The G-20 presidency has put on the table need to have a global consensus for virtual digital assest to have a coherent regulatory framework for addressing the apprehensions and concerns. This consensus will enable for drawing up of policy and complaint framework. Many countries have taken a lead in drawing up the same and attracting technology innovations within the regulatory framework. Cross-border transactions and money laundering apprehensions need a common understanding among countries to track, deduct and act upon.

The best definition that has emerged across the globe for virtual digital assest is in the General notification 1350 of 2022 dated 19th October Staatskoerant, Financial Sector Conduct Authority under Financial advisory and intermediary services Act 2002—do not miss title of act is advisory act where ‘crypto assest’ defined as a digital representation of value that is not issued by a central bank but is capable of being traded, transferred or stored for payment, investment by applying cryptographic techniques using a distributed ledger. Thus, this definition distinguishes clearly from all assest class and also from that of CBDT but allows to be used as an instrument of assest class for trading, transferring and storing as investment and also for payments. Crypto is declaring as a ‘financial product’.

This clarity of definition can be the guiding factor for the G-20 to initiate the discussions and then move ahead for deliberating for consensus.

Crypto the virtual digital asset had great winter flags slide and negative gains when a series of events in exchanges led to decline in the value of this asset class. Like the popular and famous puppet show of Rajasthan character that resurrects every time and never dies in ‘Kathputli’ (marionettes) show the virtual digital asset has been in no die attitude like a hydra that never dies. The investments, though at low scale and persons who have trust in the virtual digital is still a large number. In India in an answer to the parliamentary question the direct tax collected in FY 2022-23 Rs157.9 crores (answer in Rajya Sabha un-starred question no 3097 on 28-3-2023, besides TDS and 30 per cent taxation India is yet to float regulation.

A piecemeal approach will not work when there are around 18,000 cryptocurrencies and 460 crypto exchanges whose businesses are taking a hit because of no regulatory framework and their average daily trade volume used to be $90 billion. Thus, learning from countries that have initiated regulations and addressing international concerns, G-20 is a good platform. Notification dated 7th March 2023, under Prevention of Money–laundering Act 2002 (15 of 2033) have brought in the exchange between virtual digital asset and fiat currency, cross border transfer transfers under its fold and is a welcome development. The need is to graduate from piecemeal to that of comprehensive regulation in India.

G20 is an opportunity to address the concerns of the central bank on destabilizing effect on the monetary and fiscal stability to that of acceptance by investors and exchanging the existing many of the countries have taken across the globe. CBDC should not be confused with that of virtual digital assest. CBDC is the digital format of legal tender that has fixed value and like money in a wallet will not attract any interest. Its spectacular development for wholesale as will reduce cost of printing notes, transport, logistics and security. In retail, with digital payment system widespread at real-time basis (UPI is free of cost as repeatedly highlighted by NPCI) the CBDC unless enables cross border ease of transfer will have less takers. Virtual digital asset the crypto on other hand, is speculative in nature and thus have risk of speculation. The above-quoted best definition I came across covers this aspect by completely distinguishing the two. Another good initiative is by Dubai who has law to regulate virtual assets (March 2022), the clarity has triggered Dubai moving to become key player to work way forward for responsible business growth. Dubai Virtual Asset Regulatory Authority (VARA) is established to enable the growth of sector and also protect the investors by enabling them to take the informed decisions. VARA will create ecosystem to make rules to conduct to authorize

- Operating and managing virtual assets platforms services;

- Exchange services between virtual assets and currencies, whether national or foreign;

- Exchange services between one or more forms of virtual assets;

- Virtual asset transfer services;

- Virtual asset custody and management services;

- Services related to the virtual asset portfolio;

- Services related to the offering and trading of virtual tokens.

Besides VARA is also vested with executing the penalty, suspension or cancellation of permit in case of violations.

Dubai is targeting to become hub for Web 3.0 by having facilitating policies for the digital assets space and US is focusing to continue to be competitive in this space. In January 2020, Singapore’s Payment Services Act came into effect as a response to the Financial Action Task Force’s 2018 update to its Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) cross-border risk guidelines for cryptocurrencies. The Payment Services Act is a flexible framework for the regulation of payment systems and payment service providers in Singapore that establishes registration requirements along with AML and CFT guidelines for cryptocurrency businesses. The war between Russia and Ukraine witnessed effective use of virtual digital assets to either have effective sanctions or provide assistance in quick mode. Another is to document fraud/cyber attack/misuse incidence of digital Asset from the perspective of whether it is a design fault or technology or maladies or ignorance of the client/ investor and what check/ correction measures can be adopted.

Cryptocurrencies in the EU: new rules to boost benefits and curb threats

Cryptocurrencies in the EU: new rules to boost benefits and curb threats

- Uniform legal framework for crypto-assets in the EU

- Consumer protection and safeguards against market manipulation and financial crime

- Include crypto-assets mining in EU taxonomy for sustainable activities by 2025 to reduce carbon footprint

Chain analysis said the purpose of the index is to capture crypto adoption by “ordinary people” and to “focus on use cases related to transactions and individual saving, rather than trading and speculation.” The metrics are weighted to incorporate the wealth of the average person and the value of money generally within particular countries.

Chain analysis reports that many residents use P2P cryptocurrency exchanges as their primary on-ramp into crypto, often because they don’t have access to centralized exchanges.

The report also says many residents of these countries turn to crypto to preserve their savings in the face of currency devaluation, as well as to send and receive remittances and carry out business transactions

However, India is still focusing on how to tax whether direct or indirect by not defining the virtual digital asset class. If it is asset then taxing the entire transaction and not enabling offset will not be in line with law of land, same applies to an indirect tax of GST. By putting a higher slab on date of 30 per cent and 1 per cent TDS without defining crypto needs clarity. Only clear thing is this VDA will not be legal tender in India and Digital Currency (CBDT) will be issued by Central Bank ie RBI in India. The advertisement standards have made it clear to put disclaimers so that the investor takes informed decisions. Will this delay make India to miss out of the opportunity of being hub for Web 3.0. Besides, the solution to cyber attacks is the decentralized system that the blockchain technology offers.

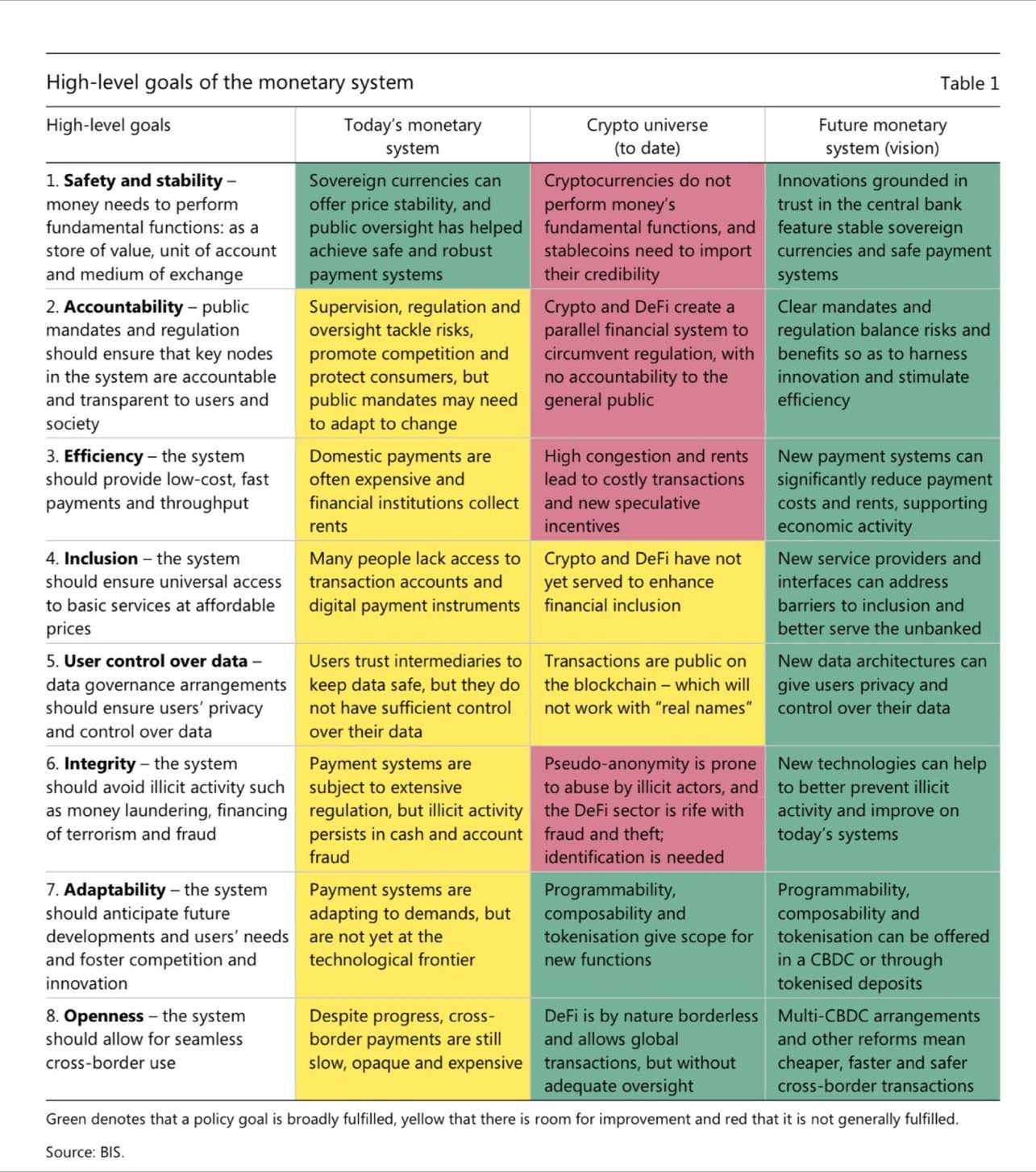

The chart below displays the technology and policy concerns that should form the discussion points in the G-20

MEPs agreed on draft rules on supervision, consumer protection and environmental sustainability of crypto-assets, including crypto such as bitcoins. The Economic and Monetary Affairs Committee adopted, with 31 votes to 4 and 23 abstentions, its negotiating position on new rules on crypto-assets. They aim to boost users’ confidence and support the development of digital services and alternative payment instruments. It is an opportunity not to be lost.

Practitioner Development Economist and ex-Secretary GoI

Disclaimer: The views expressed in the article above are those of the authors’ and do not necessarily represent or reflect the views of this publishing house. Unless otherwise noted, the author is writing in his/her personal capacity. They are not intended and should not be thought to represent official ideas, attitudes, or policies of any agency or institution.