Europe’s more than 200% gain in crypto trade volumes shows MiCA laws are luring investors – DL News

- A new Kaiko report outlines how the European crypto market is set for a renaissance.

- Throughout last year, Bitcoin was the preferred choice among European traders.

- The majority of trades conducted in the region occur through fiat and not euro-denominated stablecoins, Kaiko said.

- Europe’s new MiCA laws have helped sentiment.

Europe’s bet on crypto regulation to beckon investment is paying off.

In a new report from Kaiko, data shows trading activity shot up and euro-denominated trading in euros peaked last month, plus euro-backed stablecoin transactions are increasing.

Europe’s cryptocurrency landscape is shifting, with the euro clawing back some ground lost in the global market last year.

Data from Kaiko’s latest “State of European Crypto Markets” report attributes the gains to favourable regulation and renewed optimism.

Stay ahead of the game with our weekly newsletters

In December, monthly euro-denominated trade volume peaked at €16 billion, or about $17 billion, compared to a low of roughly €5 billion, or $5.4 billion, three months before.

A surge in trader activity has helped drive Europe’s market share in global fiat volume to 7.7%, up from 6.2% over the previous 12 months, Kaiko said.

The changes in trader activity signal a reversal of Europe’s historically lagging position in the global crypto market, particularly compared with the US and Asia Pacific.

“This trend is primed for reversal in 2024,” Kaiko wrote in the report. “Exchanges already catering for the region are at an advantage. The EU is well positioned to capitalise on a new bull market within a safer environment.”

Join the community to get our latest stories and updates

‘The MiCA effect’

Patrick Hansen, director of EU strategy and policy at Circle, attributed gains to what he in May called “the MiCA effect.” He noted at the time that VC investment into European crypto projects reached a record in 2022, according to a study by investment firm Rockaway last year.

Kicking in from June, Europe’s Markets in Crypto-Asset Regulation, or MiCA rules, includes provisions for authorisations and operating conditions for crypto service providers, consumer protection measures and rules to prevent market abuse.

Kaiko said Bitcoin has been the most popular bet.

“European traders by far favoured Bitcoin in 2023, which enjoyed significant gains throughout the final quarter of the year,” the report said.

More than €37 billion in trades were for Bitcoin, compared with about €15 billion for Ethereum.

Just a handful of exchanges account for over 98% of the euro’s trade volume.

Research also suggests the euro plays a more significant role in direct transactions compared to euro-backed stablecoins. This is different to the US, where dollar-backed stablecoins are used in nearly 90% of all crypto transactions.

Conversely, for the euro, trades involving euro-backed stablecoins account for less than 1% of the total volume.

Regulatory guardrails

The European Parliament cast its definitive vote for MiCA in April 2023.

A bill was subsequently ratified by the Economic and Financial Affairs Council of the EU in May.

MiCA entered into force at the end of June, with a phased implementation period running to December, with possible extensions, and the first compliance deadline set for June 30.

The regulation also addresses the environmental sustainability of crypto mining and establishes a classification system for various types of crypto, including stablecoins, with specific regulations for each category in a bid to ensure market stability and integrity.

Those rules have helped provide a steady guardrail for large companies abroad seeking to establish a presence there.

Data shows just a handful of exchanges account for over 98% of the euro’s trade volume, including Bitvavo, Kraken, Coinbase, Bitstamp and Binance.

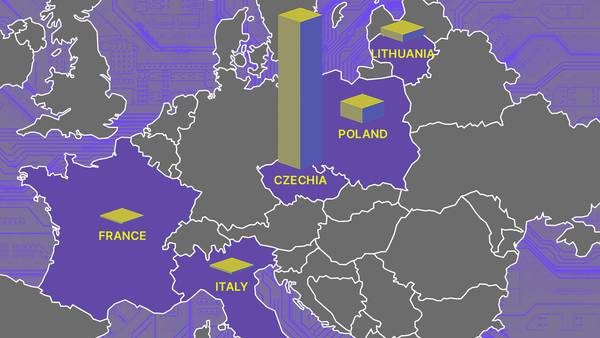

New Europe HQs

Among them, Amsterdam-based Bitvavo led with more than €34 billion in cumulative euro-denominated trade volumes last year, followed by Kraken in second at €25 billion.

“Historically the biggest companies have been either US-based or global, with headquarters in regions that tend to have lighter KYC/AML requirements, such as the Seychelles,” Kaiko said.

In the past year, an increasing number of trading platforms have been establishing their headquarters in Europe, despite facing stricter regulations, to serve the region’s hefty retail trading base, it said.

Still, North America, led by the US, is the largest crypto market, with an estimated $1.2 trillion in value received on-chain from July 2022 to June, according to Chainalysis figures.

Sebastian Sinclair is a markets correspondent for DL News. Have a tip? Contact Seb at sebastian@dlnews.com.