They said it was a fad, but some 14 years on since bitcoin was launched cryptocurrencies look like they are here to stay. There’s no doubt that while Irish people in general are slow to invest, they have embraced the opportunity presented by cryptocurrencies.

Earlier this year, a survey from Banking & Payments Federation Ireland (BPFI) found that one in five younger people hold cryptocurrencies – compared to just 3 per cent of over 55s. There is also a higher preference among men for investing (44 per cent holding investments compare to just 26 per cent of women).

“I come across it so often; I have clients in their 30s and 40s who are slow to invest or put money into their pension but they’re interested in putting money into crypto. I wouldn’t call it a ‘get rich quick’ scheme; it’s more of a fear of missing out perhaps,” says Nick Charalambous, managing director of Cork-based financial advisory firm Alpha Wealth, of the rush to crypto.

Many seasoned investors will argue that the best advice when it comes to crypto is to simply walk away, as it is more akin to gambling than investing. Central Bank governor Gabriel Makhlouf recently described it as like buying a lottery ticket. “You might win but you probably won’t,” he said.

But, given the rush to the asset, his warning may fall on deaf ears. So if you are in the market for crypto, or have already bought into it, how can you best protect yourself and your money?

Don’t spend what you can’t afford to lose

“Invest what you can afford to lose,” says Charalambous, using the phrase often applied to gambling, adding that people should also have a strategy in mind. Are they going to hold on for the long term, for example, or sell once the currency reaches a certain value?

As the Central Bank points out, just because the company from which you buy your crypto – Revolut, for example – is regulated, this doesn’t offer you any protection when it comes to crypto

Similarly, as with any “investment” portfolio, it should be diversified. “I’m not anti-crypto, but it must be proportionate to your overall portfolio,” says Charalambous.

“If you’ve €100,000 in the bank and want to invest €1,000 in crypto, that seems proportionate. But if you’ve €1,000 and are prepared to invest €1,000, that’s completely disproportionate”.

Unlike other vehicles for your money, such as deposits, which are covered up to €100,000 under the Deposit Guarantee Scheme, or investments sold by stockbrokers, insurance brokers etc, where losses are protected by up to €20,000 under the Investor Compensation Scheme if the investment firm through which you are investing fails, crypto currencies are unregulated under Irish and EU law and thus offer no protection.

So if you’re money’s gone, it’s gone. As the Central Bank points out, just because the company from which you buy your crypto – Revolut, for example – is regulated, this doesn’t offer you any protection when it comes to crypto.

This may change; the Markets in Crypto Assets Regulation (MiCA) will put in place prudential and consumer requirements for the crypto sector across the EU and is due to be implemented by 2025.

Beware of scams

It’s not just currencies that dominate the crypto world; there are also a lot of other means of investing your money, such as initial coin offerings (ICOs) and multilevel marketing-type investments, which are often just Ponzi schemes.

“Be very aware and careful of the scams that are out there,” says Charalambous, citing the recent experience of a client who lost a “meaningful” sum on RXP Trades, which claimed to be a subsidiary of a Belgian bank.

Instagram and other social media sites can be big advertisers of such scams.

Maklouf cited this “aggressive advertising” by influencers to promote crypto “while not disclosing the fact they are being paid”, as a “particular concern” of his.

It can also be the case that you might be quick to hear about it when people make money; but not when they lose it or are victims of a scam.

“Typically these things come from a tip: someone mentions it in a cafe or a bar because maybe they’ve done well,” says Charalambous, who admits that he himself fell victim to one such scam in which “everyone who invested lost money”.

But we often don’t hear such tales. “When you get scammed you don’t go and announce it – that’s the problem,” he says.

It may affect a mortgage

If you’re looking to use a crypto balance to help fund a home purchase, tread carefully as it will need to be in euro for the bank to consider it.

“You cannot get a statement with your full name and address for crypto, so banks will not accept the value in the account as evidence of balance of funds to complete the purchase of a property,” says mortgage broker Michael Dowling of Dowling Financial.

[ How to buy a first home that won’t break the bank ]

But a bit of trading here and there shouldn’t affect your application too much. “Like gambling, as long as trades are modest and not disproportionate to your income, as an adult a bank cannot stop you trading,” says Dowling.

Choose your platform carefully

As the Central Bank notes in its warning to consumers, there is “a high risk that you will lose some or all of your money” when it comes to crypto. Such currencies can be subject to wild swings, so may not be suited to those looking to get their money back quickly.

One way of mitigating your risk is to choose one of the larger platforms; it’s not always foolproof but it can reduce risk.

Charalambous says that sticking to the bigger ones, such as Coinbase, can be a safer strategy than plumping for one you might know little about.

We have all heard of people who’ve had their crypto wallets hacked.

If there’s one asset that is prone to getting lost or being stolen, it’s crypto. So be careful with keyphrases for hard wallets and maybe let a trusted person know what you have and how to access it, in case something happens you.

Don’t forget about tax

Just like gains on shares and property, if you make a gain on a cryptocurrency, you will have a tax bill to settle with Revenue and ignorance is never a defence when it comes to tax.

According to the BPFI survey, about 16 per cent of respondents said they didn’t understand the fees and taxes they needed to pay for their investments.

…if you use bitcoin to pay for a coffee, or even your legal fees, it will be seen as a ‘disposal for CGT purposes’ by Revenue. So, you will need to calculate any gain or loss which has arisen

Consider John, who sold €5,000 of crypto assets in 2021, making a gain of some €500. While this is a chargeable gain, and thus could be subject to capital gains tax at a rate of 33 per cent, John can use his annual CGT exemption of some €1,270 to defray or in this case entirely offset any tax bill. He can also use the remaining €770 of his allowance to reduce any further CGT owed. If he had already used his exemption, he would owe tax of some €165 to Revenue.

And what if he made a loss? Well, as with other gains that are subject to CGT, this loss can be carried forward to offset any tax owed on future gains.

[ The tax facts you need to know about crypto assets ]

Another point, which may be lost on some people, is that if you use bitcoin to pay for a coffee, or even your legal fees, it will be seen as a “disposal for CGT purposes” by Revenue. So, you will need to calculate any gain or loss which has arisen on the transaction and make a tax payment where necessary.

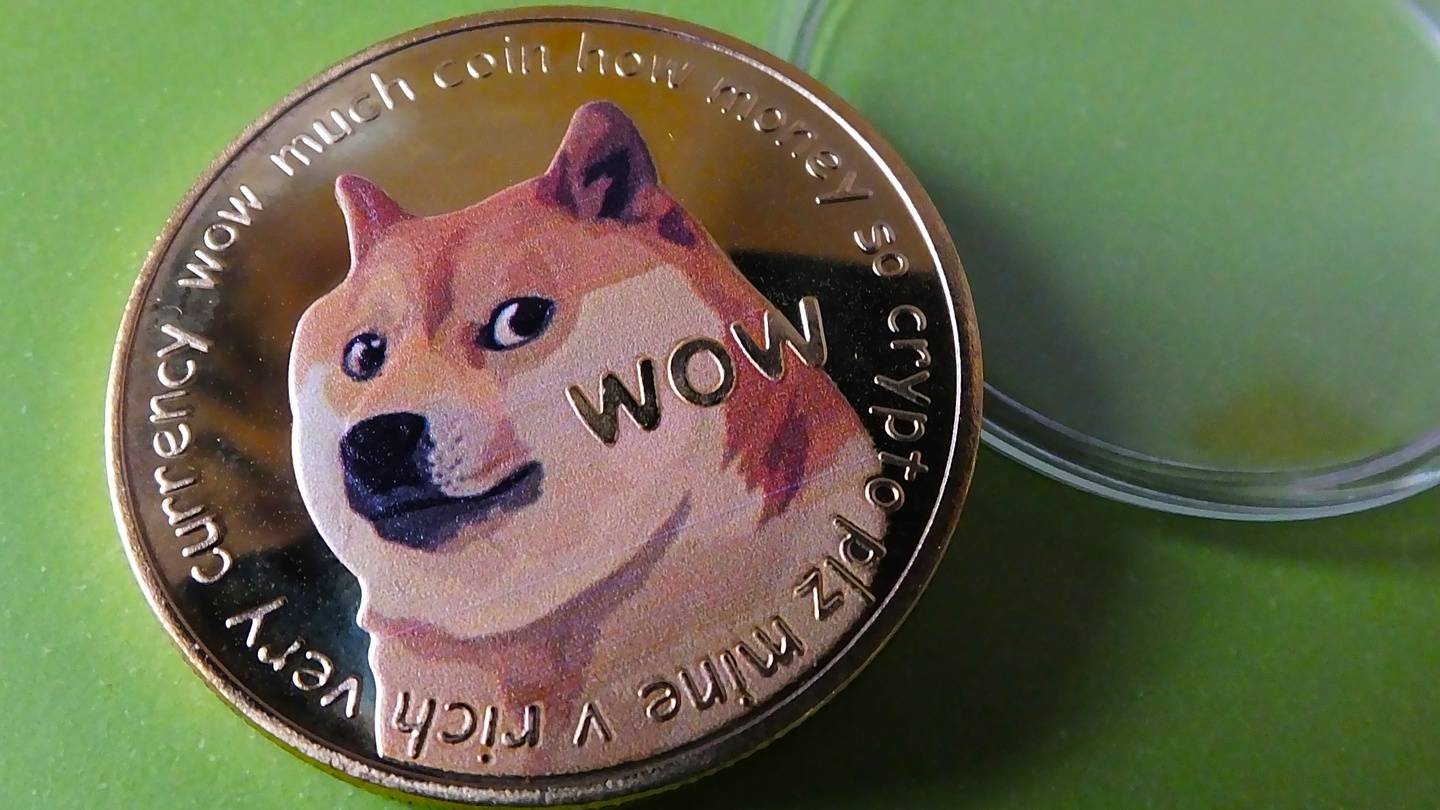

Similarly, if you use Dogecoin to buy Tether (another type of crypto coin) for example, the gain/loss on your Dogecoin will be crystallised at this point, so it becomes a taxable event.

Keeping track of such taxable events can be tricky if you’re a frequent trader.