationally. Thus, choosing COIN as a custodian is an apt decision by the U.S. Marshals Service, a federal agency dealing with asset forfeiture, including the forfeiture of crypto assets. COIN stores more than 12% of the total crypto market cap on its platform.

Per the deal, its institutional platform, Coinbase Prime, will securely store U.S. Marshal Service’s crypto and will execute the selling, trading or exchanging of high-value cryptocurrencies on behalf of U.S. Marshals Service.

The Crypto Market and Coinbase

In the first quarter of 2024, there was a sharp rise in crypto asset volatility though the same remained below its all-time high. On the other hand, crypto market capitalization reached a 52-week high of approximately $2.8 trillion in the said time frame, likely due to the launch of the bitcoin ETFs. In January this year, the Securities and Exchange Commission approved 11 spot Bitcoin exchange-traded funds.

The crypto market is highly volatile and experienced a downturn recently. Market capitalization fell 5.5% in the last trading session. While Bitcoin, the largest cryptocurrency, lost 5%, Ethereum, the second-largest cryptocurrency, lost about 6%. Needless to say, an interest rate cut by the Fed will spike volatility and, in turn, benefit the crypto market.

Coinbase is set to benefit from higher crypto asset volatility and crypto asset prices. It expects subscription and services revenues to be between $525 million and $600 million, given stable crypto asset prices. It is increasing its market share in the U.S. spot and derivatives markets, expanding its product portfolio and penetrating the international market. This apart, growth in stablecoins should fuel the top line of this company.

With a higher trading volume, COIN expects technology and development and general and administrative expenses to increase sequentially from $660 million to $710 million in the second quarter of 2024.

Both Coinbase Financial Markets and Coinbase International Exchange are exhibiting promising growth in their early stages. Its institutional business is benefiting from bitcoin ETFs.

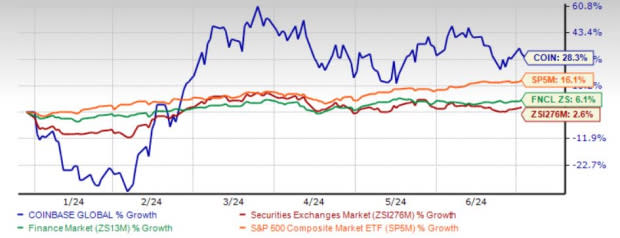

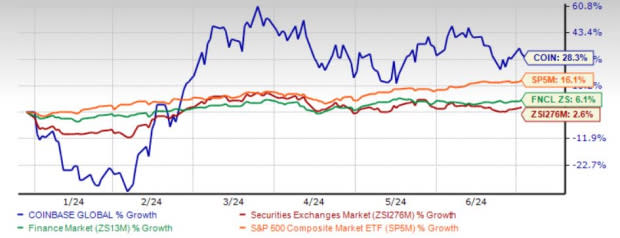

Price Performance

Shares of Coinbase have gained 28.3% year to date, outperforming the industry’s increase of 2.6%, the Finance sector’s rise of 6.1% and the Zacks S&P 500 composite’s increase of 16.1% in the said time frame. Its outperformance is backed by product expansion, operational expertise and a solid crypto market.

COIN Outperforms Industry, Sector & S&P YTD

Image Source: Zacks Investment Research

Shares of Robinhood Markets HOOD and Interactive Brokers Group, Inc. IBKR, two other crypto-oriented stocks, have rallied 79.9% and 51.4%, respectively, year to date.

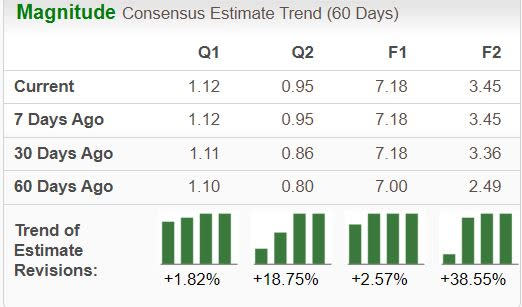

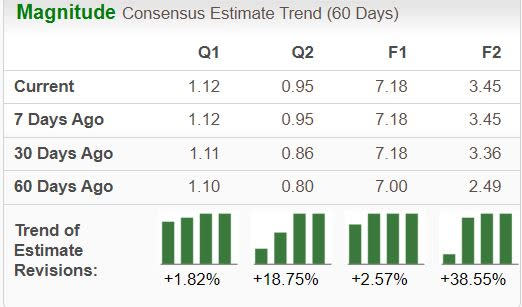

Northbound Estimate Revision

The Zacks Consensus Estimate for COIN’s 2024 and 2025 earnings has moved 2.6% and 43.6% north, respectively, in the past 60 days.

Image Source: Zacks Investment Research

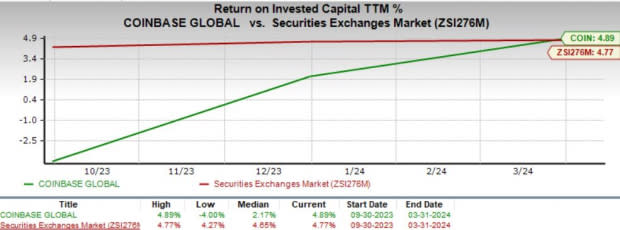

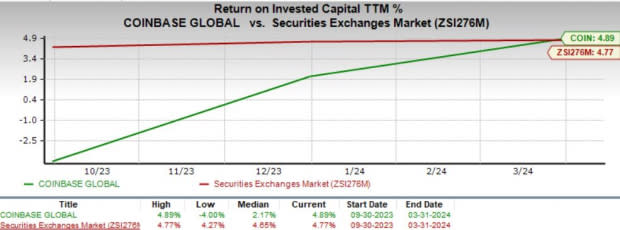

Return on Invested Capital

Return on invested capital in the trailing 12 months was 14.5%, better than the industry average of 5.9%, which reflected the insurer’s efficiency in utilizing funds to generate income.

Image Source: Zacks Investment Research

Premium Valuation

COIN is expensive currently. It is trading at a P/E multiple of 53.2, higher than the industry average of 24.7. However, given the growth prospect, rising estimates and better return on invested capital, a premium valuation is justified.

Image Source: Zacks Investment Research

Coinbase’s Growth Plan

To accelerate growth, Coinbase is deepening its roots in international markets. It is now registered as a Restricted Dealer by the Canadian Securities Administrators and is thus the largest and first international cryptocurrency exchange registered in Canada.

Strengthening banking connections, locking of new licenses, and expansion of tailor-made product ranges to meet unique customer preferences are aiding COIN in scaling new heights.

The company envisions increased crypto adoption as it believes “growing the cryptoeconomy means promoting safe and efficient markets.” It is thus prioritizing crypto utility by investing in infrastructure and foundational platforms like Base, which is designed to optimize the infrastructure of Ethereum by increasing the network’s speed and affordability. Notably, Base has considerably lowered transaction fees and increased transaction speed. The company estimates second-quarter 2024 transaction expenses to be in the mid-teens as a percentage of net revenues. COIN stays focused on maintaining a low-cost structure.

Conclusion

COIN’s efforts to accelerate growth in the crypto market, increase market share in spot trading on consumer and institutional trading platforms and improve trading experience along with continued innovation and cost control initiatives make this Zacks Rank #1 (Strong Buy) stock a strong contender for addition to one’s portfolio.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD) : Free Stock Analysis Report