How Poland attracted the most crypto firms in the EU — and why France may soon snatch them away – DL News

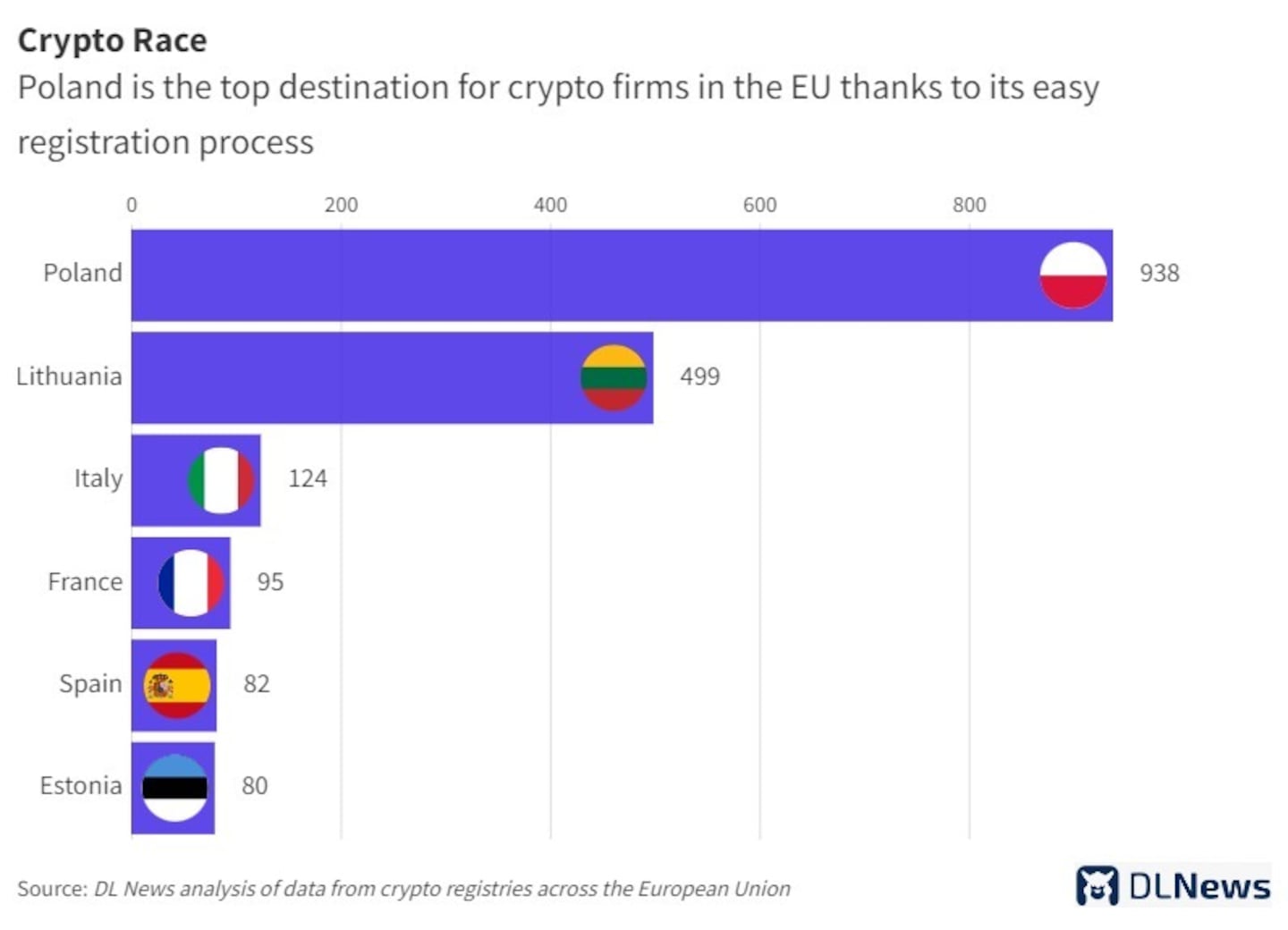

- A DL News analysis of EU corporate registration data shows Poland with almost twice as many crypto ventures as runner-up Lithuania.

- Poland’s easy application process may backfire as incoming MiCA law is poised to change crypto rules across the bloc.

- France aims to leapfrog rivals and become continental crypto hub by harmonising its registration process with MiCA now.

In the race to become the European Union’s crypto hub a number of contenders jump to mind — Paris, Berlin, Lisbon. But it is Poland and its capital Warsaw that has become the top destination for newly registered digital assets enterprises.

At least for now. France is taking a number of steps to leapfrog Poland and become the EU’s crypto hub.

That’s the upshot of a DL News analysis of the crypto sector in the EU. Of the 2,000 registered crypto companies across the 27-nation bloc, almost half are based in Poland, according to a data compiled from official registries in EU member states.

The Eastern European nation sports almost twice as many registrants as second-place Lithuania. And every week more firms sign up in its Virtual Currency Business Registry.

So what’s so special about Poland?

EU foothold

For starters, it only takes two weeks and less than €150 in fees to register a crypto venture in the nation. This is the basic state-issued fee to register, and other compliance costs may add up for firms on top of that.

There’s no obligation for a company to commit to a bricks and mortar operation. And the topper: By setting up shop in Poland, a crypto firm can have easier access to the rest of the European market.

“Certain companies are registered in Poland just to have a foothold in the EU,” Jarosław Nowacki, an attorney at tau.legal, a Polish law firm, told DL News.

Join the community to get our latest stories and updates

Crypto outfits are still not permitted to solicit customers in other EU nations unless they obtain the appropriate approvals. That’s all going to change in the months to come as the bloc implements the landmark Markets in Crypto-Assets law, known as MiCA.

It’s set to go into effect in December 2024 and bring clarity to the burgeoning digital assets industry in the world’s biggest free trade bloc.

For the next 15 months, Poland and other member states are expected to jockey for position to win over crypto entrepreneurs.

Officials must adapt their home-grown rules to the regime in Brussels and those who work fastest may garner a key advantage. Under MiCA, a crypto firm based in any EU nation can “passport” into any other member state with little fuss.

To get a handle on how the contest is shaping up, DL News collected data from the official registers on virtual assets service providers, or VASPs, from EU member countries. In some nations there are separate registers for virtual assets, while in others the VASPs can be found on business registers.

Officials in Romania and Latvia did not reply to requests on VASP data. Officials from the national banks of Slovakia and Czech Republic told DL News they do not provide a VASP registry or licensing process.

For these kinds of service providers, you need to create an ecosystem.

— Francesco Paolo Patti

With 938 registered crypto companies managed by the Chamber of Tax Authorisation, Poland is far ahead of its rivals. Only Lithuania, with 499, and Italy, with 125, have more than a hundred crypto companies in the official list of virtual assets service providers.

As for Belgium, which happens to house the headquarters of the EU in Brussels, its registry is empty.

Even though Poland has pole position that doesn’t mean it will automatically become the EU’s future crypto base. In France, it can take a year to obtain a crypto licence. Yet France has been forging a MiCA-ready regime well ahead of the December 2024 deadline.

French spingboard

Top crypto firms have responded to French efforts: Circle, the stablecoin provider, and OKX, a leading crypto exchange, have applied for the high-level licence in France, which aligns closely with MiCA requirements.

If approved, they would use France as a springboard for all of the EU. And, by doing the compliance work now they can grab a head start.

Poland, on the other hand, has simply made registration relatively painless but that does not mean it is MiCA-ready. Cultivating a startup hub is not easy. You need a clear regulatory regime that syncs with Brussels’ rules and an entrepreneurial culture that attracts talent, funding, and major players.

“For these kinds of service providers, you need to create an ecosystem,” said Francesco Paolo Patti, associate professor at Milan’s Bocconi University and member of the European Law Institute.

Italian rules

For example, it’s a big problem if a crypto service provider gains authorisation in a country but there are no banking partners to provide accounts.

Polish authorities would be wise to ensure VASPs can foster relationships with financial institutions, Patti said.

Yet because crypto outfits aren’t required to be physically based in Poland, Patti is sceptical officials will have much incentive to work hard to retain the scores of firms on their registry.

In Italy, for instance, firms must have offices in place to register. It follows that Italian authorities may want to retain the tax-paying crypto businesses to stay after MiCA is implemented.

As for Poland,registrants include Coinlab and the Bitcoin.ro exchange, plus Estonian companies such as Fintechx OU and BC Trade Europe OU. Binance also registered its Polish entity, Binance Poland s.p. z.o.o, in Warsaw.

Poland’s challenge

Some of the crypto ventures maintain offices in Poland, while others have no presence at all. Many entities appear to be persons registered as legal entities for providing virtual assets exchange services, with a given name and surname instead of a company title.

The challenge for Poland will be adapting its registration process to the more rigorous demands of MiCA.

At the moment, crypto directors need to do little more than declare compliance with money-laundering laws and provide proof of experience related to crypto, Nowacki said. And the entire registration process can be done online.

Because Poland doesn’t categorise crypto as a regulated financial activity, the registration process is managed by the Chamber of Tax Administration, instead of the Polish Financial Supervision Authority. It also means crypto firms don’t have to get licensed, which is a stricter process than registration, Nowacki said. Unless, they fall under other European laws covering securities or payment services.

French licence

In France, the stakes are higher.

To get a mandatory registration from the Financial Markets Authority, or AMF, officials review business practices, human resources management, IT systems and conflict of interest policies. Then, of course, there is compliance with anti-money laundering rules.

Firms must pay a €1,000 fee for a basic AMF registration, which is about 10 times more than in Poland. Legal fees often run tens of thousands of euros, lawyers say.

For a higher-tier licence, crypto firms can become virtually compliant with MiCA months ahead of time. This route is twice as expensive as the basic registration, and firms must also maintain a minimum level of reserves and purchase insurance.

William O’Rorke, associate lawyer at French law firm ORWL, said clients are more interested in obtaining this licence now, since it is virtually identical to MiCA requirements. But it’s a process.

“It is a mountain to climb,” Anne-Sophie Cissey, head of legal and compliance at web3 market maker Flowdesk, recently told DL News.

For now, the sole buyer of the high-end licence is the digital assets unit of Societe Generale, France’s third-biggest bank.

Industry giants like Circle and Binance know “that if they are able to get this French licence today, they will then have authorisation under MICA,” Patti said.

Malta’s move

Malta is now following suit by revamping its crypto rulebook ahead of MiCA’s implementation. Malta’s financial authorities said in September they are preparing firms to comply with the new EU rules ahead of time.

“With a large number of blockchain developers in Poland, and the still relatively lower costs of running a business here, my hopes are that Poland could become a sort of crypto hub for entities regulated under MiCA,” Nowacki said.

Those hopes may fade if founders decide it’s wiser to get MiCA compliant sooner rather than later in another country.

Have a tip about crypto regulation? Contact the authors at [email protected] and [email protected].

Updated on September 22 to report that registration in Poland may have additional costs.