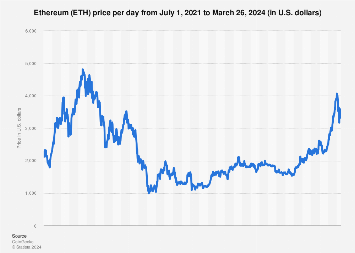

Ethereum’s price history suggests that that crypto was worth significantly less in 2022 than during late 2021, although nowhere near the lowest price recorded. Much like Bitcoin (BTC), the price of ETH went up in 2021 but for different reasons altogether: Ethereum, for instance, hit the news when a digital art piece was sold as the world’s most expensive NFT for over 38,000 ETH – or 69.3 million U.S. dollars. Unlike Bitcoin – of which the price growth was fueled by the IPO of the U.S.’ biggest crypto trader Coinbase – the rally on Ethereum came from technological developments that caused much excitement among traders. First, the so-called ‘Berlin update’ rolled out on the Ethereum network in April 2021, an update which would eventually lead to the Ethereum Merge in 2022 and reduced ETH gas prices – or reduced transaction fees. The collapse of FTX in late 2022, however, changed much for the cryptocurrency. As of March 26, 2024, Ethereum was worth 3,588.49 U.S. dollars – significantly less than the 4,400 U.S. dollars by the end of 2021.

Ethereum’s future and the DeFi industry

Price developments on Ethereum are difficult to predict, but cannot be seen without the world of DeFi – or Decentralized Finance. This industry used technology to remove intermediaries between parties in a financial transaction. One example includes crypto wallets such as Coinbase Wallet that grew in popularity in recent years, with other examples including smart contractor Uniswap, Maker (responsible for stablecoin DAI), money lender Dharma and market protocol Compound. Ethereum’s future developments are tied with this industry: Unlike Bitcoin and Ripple, Ethereum is technically not a currency but an open-source software platform for blockchain applications – with Ether being the cryptocurrency that is used inside the Ethereum network. Essentially, Ethereum facilitates DeFi – meaning that if DeFi does well, so does Ethereum.

NFTs: the most well-known application of Ethereum

NFTs or non-fungible tokens grew nearly ten-fold between 2018 and 2020, as can be seen in the market cap of NFTs worldwide. These digital blockchain assets can essentially function as a unique code connected to a digital file, allowing to distinguish the original file from any potential copies. This application is especially prominent in crypto art, although there are other applications: gaming, sports and collectibles are other segments where NFT sales occur.