After the Labour Party’s sweeping victory in the United Kingdom’s general elections, crypto and blockchain advocates have called on the new government to apply consistent policies toward digital assets. Meanwhile, Mt. Gox has dominated the news in the last 24 hours, with one analyst claiming most of the Bitcoin repaid by administrators for the collapsed exchange could be sold. Bitcoin fell to $55,200 on news creditors had transferred $2.7 billion from cold wallets to a new wallet.

U.K. crypto advocates want clear crypto policy after Labour win

With the Labour Party set to form a majority government in the United Kingdom, crypto industry advocates have called on the new administration to apply consistent policies regarding digital assets.

According to Keld van Schreven, the co-founder and managing director of digital asset investment company KR1, the change in leadership comes at a “pivotal time” for the U.K.’s blockchain industry.

“Great progress has been made on outlining a regulatory framework, but more work needs to be done to make the U.K. a global crypto hub,” Schreven said.

Meanwhile, Bivu Das, the managing director of Kraken’s U.K. operations, said he expects crypto policy to be “business as usual” under the new government. Nevertheless, “The incoming government has an opportunity to keep driving innovation and growth in this emerging asset class and reinforcing the U.K.’s position as a leading jurisdiction for blockchain-based innovation,” Das said.

As of July 5, the Labour Party had accumulated 412 seats in the 650-seat House of Commons, whereas the Conservatives likely won 122 seats.

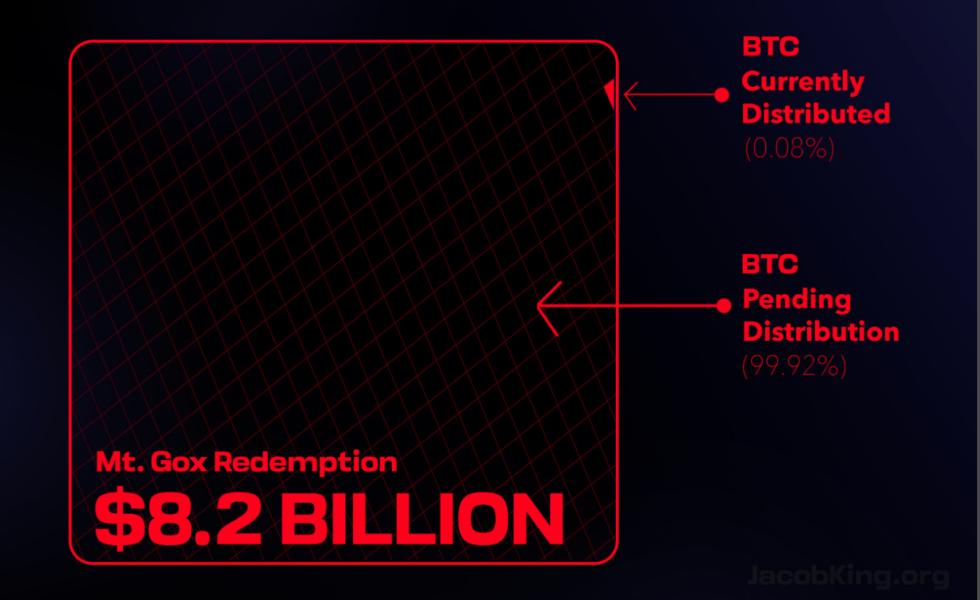

Up to 99% of Mt. Gox’s $8.2 billion Bitcoin could be sold: Analyst

Most of the Bitcoin BTCUSD being repaid by defunct exchange Mt. Gox will be market-sold, threatening to cause more downside pressure for BTC.

According to finance analyst Jacob King, the Mt. Gox repayments could add $8.2 billion worth of additional selling pressure to Bitcoin’s price.

The analysts said that onchain movements already point to the fact that Mt. Gox’s creditors have started selling, King wrote in a July 4 X post:

“No Bitcoiner will say this out loud, but the majority of the $8.2 Billion in $BTC that is set to be distributed back to ex-clients are going to be sold off.”

The gloomy prediction cames hours after Mt. Gox began repaying its debts in Bitcoin and Bitcoin Cash (BCH), the collapsed crypto exchange announced on July 5.

Bitcoin drops to $55,000 after Mt. Gox moves $2.7 billio from cold storage

Bitcoin fell to $55,200 on Coinbase after collapsed Japanese crypto exchange Mt. Gox has transferred 47,229 Bitcoin — worth $2.71 billion at current prices — to a new wallet address in its first major transaction since May.

According to blockchain analytics platform Arkham Intelligence, the exchange transferred the Bitcoin at 12:30 am UTC on July 5 out from “cold storage.”

The movement comes amid the exchange’s scheduled plan to begin repaying creditors this month. A total of $8.5 billion worth of Bitcoin is slated to be paid back to creditors.

Several market commentators voiced concerns over the sheer volume of Bitcoin that could hit the market following Mt. Gox creditors selling their holdings, which have been inaccessible for more than ten years.

However, other analysts worked to allay fears of a massive sell-off, saying the total amount of Bitcoin that stands to be “dumped” on the market is probably closer to a value of around $4.5 billion.

On May 28, Mt. Gox transferred nearly $7.3 billion worth of Bitcoin to another unknown wallet address. The price of Bitcoin dipped as much as 2% afterward.

Additional reporting by Felix Ng, Sam Bourgi and Geraint Price.