EU Landmark Crypto Law MiCA Published in the Official Journal: Regulation of Crypto-Asset Service Providers to Commence from 30 December 2024

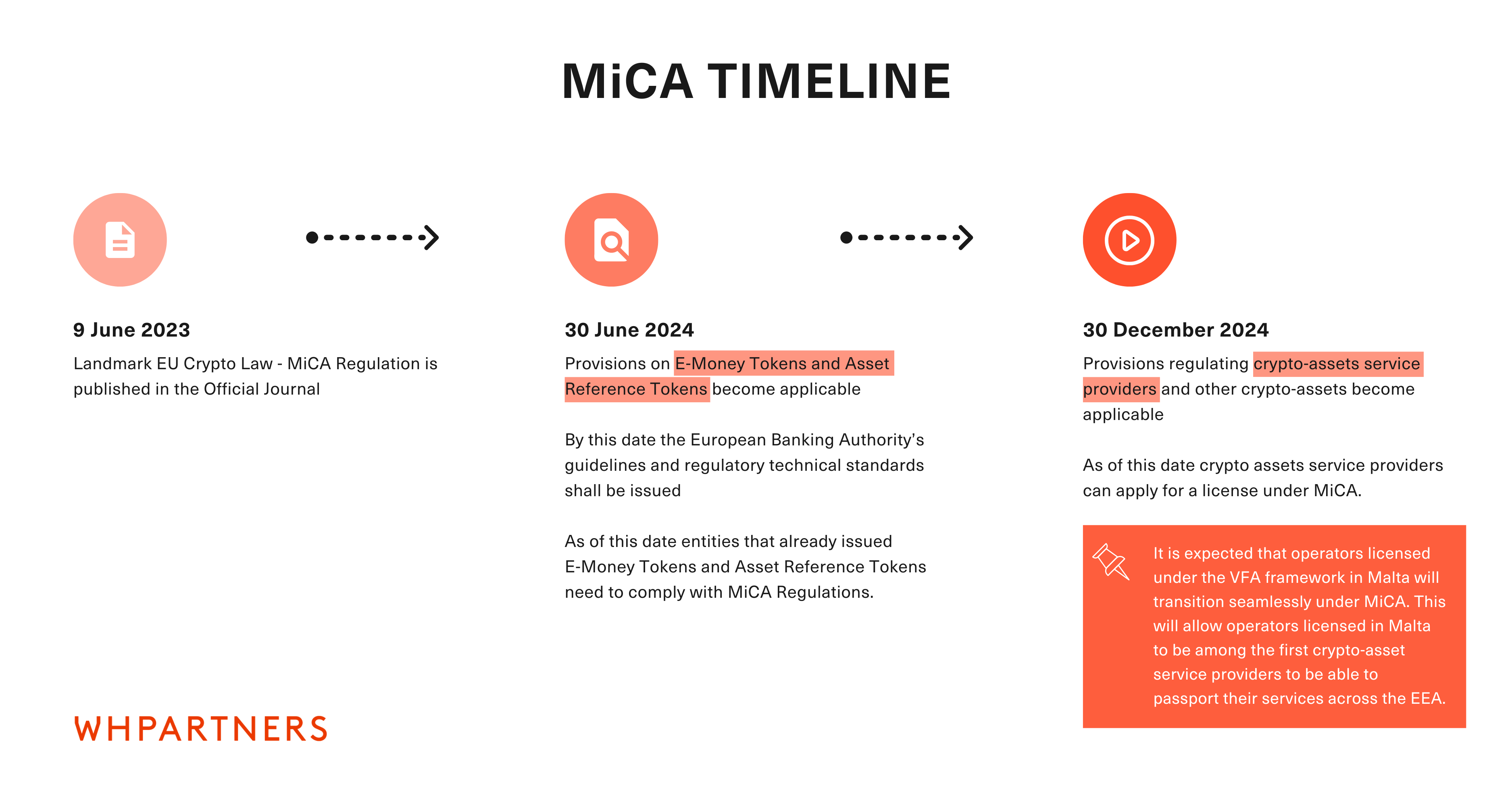

Markets in Crypto-Assets (“MiCA”) Regulation has been finally officially published in the Official Journal of the European Union (the “EU”) on 9 June 2023. This significant milestone marks the beginning of a new era for the regulation of crypto-assets within the entire Union.

MiCA Regulation enters into force on the 20th day following that of its publication.

As a result, the provisions on e-money tokens and asset-referenced tokens will become applicable 12 months after the regulation enters into force. This means that the provisions designed to regulate stablecoins will start applying from 30 June 2024.

With respect to the other provisions, specifically those regulating crypto-asset service providers, they will start applying 18 months after the Regulation enters into force. This sets the date for these provisions to start applying as 30 December 2024.

In addition, by 30 June 2024 the European Banking Authority (the “EBA”) is required to develop draft regulatory technical standards to establish standard forms, templates, and procedures for cooperation and exchange of information between competent authorities, as well as to issue guidelines specifying the criteria and elements that crypto-asset service providers should consider when conducting assessments and risk mitigation measures.

As of 30 June 2023 MiCA will officially become the first pan-national instrument worldwide establishing a harmonized crypto regulatory framework at the EU level. It will apply directly across the EU Member States EU replacing the existing domestic laws and harmonizing all national legislations in the area of crypto assets and related to them activities. It is expected that operators licensed under the VFA framework in Malta will be transitioned seamlessly under MiCA upon the applicability of the provisions relating to crypto-assets service providers. This will allow operators licensed in Malta to be among the first crypto-asset service providers to be able to passport their services across the EEA.