European Parliament lawmakers strongly supported a continent-wide tax-reporting rule for crypto transactions, with approximately 90% of voters showing their approval.

While the majority of attendees in the room were in favor, 535 individuals voted in support and 57 opposed. There were 60 abstentions concerning the crypto tax rule scheduled for implementation in 2026.

European Crypto Tax Rules Aim to Counteract Fraud

During a plenary session on September 13 in Strasbourg, France, European lawmakers widely supported the imposition of stricter tax reporting obligations on crypto exchanges.

The rules aim to assist tax authorities across Europe in monitoring crypto-asset trading and income, reducing the chances of tax fraud.

The European Commission initially proposed the framework in December 2022. If implemented, it will enforce a system for crypto-asset service providers to report transactions made by their European clients.

The recent plenary session marked a significant milestone for the framework’s progress, being the third major discussion. The Commission established its general approach to the proposal at the May meeting of the Economic and Financial Affairs Council.

Europe Continues to Work on Regulating Crypto

To establish the crypto tax framework, the Commission plans to modify the Directive on Administrative Cooperation (DAC).

The DAC serves as the primary platform for tax authorities to exchange data. Additionally, the proposal includes various minor adjustments to enhance the current sharing of tax-related information.

This coincides with the European Union’s ongoing discussions regarding the regulation of crypto assets.

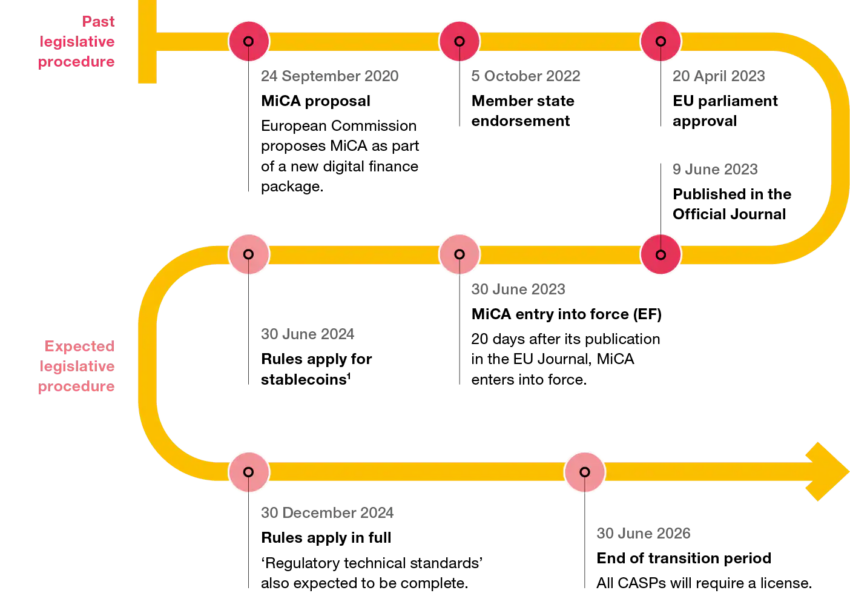

Following a strong endorsement of crypto regulations within the European Union, EU finance ministers approved the Markets in Crypto-Assets (MiCA) legislation on May 16.

These regulations primarily target the closure of tax avoidance loopholes and were put into effect in July.

On August 16, Europe marked the launch of its first spot Bitcoin exchange-traded fund (ETF) on the Euronext Amsterdam stock exchange.

The ETF, known as the Jacobi FT Wilshire Bitcoin ETF, has the ticker symbol BCOIN. It operates under the regulatory authority of the Guernsey Financial Services Commission (GFSC).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.