International manhunt for fugitive Chinese ‘Crypto Queen’ at heart of £3billion fraud takes new twist as experts spot £1m worth of Bitcoin she is accused of stealing has been moved online in the past few weeks

A Chinese ‘Crypto Queen’ on the run from Britain for her part in a £3billion swindle may have been moving stolen Bitcoin around the world in the past few weeks despite being subject to an international manhunt, MailOnline can reveal today.

‘Supervillain’ Yadi Zhang, also known as Zhimin Qian, fled to the UK in 2017 after allegedly ripping off 128,000 investors in China and converting their cash into cryptocurrency.

In 2018, the Metropolitan Police seized devices containing 61,000 bitcoin — worth more than £3.4billion – when they raided a £5million Hampstead mansion Yhang was renting for £17,300-a-month with her ‘carer and assistant’ Jian Wen, who was convicted of money laundering offences last week.

Detectives found Zhang’s diaries revealed that she had dreamt of buying a tiny European country in the Balkans where she would be made queen and be given diplomatic immunity from prosecution. She had even designed and set aside millions for her own crown jewels.

Zhang vanished hours before she was due to be interviewed by police in September 2020 and has not been seen since.

The Chinese national, who is believed to have multiple passports under false names, managed to flee the UK with around 4,500 bitcoin, worth around £250million, which remains missing from crypto-wallets seized in London.

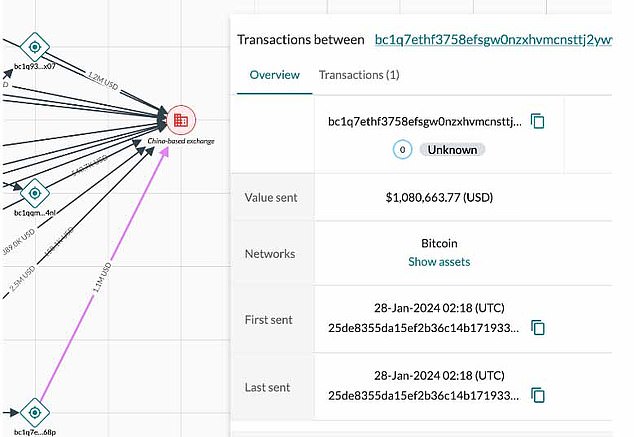

Dr Tom Robinson, Co-Founder & Chief Scientist at world-leading blockchain analytics firm Elliptic, told MailOnline today that despite an international manhunt for Zhang, around £1million of the bitcoin she is accused of stealing was transferred to a Chinese exchange just a few weeks ago, in late January.

He said: ‘Bitcoin worth hundreds of millions of pounds that disappeared from a seized wallet is still on the move. Some can be traced to an exchange with links to China, which might have information that could help locate whoever took these funds’.

Elliptic, who regularly work with the police, were able to identify the missing Bitcoin based on details during Jian Wen’s trial and use the Bitcoin blockchain to follow transactions that lead back to China.

Yadi Zhang, left, also known as Zhimin Qian, fled to the UK in 2017 after allegedly ripping off 128,000 investors in China and converting their cash into cryptocurrency. Her ‘carer and assistant’ Jian Wen, right, was convicted of money laundering offences last week

Yadi Zhang’s St Kitts and Nevis passport. She stole the name from another Chinese person and used it to get ID documents

Analytics firm Elliptic believe some of the missing Bitcoin dormant until as recently as January 2024 – when around $1m of it was moved to a Chinese based exchange

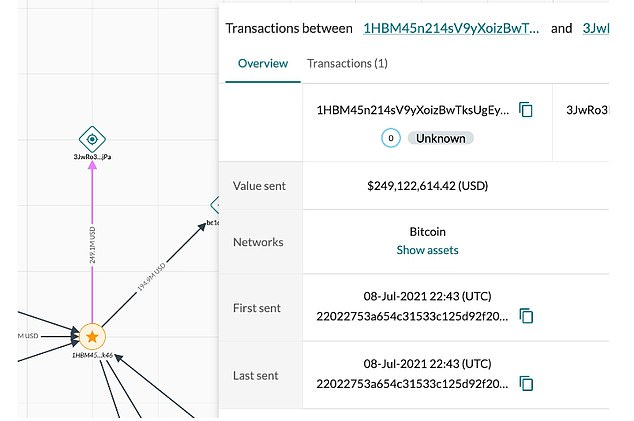

Elliptic say that around $250million of bitcoin in 2021, now worth around £250million, was emptied from a wallet on July 8 three years ago

The huge sum was sent to a small cryptocurrency exchange with links to China. A mixer, used to conceal further blockchain transactions by generating new untraceable coins, was then used to cover tracks.

Dr Robinson said: ‘It’s not clear who is responsible for moving the 4,500 BTC from the wallet. It’s possible that backups existed, allowing someone to move the funds even after the wallet had been seized by investigators.

‘Interestingly, not all of the missing bitcoins were moved and laundered immediately. Some remained dormant until as recently as January 2024, when they continued to be sent to the small exchange’.

A Met spokesman said today: ‘Yadi Zheng is wanted for questioning and work continues to locate her’.

Diaries found in the raid revealed that Zhang had plans to be queen of Liberland – a small parcel of land nestled on the west bank of the Danube river sandwiched between Croatia and Serbia.

Liberland is an unrecognised micro-country with hopes of becoming a sovereign European sovereign state. Zhang believed living as queen would secure her a diplomatic passport and immunity from prosecution for her part in a giant Ponzi fraud ripping up 128,000 investors in China, where 14 have been prosecuted so far.

Zhang, who was said to spend 20 hours a day in bed trading Bitcoin, had set aside £5million to buy herself a crown and sceptre as well as use the three square miles of Liberland to build an airport and the world’s biggest Buddhist temple, which she would use as way of convincing the Dalai Lama to make her a reincarnated goddess.

But her dreams came crashing down when authorities discovered her alleged bitcoin swindle.

Zhang has been on the run since and is subject to an Interpol red notice.

Her ‘carer and assistant’, Jian Wen, was convicted in a money-laundering trial that concluded in London last week, during which Wen’s lawyer Mark Harries KC called Qian an ‘expert criminal supervillain’ and ‘master of deception’.

Qian hoped the unofficial country Liberland would make her Queen and she could build a Buddhist temple

Wen was living in a basement room under a Chinese takeaway in Abbey Wood, south-east London. But within weeks, she moved into this fabulous six-bedroom house in Hampstead Heath, paying £17,000 a month in rent in September 2017

Wen tried to buy this £23million Hampstead mansion – prompting alarm bells to sound

Mr Harries told Southwark Crown Court that Qian’s ‘spectre has haunted this trial from start to finish’.

Fugitive Qian, who was referred to in court under her stolen alias Yadi Zhang, fronted a Chinese company selling investment products that promised huge returns of up to 300 per cent and claimed to be bitcoin mining, according to court documents.

She fled Britain in 2020 and her whereabouts are still unknown. She allegedly used crypto exchange site Huobi to convert investor money into billions of pounds worth of bitcoin.

When Jian Wen arrived in the UK with barely £5,000 to her name, she took a job in a Chinese takeaway and moved into the gloomy basement bedsit below it.

But within weeks she was living in a £5million six-bedroom house yards from Hampstead Heath, sending her son to prestigious £6,000-a-term Heathside prep, driving a new Mercedes and going on lavish shopping trips to Harrods.

No expense was spared as she jetted to Germany, Rome, Zurich, Norway, Thailand, China, Japan, where she saw the sights under the guise of a jewellery business owner trading in diamonds and antiques.

Wen then bought two flats in Dubai for more than £500,000 and began looking at bidding for a £10million 18th century Italian villa with views of the Tuscan coast.

It was only when she tried to acquire some of London‘s costliest properties, including a £23million Hampstead mansion, that alarm bells started to ring about the unexplained source of her funds.

Now police have linked Wen’s accounts to £3.4billion in the cryptocurrency, which she was helping a fugitive fraudster to launder. Piles of cash were found in her home and she is now facing jail.

The extraordinary story of her life at the heart of one of Britain’s biggest Bitcoin seizure can be told after a five-year probe has ended in her conviction for money laundering yesterday. The seized Bitcoin is subject to further legal proceedings so it remains unclear where it will go.

Qian and Wen travelled across Europe together selling Bitcoin to buy expensive jewellery including watches worth up to £70,000 from Van Cleef and Arpels in Switzerland.

In three months, more than £90,000 was spent in Harrods on designer clothing, jewellery and designer shoes using a rewards card in Wen’s name.

Qian, who employed her as his live-in PA after a meeting at the five-star Royal Garden Hotel in Kensington, has since vanished.

Wen insists she had no idea the Bitcoin came from the proceeds of fraud and claimed she had been tricked by Qian.

So how did Wen, a penniless immigrant, end up working at the heart of global organised crime? And how – after enjoying an unlikely life of unimaginable luxury – did she end up facing the prospect of a long spell in a grim British prison?

Wen poses at the Lindt shop in Zurich on one of her trips to Europe. She claimed it was to buy items for a jewellery business, producing receipts for diamonds and watches

Piles of cash were found by police during searches connected to Jian Wen. She now faces being sent to prison

Wen jetted across Europe, including to Germany. She denied knowing she was involved in money laundering and said she was lied to

To understand her incredible story, which resembles a film or work of fiction, we must return to 2016, when Wen was a single mother living below a Chinese takeaway in Abbey Wood, south-east London.

Despite living in one of the world’s most expensive cities, she earned just £5,979 a year – a pitiful sum that would have made her life a day to day fight for survival.

These hardships would not have been unusual for Wen, who told jurors she grew up in a working class family in China before meeting her husband Marcus Barraclough and coming to the UK while heavily pregnant on a spousal visa in 2007.

The marriage broke down after the birth of their son and she lived for a time in Leeds, where she completed a law diploma and gained a BA in economics before moving to London in the summer of 2017.

A receipt for £75,000 worth of diamonds bought in Zurich

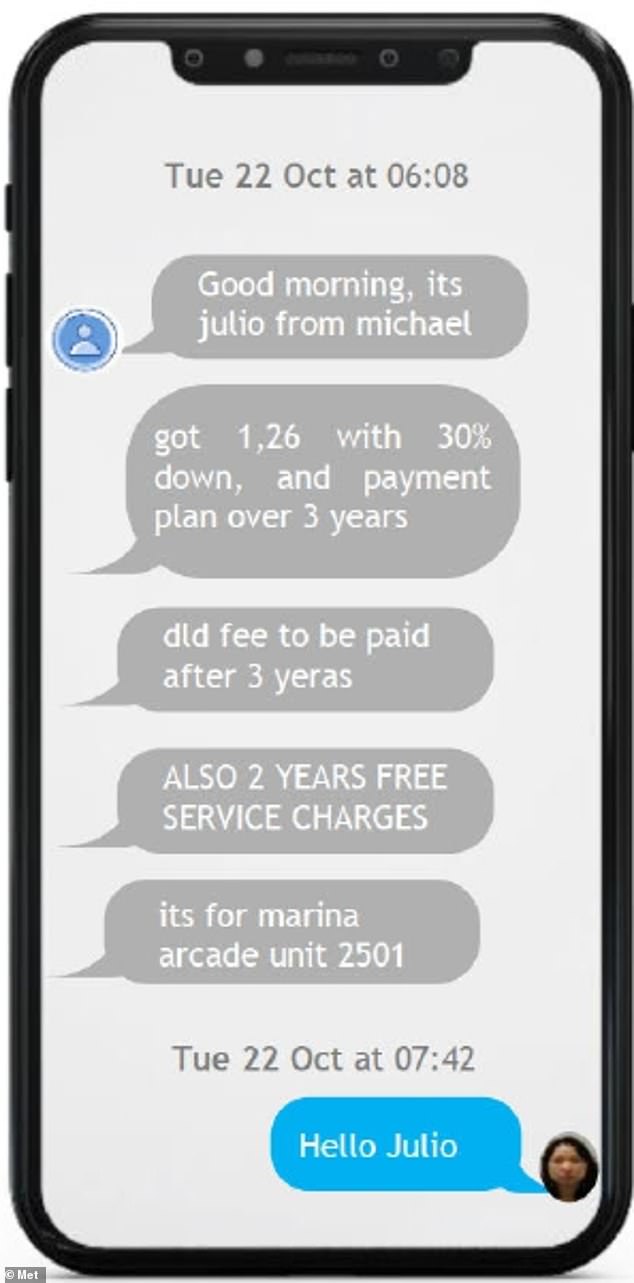

It was there – while working in the Chinese takeaway – that she spotted an advert on WeChat, a Chinese social media app.

The post advertised the role of a ‘butler’ for a woman who claimed to run an international business trading in diamonds and antiques and boasted of spending tens of thousands of pounds on designer clothes in Harrods.

Just weeks after meeting Zhang at the Royal Garden Hotel, Wen and the fraudster moved into a £17,000-a-month Hampstead mansion after putting down a £40,000 deposit.

As they travelled the world together, Wen opened a series of cryptocurrency accounts – making meticulous notes of transactions in a Wallace and Gromit notebook – while they both used aliases to avoid provoking suspicion.

They sold Bitcoin and bought fine jewellery, splashing out on over £44,000 worth of gems at Christopher Walser Vintage Diamonds in Zurich, and watches worth £119,000 from Van Cleef & Arpels.

In three months, more than £90,000 was spent in Harrods on designer clothing, jewellery and shoes using a rewards card in Wen’s name.

She snapped up two apartments in Dubai for more than £500,000 and looked into buying a £10m 18th century Tuscan villa with a sea view.

Wen then attempted to buy a £23.5m seven-bedroom Hampstead mansion with a swimming pool and a nearby £12.5m home with a cinema and gym.

But the spending spree triggered anti-money laundering checks and the purchases were halted after she could not explain the source of the Bitcoin she planned to use to pay for the properties.

Wen initially claimed the cryptocurrency had been mined, then said it was given to her as a ‘love present’, stating she had been given 3,000 bitcoin, then worth £15million, by Qian.

Jian went to Norway on business too. It was an incredible transformation for a woman who had been living above or below Chinese takeaways for years

Jian Wen took meticulous notes in a Wallace and Gromit notebook showing what was bought and sold in terms of crypto. In this one she said ‘I’ll be dead if they broke the BTC code’ – BTC is a reference to Bitcoin

Scotland Yard launched a major investigation making the UK’s biggest-ever cryptocurrency seizure in 2021 when more than 61,000 Bitcoin were discovered in digital wallets hidden in a safety deposit box.

The cryptocurrency was worth £1.4billion at the time, but its value has now risen to £3.4billion.

Qian fled the UK after police raided her address and her whereabouts are currently unknown.

Wen had insisted she had no idea the Bitcoin came from the proceeds of fraud and claimed she had been duped by Qian.

She said she helped Qian run a jewellery business which had branches in Singapore, Malaysia and China.

Asked about her shopping spree in Harrods, Wen told jurors: ‘I was the one carrying the bags.’

But revealing the truth behind her role, prosecutor Gillian Jones KC said: ‘The defendant went on to travel extensively both nationally and internationally either by herself or together with Miss Zhang.

‘When travelling in company with Miss Zhang countries which had an extradition treaty with China were avoided.

‘During those trips, Bitcoin was sold, and fine jewellery purchased, and we can see in communications that property in Europe was considered for purchase.

‘You will see in photos found on mobile phones that they never appear in photos together.

‘It appears that this was one of Miss Zhang’s requirements, no doubt to prevent the risk of her being tracked down through Miss Wen.’

Messages Wen exchanged during the purchase of a flat in Dubai

Mr Jones said that legitimately mining the 61,000 BTC of cryptocurrency that was found in Wen’s position would have required enough energy to to power 25,000 homes.

Questioning Wen’s assertion that the crypto was given to her as a gift, the barrister told the jury: ‘That is quite a pay cheque. You are going to have to look carefully at the circumstances of that purported gift.

‘A gesture by a very generous benefactor pleased with the care and assistance provided, or a device or sham to create an air of legitimacy as to the source of funds when Miss Wen attempted to purchase high value property on behalf of Miss Zhang.’

Wen, of Hampstead, denied three charges but was convicted of one charge of entering or becoming concerned in a money laundering arrangement.

The two remaining charges were dropped by the prosecution.

Andrew Penhale, Chief Crown Prosecutor, said: ‘Bitcoin and other cryptocurrencies are increasingly being used by organised criminals to disguise and transfer assets, so that fraudsters may enjoy the benefits of their criminal conduct. This case, involving the largest cryptocurrency seizure in the UK, illustrates the scale of criminal proceeds available to those fraudsters.’

Judge Sally-Ann Hales, KC, remanded Wen in custody ahead of sentence on May 10.