A former Chinese takeaway worker found guilty of money laundering after police discovered more than £5 billion worth of Bitcoin has been jailed.

Jian Wen, 42, had tried to buy some of London’s most expensive properties, including a £23 million Hampstead mansion, leading police to become suspicious.

It turned out she was acting as a front in a wealth management scam which saw more than 128,000 investors ripped off.

Wen moved to the UK in 2007 and lived modestly in Leeds between 2011 and 2017 before moving to London and picking up a job at a Chinese takeaway in Abbey Wood.

She saw an advert on Chinese social media app WeChat to be a ‘butler’ for a woman who claimed to run a business trading in diamonds and antiques across the world.

Wen soon moved in to a upmarket six-bedroom house in Hampstead Heath in September 2017, paying a whopping £17,000 a month in rent.

She drove around in a Mercedes and flew her son over from China 18 months later to attend the £6,000-a-term Heathside prep nearby.

Wen also drove a £25,000 E-Class Mercedes and spent £30,000-a-month at Harrods.

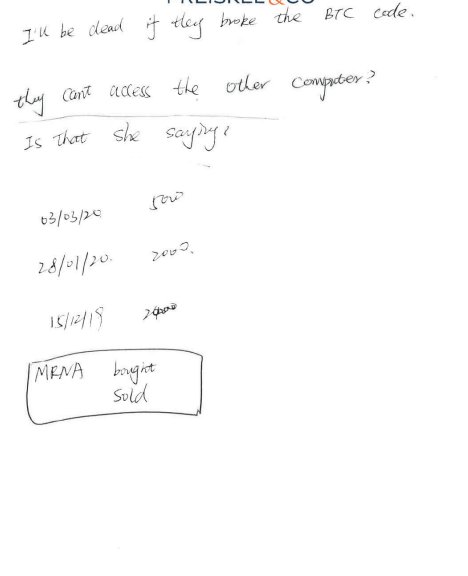

Police raided the Hampstead property, known as the Manor House and seized a safety deposit box containing digital wallets holding more than £1.4 billion worth of Bitcoin.

Wen denied any wrongdoing but was convicted by a jury at Southwark Crown Court on Friday of entering or becoming concerned in a money laundering arrangement between October 2017 and January 2022.

The charge related to the laundering of 150 Bitcoin worth around £7.5 million.

Wen claimed she had no idea the Bitcoin came from fraud proceeds and insisted she had been duped by one of the fraudsters.

Latest London news

To get the latest news from the capital visit Metro.co.uk’s London news hub.

She said she helped run a legitimate jewellery business which had branches in Singapore, Malaysia and China.

Judge Sally-Ann Hales, KC, told Wen: ‘I have no doubt that you came to enjoy the better things in life.

‘Evidence shows that you were generously rewarded for your services.

‘It is submitted on your behalf that your culpability falls into the medium range. I do not agree. The offending was sophisticated and it involved significant planning.

‘I do not agree that your involvement in the offence was due to any element of exploitation.

Speaking of the 128,000 investors who were ripped off in China, the judge said: ‘It is a matter of common sense to expect, and it can reasonably be assumed that individual investors suffered economic hardship and loss.’

Wen, who has been in custody since March 2022, was jailed for a total of six years and eight months.

Prosecutor Gillian Jones KC earlier told jurors Wen did not dispute that she dealt with the Bitcoin.

He said: ‘The question you will have to answer in respect of each count is in fact a simple one, whether Miss Wen either knew or suspected that she was dealing with the proceeds of crime when she was dealing with that Bitcoin.

‘She chose to ignore the concerns raised and warnings given over the source of the funds.

‘No doubt because the defendant was paid handsomely for the role she played, transforming almost overnight the circumstances in which she lived.

‘As to income, records held by Her Majesty’s Revenue and Customs, show that the defendant between 2015 and 2017 filed self-assessment tax returns.

‘In the tax year 2015/2016 she declared gross earnings from working at a Chinese takeaway in the sum of £12,800.

‘In 2016/2017 she declared income from working for APAC Sourcing Limited, a company which sources products from China in the sum of £5,979.

‘There is no record either by way of self-assessment tax returns or PAYE of the defendant receiving any income in the tax years 2017/2018 or 2018/2019.’

Wen travelled across Europe selling Bitcoin to buy expensive jewellery including watches worth up to £70,000 from Van Cleef and Arpels in Switzerland.

In three months she spent £90,000 in Harrods on designer clothing, jewellery and shoes.

Wen bought two apartments in Dubai for more than £500,000 and tried to purchase an 18th century Tuscan villa with a sea view for £10 million.

She also attempted to acquire high value properties in London with the Bitcoin, including a seven-bedroom Hampstead mansion with a swimming pool for £23.5m and a £12.5m eight-bedroom home with a cinema and gym.

But the sales did not go ahead as the source of the currency could not be verified.

Wen was arrested in the summer of 2021 after officers raided her home.

Mark Harris KC, defending, claimed Wen was acting under orders from others and she did not play a leading role.

‘It would be wrong to punish her for someone else’s criminality that she was not involved in and knew nothing about,’ he said.

‘There should be left a potential room for others who may be convicted of much wider, and a much more significant degree of criminality.’

The jury had failed to reach verdicts on two further money laundering charges and they were ordered to lie on file.

Andrew Penhale, Chief Crown Prosecutor, earlier said: ‘Bitcoin and other cryptocurrencies are increasingly being used by organised criminals to disguise and transfer assets, so that fraudsters may enjoy the benefits of their criminal conduct.

‘This case, involving the largest cryptocurrency seizure in the UK, illustrates the scale of criminal proceeds available to those fraudsters.

‘The CPS is committed to working closely with law enforcement and investigatory authorities, to bring to justice individuals and companies who engage in laundering criminal proceeds through cryptocurrency.’

MORE : Twenty five arrested after massive street fight leaves ten seriously injured

MORE : Pensioner mugged with ‘lion killer’ jiu-jitsu move in Benidorm

MORE : Boy, 16, stabbed to death on London street with another teen arrested

Get your need-to-know

latest news, feel-good stories, analysis and more

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.