(By Caixin journalists Yue Yue and Qing Na)

It is hard to square how a high roller who lived in a villa, spent tens of thousands of pounds on luxuries, and even bought properties worth more than half a million pounds in Dubai could have once been a worker living above a Chinese restaurant in the UK.

The person who experienced this change of fortunes was Wen Jian, a 42-year-old from Hendon in North London, who was found to have participated in what the British Metropolitan police described as the largest Bitcoin money laundering case in UK history, resulting in the seizure of 61,000 bitcoins, now worth approximately 31 billion RMB (US$4.3 billion).

Last month, Southwark Crown Court found Wen guilty of getting involved in the money laundering scheme, following a five-year cryptocurrency investigation, according to a statement issued by the Metropolitan police on 20 March.

Wen, who migrated to the UK in 2007 after marrying a British man, caught the attention of investigators after she tried to purchase several London properties between 2017 and 2018, with one valued as high as 23.5 million pounds (US$29.6 million). After her interest in the properties drew questions about where she got her money, authorities opened the investigation that led to the money laundering charges. She is scheduled to be sentenced on 10 May.

Wen’s fall, however, is just the tip of the iceberg of a larger Bitcoin fraud operated out of China by a suspect known as “Hua Hua”, who is still at large, according to court documents.

Wen first worked as Hua Hua’s personal assistant in the UK, before moving up to help her launder criminal proceeds from China starting in 2017 by transferring Bitcoin across borders and then converting it into cash and expensive assets.

Recounting her experience with Hua Hua, Wen told the court that she was unaware that the money had been made illegally and was also a victim of the other woman. “I was used,” she said, noting that she did not actually own any of the luxuries she purchased and that she was just a bag carrier.

… Wen’s case is linked to illegal fundraising that was orchestrated by Tianjin Lantian Gerui Electronic Technology Co. Ltd., which illegally raised 43.5 billion RMB, resulting in more than 100,000 victims across China.

Illegal fundraising

Caixin has learned from sources with knowledge of the matter that Wen’s case is linked to illegal fundraising that was orchestrated by Tianjin Lantian Gerui Electronic Technology Co. Ltd., which illegally raised 43.5 billion RMB, resulting in more than 100,000 victims across China.

The Chinese company was actually controlled by Hua Hua, whose real name is Qian Zhimin, the sources told Caixin. She is 45 years old.

Gerui Electronic was established in 2014 in the northern Chinese municipality of Tianjin, according to the company’s registration information. It provides electronic products and internet services.

Between 2014 and 2017, under the mask of a technology company, Gerui Electronic introduced multiple wealth management products that it touted as having zero risks and high returns to lure investors.

These products required investors to lock up their money for anywhere from six months to two-and-a-half years, with a minimum contribution of 6,000 RMB, according to marketing materials seen by Caixin. They advertised rates of returns from 100% to 300%.

_13.jpg)

Qian kept a very low profile. Even at Gerui Electronic, many people did not know her real name. She kept her name off all of the business’s registration paperwork, using other people she employed to put their names down on paper. Ren Jiangtao, Gerui Electronic’s sole shareholder, was one of them.

Ren said that Qian handled the wealth management products backed by cryptocurrencies, including one offered by Gerui Electronic, and managed illegal gains from the products, according to a verdict published in 2020 by a court in North China’s Hebei province, seen by Caixin.

The company offered cryptocurrency insurance products with an annual return rate of 100%, but turned out to be a shell company without any insurance license.

To bolster her marketing narrative, Qian set up a company in 2017 in the Cayman Islands, a British overseas territory. The company offered cryptocurrency insurance products with an annual return rate of 100%, but turned out to be a shell company without any insurance license. All products sold through Qian’s insurance arm were, in essence, those from Gerui Electronic.

This went on for three years until 2017, when regulators grew interested in cryptocurrency scams during the wave of initial coin offerings (ICOs) that swept China. In September that year, Chinese regulators banned all ICOs.

Immigration

In July 2017, Gerui Electronic suspended issuing dividends to investors in its wealth management products, citing the need to upgrade its financial management system. Meanwhile, Qian had already completed investment immigration procedures, securing a new identity with plans to leave China.

Qian arrived in London in September 2017 on a passport from the Federation of Saint Kitts and Nevis in the Caribbean, according to the Metropolitan police. The passport was issued under the name Zhang Yadi and had a different birthdate than Qian’s.

The island nation, which allows dual citizenship, offers foreigners who invest at least $250,000 in the country the chance to apply for citizenship. People with a St. Kitts and Nevis passport can enter more than 150 countries without a visa, including the UK.

The island country has voided Qian’s passport after learning that it had been used in criminal matters, its Prime Minister Terrance Drew said at a press conference on 8 March.

The verdict by the Hebei court suggests that Qian had been planning to transfer her assets to the UK as early as 2015. An investor surnamed Zhao told the court he and about 30 other people visited Gerui Electronic’s London branch late that year on a company-organised trip.

In late 2017, police in Tianjin launched an investigation into Gerui Electronic on suspicion of illegal fundraising. The investigation led to the detention of 50 people in 2019, according to an update by the police at the time. The company illegally raised 43.5 billion RMB, according to a statement published in June 2023 by Beijing Ze Tian Law Firm, which was involved in the defense of Gerui Electronic’s general manager, Wu Xiaolong.

… an investor who has registered for refunds told Caixin that he expected to receive less than 10% of his initial investment.

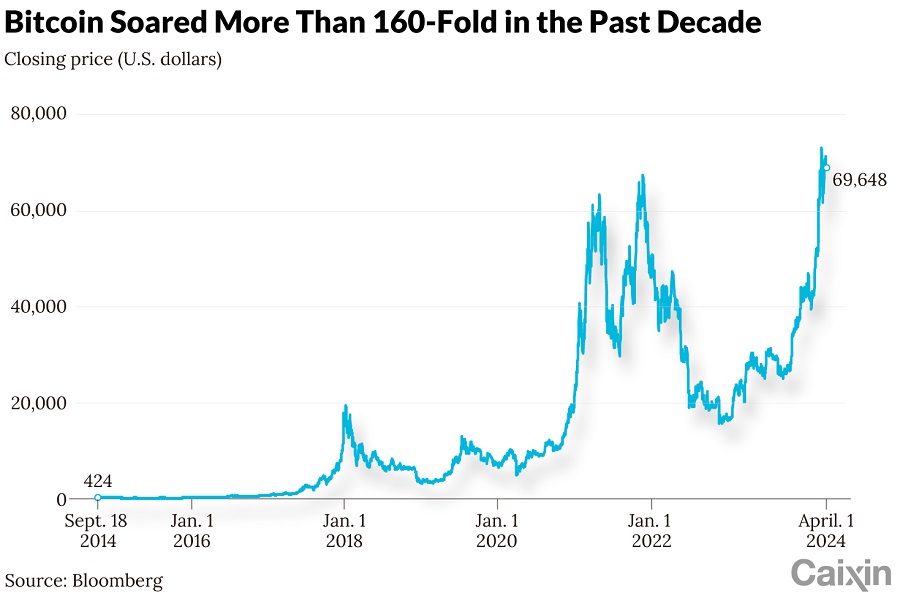

According to Caixin calculations based on analysis by cryptocurrency research firm Elliptic Enterprises Ltd. and the market price of Bitcoin back in early 2017, at least about 500 million RMB was transferred across borders via the cryptocurrency at the time.

The value of the now-seized 61,000 bitcoins has surged to roughly 31 billion RMB.

Recovery efforts

Over the past two years, local police across China began trying to return funds to investors. However, an investor who has registered for refunds told Caixin that he expected to receive less than 10% of his initial investment.

The UK’s Crown Prosecution Service has obtained orders freezing the 61,000 bitcoins, Andrew Penhale, a chief crown prosecutor, said in a 20 March statement. According to UK law, in cases where criminal gains remain unclaimed, half goes to fund law enforcement via a Home Office scheme. The rest goes to the police.

“The case shows countries should enhance cross-border collaboration among law enforcement agencies for crimes such as fundraising fraud and money laundering,” said a lawyer with experience dealing with recovering illegal proceeds overseas.

He pointed out that the original crime took place in China, even though the assets were seized in the UK. “It would be unreasonable if the money was not returned to Chinese investors and was taken (by authorities) in the UK,” he told Caixin.

Other lawyers that Caixin spoke to suggested a civil recovery might be a more efficient path to securing funds for Chinese investors. However, some argue that this might be a difficult path considering the case had been tried on criminal grounds.

According to the treaty signed by China and the UK in 2013 regarding mutual legal assistance in criminal matters, the requested party that possesses confiscated assets may, to the extent permitted by its laws, return or share those assets or the proceeds from the sale of such assets with the party making the request. But the two sides have to reach an agreement first.

The Metropolitan police told Caixin via email on 4 April that it has received a request from Chinese authorities regarding the arrangement for the seized 61,000 bitcoins.

This article was first published by Caixin Global as “Cover Story: How Billions in Bitcoin Laundered From China Ended Up in British Hands”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: China’s crackdown on cryptocurrencies: Bitcoin miners eyeing overseas ventures | Why Bitcoin can never be a mainstream currency | [Big read] Golden passports, visas and residential permits: How the wealthy go places